Why the World Economy Won’t Collapse, Bullish for Stock Stocks

Stock-Markets / Stock Markets 2012 May 03, 2012 - 08:52 AM GMTBy: Brian_Bloom

Arising from my last week’s blog, a reader sent me the following link: Bond, Stock & Gold Market Update - Lundeen

Arising from my last week’s blog, a reader sent me the following link: Bond, Stock & Gold Market Update - Lundeen

He also posed a particularly interesting question (paraphrased): “If Mr Lundeen’s conclusion regarding rising risks in the bond markets is correct, is it possible (maybe even likely) that – if money fleeing the bond markets was to seek alternative investment avenues – all three of the equity markets, the commodity markets and the gold market might rise?”

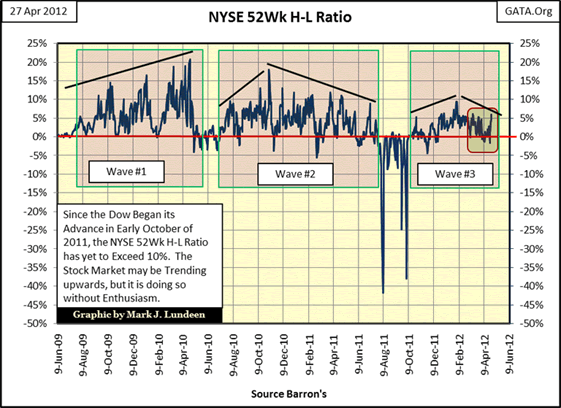

I found Mr Lundeen’s article very well thought through and, in particular, one chart caught my eye:

Clearly, the internals of the equity market are far from robust. There is also a subtlety inherent in this chart: It shows three waves of activity since June 2009.

“Primary Direction” markets are typified by 3 primary waves and two secondary reaction waves. “Secondary Direction” markets are typified by two main waves and one reaction wave.

With this in mind I can’t be sure if the information above (contained within three waves) is an aberration or whether it is a highly relevant driver. But, regardless of whether the above is consistent with the greater “wave” pattern of the markets, the fact that the H-L Ratio has never reached more than 20% since June 2009 seems very significant – particularly when seen in context of the fact that the $SPX has not yet reached a new high. i.e. It seems reasonable to conclude that equities are not in a Primary Bull Market. This would be consistent with Dow Theory, which would require, amongst other things that both the Industrial Market and the Transport Market should rise to new highs from a base of exceptional value – defined as dividend yields of around 6%.

That being the case, it seems more appropriate to categorise the move since 2009 as a secondary upward reaction in a Primary Bear market. I have never disagreed with that argument. In fact, the argument – to which I still subscribe – was the source of two significantly wrong calls on my part when I underestimated the resolve of the authorities to spruik the markets. The issue, as always, will be one of timing.

For the record, my errors were these:

1. I thought the 2003 low would be penetrated on the downside following the Global Financial Crisis in 2008.

2. We are currently witnessing a “third” up wave in what should, technically speaking, be an upward reaction that had two main waves. That third wave “should” not have happened. i.e. The peak of early 2011 “should” not have been penetrated on the upside.

Explanation:

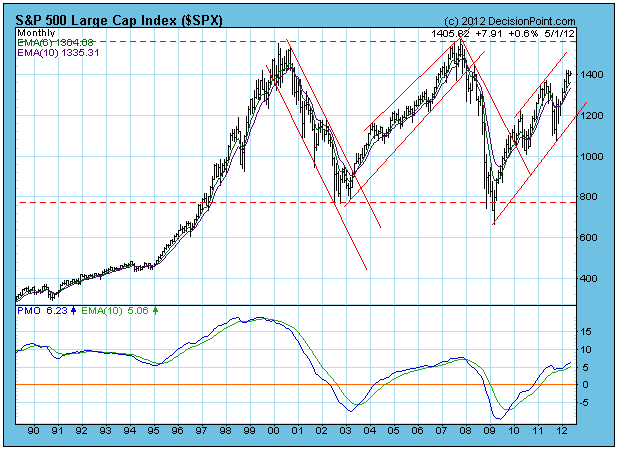

If the market moves in a 1-2-3-4-5; 1-2-3; 1-2-3-4-5 fashion, and, if we are in a Primary Bear Market, then we should see three down waves and two upward reactions. By reference to the chart below (courtesy DecisionPoint.com), it can be seen that if we are in a Primary Bear Market, there needs to be at least one more Primary down-move.

