College Education Debt and Earnings Economics

Politics / Student Finances Mar 14, 2012 - 08:03 AM GMTBy: BATR

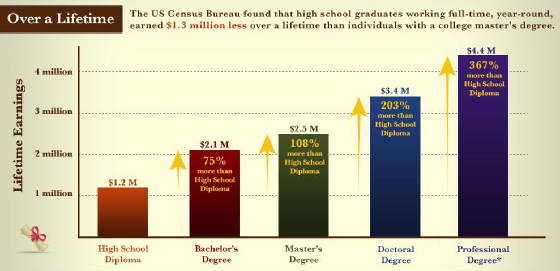

For previous generations, the dream of a college education for their children was a primary motivation. Gaining access to the teachings of higher learning is certainly a laudable objective. While this goal still holds true, there is a systemic disconnect from attending institutions that cost a king’s ransom and having marketable skills to earn a generous income in the post industrial economy. When government employment becomes the most sought after occupation, the economic future of the country sinks into deep decline. The old correlation with the higher your education, the greater your income, is no more.

For previous generations, the dream of a college education for their children was a primary motivation. Gaining access to the teachings of higher learning is certainly a laudable objective. While this goal still holds true, there is a systemic disconnect from attending institutions that cost a king’s ransom and having marketable skills to earn a generous income in the post industrial economy. When government employment becomes the most sought after occupation, the economic future of the country sinks into deep decline. The old correlation with the higher your education, the greater your income, is no more.

The incurring debt that saddles students is unsustainable. The Business Insider reports in The $100 Billion Student Debt Bubble May Finally Blow, "As it stands, no matter how deep borrowers find themselves buried in student loan debt, they can't discharge it in bankruptcy court – all because it doesn't qualify as an "undue hardship." As the economy struggles and minimum wage employment becomes the norm, how can attending college retain its glow?1) Americans now owe more than $875 billion on student loans, which is more than the total amount that Americans owe on their credit cards

2) Since 1982, the cost of medical care in the United States has gone up over 200% but that is nothing compared to the cost of college tuition which has gone up by more than 400%

3) The unemployment rate for college graduates under the age of 25 is over 9%

4) There are about two million recent college graduates that are currently unemployed

5) There are about two million recent college graduates that are currently unemployed

6) In the United States today, 317,000 waiters and waitresses have college degrees

7) The Project on Student Debt estimates that 206,000 Americans graduated from college with more than $40,000 in student loan debt during 2008

8) In the United States today, 24.5 percent of all retail sales persons have a college degree

9) Total student loan debt in the United States is now increasing at a rate of approximately $2,853.88 per second

10) Total student loan debt in the United States is now increasing at a rate of approximately $2,853.88 per second

11) There are 365,000 cashiers in the United States today that have college degrees

12) Starting salaries for college graduates across the United States are down in 2010

In 1992, there were 5.1 million "underemployed" college graduates in the United States. In 2008, there were 17 million "underemployed" college graduates in the United States

13) In the United States today, over 18,000 parking lot attendants have college degrees

14) Federal statistics reveal that only 36 percent of the full-time students who began college in 2001 received a bachelor's degree within four years

15) According to a recent survey by Twentysomething Inc., a staggering 85 percent of college seniors planned to move back home after graduation last May

The cost of college is not uniform. The College Board reports,

The value of attending a prestigious private institution especially has a real harsh impact, if student loans are necessary to pay for that experience. "College tuition increases about 8 percent annually or doubles about every nine years, according to FinAid.org." The continual increase in college costs is the persistent dilemma that challenges the ultimate benefit of attending university."In 2011-12, 44 percent of all full-time undergraduate college students attend a four-year college that has published charges of less than $9,000 per year for tuition and fees.

At the other end of the spectrum, approximately 28 percent of full-time private nonprofit four-year college students are enrolled in institutions charging $36,000 or more yearly in tuition and fees."

America has become a society for elites. The embodiment of success, sold under the mantra of achieving degrees of higher learning, no longer works. For all the "so called" professionals that act as gatekeepers for the establishment, the rewards from the system flow, as long as their loyalty, to the corporatist institutions remains. However, for all the ordinary college graduates that seek a better life through hard work, the prospect of entering the inner circles of the "golden parachute" is elusive.

Earning your way to the top may motivate the most competitive of type A personalities, but the survival of the most ruthless is no standard for a free society. The wisdom that college is supposed to share is not valued much in global business.

Some will conclude that only practical disciplines like engineering, accounting or medicine have pragmatic worth. Nevertheless, the systematic dismantling of the domestic economy is intrinsically responsible for the lost opportunities that can benefit from a work force of college graduates. Look no further than to the study of law for a primary reason for the sharp delineation in the lower ing of living standards.

The economics of college do not work for most students because the costs of the educational electives are void of entrepreneurial content. Transacting business commerce is still the fundamental activity in earning a living. As with any economic deal, both parties need to come away from the undertaking with a sense of satisfaction. Where is the gratification from flipping burgers in order to make your student loan payment?

The knowledge gained from the university exposure of classic studies is invaluable in the life of any adult. However, the cruel costs many colleges charge for that experience, have more to do with inflated institutional egos, than teaching developing intellectual minds.

As long as college graduates are prime victims of declining middle class prospects, the indebtedness of tuition bills will burden their futures. The solution is to grow a domestic economy based upon independence in manufacturing and self-sufficiency. Attending college on loans is a very bad decision. The money spent for a useless degree is better spent on buying or starting a business.

James Hall

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2012 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.