Gold to Rise to $1,850 On Inflation and Currency Debasement

Commodities / Gold and Silver 2012 Mar 23, 2012 - 06:59 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,651.00, EUR 1,246.04, and GBP 1,040.85 per ounce. Yesterday's AM fix was USD 1,636.00, EUR 1,243.16 and GBP 1,035.97 per ounce.

Gold’s London AM fix this morning was USD 1,651.00, EUR 1,246.04, and GBP 1,040.85 per ounce. Yesterday's AM fix was USD 1,636.00, EUR 1,243.16 and GBP 1,035.97 per ounce.

Silver is trading at $31.65/oz, €23.92/oz and £19.99/oz.Platinum is trading at $1,617.00/oz, palladium at $649./oz and rhodium at $1,425/oz.

Gold fell 0.41% or $6.80 in New York yesterday and closed at $1,642.50/oz. Gold traded sideways in Asia overnight and rose in European trading which has gold now trading at $1,650.89/oz.

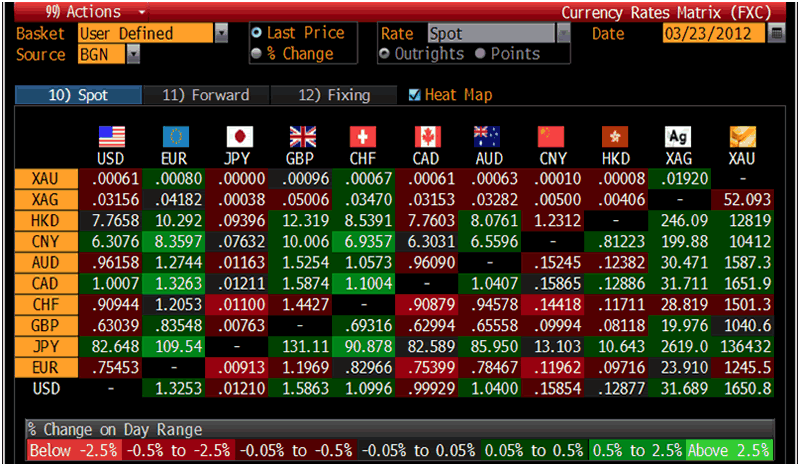

Cross Currency Table – (Bloomberg)

Hopes that the US economy is recovering and that the Eurozone debt debacle is over has led to increased risk appetite in recent weeks. This sent gold to a 2 month low yesterday.

Gold has fallen 2.8% so far in March. This has been attributed to Fed Chairman Bernanke denying that QE will take place.

Investors will be watching the fund flows to see if large institutions and hedge funds are increasing or reducing allocations to gold ETF’s which could influence prices.

ETF gold demand has remained strong and “sticky” showing that most buyers are long term and passive in nature and not speculators, traders or paper players who use the COMEX and futures markets to get exposure to gold.

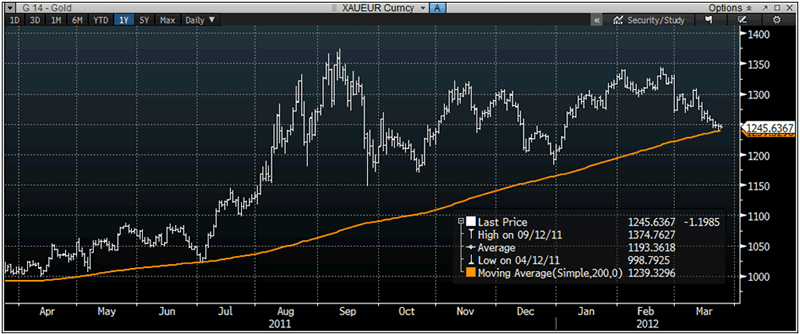

Technicals: Euro Gold Testing Support at 200 DMA - EUR 1,239/oz

Gold’s technicals remain poor and prices are heading for their fourth straight week of losses. This is particularly the case in US dollar terms due to the recent period of dollar strength.

XAU-EUR 1 Year Chart – (Bloomberg)

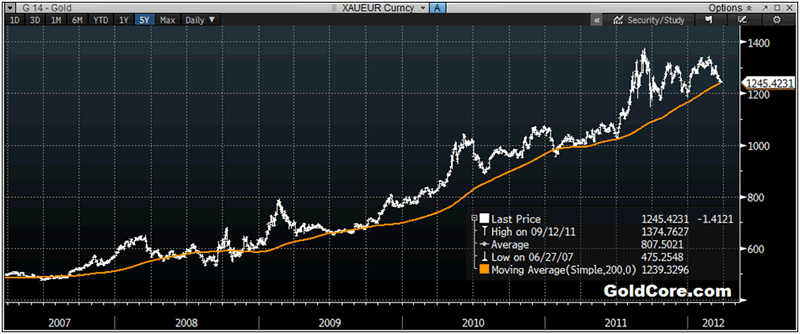

However gold’s technicals in euro and other fiat currency terms are not as poor. Euro gold support is at the 200 daily moving average (DMA) at EUR 1,239.35/oz. As can be seen in the charts buying euro gold at the 200 DMA has been prudent in recent years. For those wishing to time the market this is another good buying opportunity.

Gold continues to climb the classic bull market ‘wall of worry’ and this has all the hallmarks of yet another period of correction and consolidation prior to further depreciation in the euro and other fiat currencies.

From a contrarian point of view, as long as the words ‘fiat’ and ‘debasement’ remain taboo in the popular press and media, gold’s bull market seems assured.

Gold +15% To $1,850/oz in Q2 On Inflation and Currency Debasement - BARCAP

Barclays Capital see this most recent sell off as an opportunity to buy gold.

With gold prices are at their lowest since January, Barclays Capital are buying the dip as they expect gold to rally around 15% to $1,850/oz by the second quarter due to currency debasement and inflation worries.

XAU-EUR 5 Year – (Bloomberg)

BarCap said it expects precious metals to be one of the commodity price leaders in the second quarter, citing the "resumption of the kind of currency debasement/inflation concerns that have been the big driver of gold and silver prices over the past 12 months".

It recommended that investors take a long position in December 2012 palladium, saying lower Russian exports should push the market into a supply deficit and bring prices "significantly above current levels" by later this year.

BarCap put a second-quarter price of $745 per ounce for palladium futures on the London Metal Exchange, versus the past four weeks' average of $701. Spot palladium on the LME hit a session bottom below $645 on Thursday

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.