If the year 2000 was “the peak” of the Primary Bull market then wave 1 on the down move ended in 2003, wave 3 ended in early 2009 and wave 5 is yet to manifest – because Wave 4 is still forming. But, as mentioned earlier, Wave 4 should not have three up-legs. That was the source of my second error.

The weakness of the market’s internals is confirming for me that we are indeed in a Primary Bear Market but that the external interference by the authorities is serving to create a technical smokescreen. That is why it is so important not to argue with the markets.

In context of the P&F charts calling for a continuing bull market – referred to in my blog of last week - what the P&F charts seem to be saying is that the Secondary upward reacting wave still has some way to run. (Of course, if the wave rises to a new all time high and is confirmed by the transports, then this wave may be Wave1 of a new Primary Bull Market – but I can’t see that happening based on visible evidence and it would be inconsistent with Dow Theory’s requirement to have high underlying value in terms of dividend yields.)

So, to put some boundary walls around the thought processes: Whilst the US equity markets are giving off buy signals, all my thoughts are in context of what I remain convinced is a prevailing Primary Bear Market.

Whilst I won’t bet on it, it seems unlikely that the equity markets will reach new highs. More likely, it seems to me that the rises are being caused by some “feelings” of optimism flowing from activity in the energy industry/ies and supported by generalised spruiking by the PPT as the US economy seems to be bottoming – for the time being. We should bear in mind that there is a Presidential election coming up.

Now, turning to the point raised by the reader regarding the vulnerability of the bond markets. He made the following statement:

“The obvious part of the bond markets that could take the hit are the sovereign bonds (particularly the European bonds), the US Municipal bonds and the corporate bonds that were less than AAA rated. “

Mr Lundeen spoke specifically about tax free municipal bonds being a high risk proposition – which is why the yields are higher than on taxable Best Grade Corporate bonds. I agree with the reader’s observation: Logic dictates that some European country sovereign bonds will also be perceived as high risk.

However, the Achilles heel of the argument he put forward (it may be true but if it is not true then, in my view, that is where the flaw will manifest) is that it doesn’t follow that sovereign US bonds will be perceived as too high a risk for investors to hold onto. Until that happens, it will be business as usual.

What is business as usual?

In the grand scheme of things, there should still be a “ladder” of yields with the lowest risk investment showing the lowest yield; and the highest risk investment demanding the highest yield. In short, the ladder arises from a concept call risk-weighting.

In very simplistic terms:

Traditionally, the “risk ladder” has had long dated sovereign US government bonds at the bottom rung – at (say) 4% p.a.

The stock market (dividends plus capital gains) has been perceived to have around three times the risk, so the risk weighted ROI of equities has been (say) 3 X 4% = 12% p.a.

Venture capital has been perceived to have a risk that is around three times that of the stock market. So the minimum risk weighted return on investment typically demanded by a Venture Capitalist will be around (say) 3 X 12% - = 36% p.a.

Maybe high risk municipalities will have to pay somewhere between 12% and 36% p.a. to attract capital. Alternatively, if they can’t attract it all then they may have to be backstopped by a Federal Government “partial” guarantee. The alternative is that entire cities and some states may go into decay.

What the reader was contemplating as a possibility – namely a simultaneous collapse of the bond markets and rises in all three of the equities, gold and commodities markets has an implicit underlying assumption: The assumption is that “return on investment” will become less relevant than “wealth protection”. i.e. The assumption is that it will no longer be “business a usual”.

As a general statement, if the world economic system implodes, then a paranoid fixation on capital preservation will be true for the 1%. The other 99% will become fixated on the need for cash flow and income to cover day to day expenses. This group will likely be forced to live off capital and will be net sellers of all forms of assets, gold, bonds and housing included.

Of course, if you get your timing right – assuming there is going to be systemic collapse – then you could make a fortune if you buy gold as it explodes upwards. In my view, that will require more luck than judgement.

And there is also another dimension to this: If you are in the 1 % and you are in capital preservation mode in a world that is collapsing around your ears, then – by definition – you will not have faith that some third party can be trusted to warehouse your assets if you buy commodities. You will want to take delivery of your commodities. Where will the average 1% person keep thousands of tons of copper (for example)? It seems to me that in a scenario where the system implodes, gold may or may not explode but commodities are likely to implode with everything else – including bonds and equities.

The issue on which I have been focusing is that many people – who typically form part of the 99% - have been speculating that such an explosion in the gold price would be imminent; and the proportion of the 99% who think this way has been increasing since 2000. It seems to me that the “many” may have become “too many”. The gold market is currently being driven as much by speculation as by fundamentals at present.

In this context, if the “day of reckoning” is postponed, and income continues to be an issue, then the speculation in the gold market needs to be washed out before the gold price continues to rise seriously. Those same people are going to need cash flow to live. Those are the people who will be wiped out.

So, this brings us to the question: How close are we to a day of reckoning?

I watched the interview with Ms Kudlow – link provided in Mr Lundeen’s article – and noted that it took place a some time ago i.e. Some people thought then that the day of reckoning with the tax free muni bonds was imminent. It hasn’t happened yet.

Nevertheless, even if the yields of tax free muni bonds explode upwards because some municipalities and even states go insolvent, why would it follow that yields on Federal Government bonds would skyrocket?

Frankly, I think that the arguments regarding a systemic collapse are both premature and excessively pessimistic and, even if they were accurate, then nothing anyone can do (including the 1%) will stave off a consequential collapse of the world’s economy. And, if the world economy collapses, what would be the benefit of owning gold when it won’t be able to buy you anything except on the black market?

Clearly, to me, rampant printing of fiat money will inevitably lead to systemic collapse. And if an ordinary bloke like me can see it then why should we assume that the 1% cannot see it. And, if the 1% can see it, then why would they do that (drown the world economy in fiat currency)? To assume that they will do that is to assume that they are stupid. I may not agree with Bernanke or Geithner or whoever else is taking these politically driven decisions to spruik the markets and the economy but the last thing I would accuse these people of is “stupidity”.

In summary, the charts are telling me that the current secondary up-move in the Primary Bear Market will continue for the foreseeable future and that the markets are not expecting rampant inflation. I have argued with the market twice before since 2008. I won’t do it a third time.

My guess is that at or soon after the presidential elections, a dose of reality will likely emerge and the “final” Primary down leg will emerge – which will become visible on the charts. That leg will be extremely painful for everyone. It will be deflationary and it will continue – on and on and on until the sovereign debt overhang problem is finally resolved. It may take upwards of 15 years before the next Primary Bull Market emerges.

My guess is further, that if/when the Bull Market emerges it will be at a shallower angle of incline to that which prevailed between 1933 and 2000. The depths to which the third primary down leg will plumb will be a function of how “neatly” the sovereign debt issue is addressed. It also seems to me that, because “real” growth is now trending towards population growth and productivity savings, (as demonstrated in last week’s blog) there will be not much purpose served in continuing to print excessive amounts of money. Economic activity will remain growing slowly and, therefore, demand for excessive amounts of capital will abate (after the current debt has been repaid). Therefore, the “ladder” of risk will shift downwards in the foreseeable future. Maybe Government bonds will be 2% and the market will yield 6% and venture capitalists will demand 18%. Or maybe it will be 1%, 3% and 9%. Who knows? Whatever happens, it will be painful for retirees. That it must happen, fundamentally, is being dictated by the amount of sovereign debt that needs to be serviced.

In my mind, the neatest way to clear the sovereign debt decks (and minimise the impact of an all-out Depression) will be “equity for debt swaps” and, in The Last Finesse, I make a suggestion regarding how up to a 1/3 of all global sovereign debt might be taken off the books in this manner.

Ultimately, the reason I am optimistic about the long term future is that the depth and breadth of new technologies currently under development is breathtaking. There will be two limiting issues: Resource availability and the need for a greater emphasis on ethical behaviour.

For the purposes of disclosure: I stopped trading on the markets some years ago – long before the GFC manifested – because the short term charts were becoming unreliable in their signals. Since then, my spare capital has been diverted to buy-and-hold situations that require an enormous amount of patience – which I happen to have. These investments were made in anticipation of the underlying companies eventually becoming cash cows. I continue to watch the charts from a long term, strategic perspective and will continue to comment thereon.

Brian Bloom

Author, Beyond Neanderthal and The Last Finesse

In the global corridors of power, a group of faceless men is positioning to usurp control of one of the world’s primary energy resources. Climate change looms large. Can the world be finessed into embracing nuclear energy? Set in the beautiful but politically corrupt country of Myanmar, The Last Finesse, through its entertaining and easy-to-read storyline, examines the issues of climate change, nuclear energy, the rickety world economy and the general absence of ethical behaviour in today’s world. The Last Finesse is a “prequel” to Beyond Neanderthal, which takes a right-brain, visionary look at possible ways of addressing the same challenges. The Last Finesse takes a more “left brain” approach. It is being published in all e-book formats.

Copyright © 2012 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.