Fed Following Short-term Money Market Interest Rates Towards US Recession

Interest-Rates / US Interest Rates Jan 26, 2008 - 02:08 AM GMT

I have said multiple times in the past that the Federal Reserve doesn't lead with interest rate cuts. It follows. The proof is in the chart to the left, which compares the 3-month Treasury Bill Discount Rate to the Federal Funds Rate (blue) and the Fed Discount Rate (red). What this indicates is that there is more room to cut interest rates next week.

I have said multiple times in the past that the Federal Reserve doesn't lead with interest rate cuts. It follows. The proof is in the chart to the left, which compares the 3-month Treasury Bill Discount Rate to the Federal Funds Rate (blue) and the Fed Discount Rate (red). What this indicates is that there is more room to cut interest rates next week.

But this chart has a darker message , too. The flight to safety in short-term money market funds is a leading economic indicator of a recession.

The largest carry trade of all.

The Federal Reserve has a monopoly on borrowing short-term funds from the U.S. Treasury (at the 3-month T-Bill Rate) and lending them to other banks at the Fed Discount Rate (red). Their ability to do this is unlimited and risk-free, since they can demand only the best collateral for their loans to member banks. Remember, the Federal Reserve is in reality a private consortium of banks with a Federal Charter. They are in business for a profit. They will not risk their capital to save the banking system.

End of the decline? Not so fast!

Rather than review all the arguments why the bear market isn't over, I'd like to direct you to Planet Yelnick , where I have posted my most recent thoughts about the decline, so far. The markets started off the day, trying to extend the gains for a third day. Unfortunately, the gains may not hold to the end of the day. The reason? Impulse waves rarely overlap one another. A sure sign that we are still in a decline would mean a failure of the rally to overtake the last wave.

Rather than review all the arguments why the bear market isn't over, I'd like to direct you to Planet Yelnick , where I have posted my most recent thoughts about the decline, so far. The markets started off the day, trying to extend the gains for a third day. Unfortunately, the gains may not hold to the end of the day. The reason? Impulse waves rarely overlap one another. A sure sign that we are still in a decline would mean a failure of the rally to overtake the last wave.

The bond market revolts over the stimulus package.

According to MarketWatch , treasury bonds are down as a result of the gains in the stock indices made on the back of the Microsoft earnings. It is thought that optimism on Wall Street is the cause for higher bond rates as investors rotate back into stocks. There is darker side to that argument. Consider the plight of bondholders as they see the new stimulus coming into the economy from lower Fed Fund rates and tax rebates. That is considered inflationary and not friendly to bond investors.

According to MarketWatch , treasury bonds are down as a result of the gains in the stock indices made on the back of the Microsoft earnings. It is thought that optimism on Wall Street is the cause for higher bond rates as investors rotate back into stocks. There is darker side to that argument. Consider the plight of bondholders as they see the new stimulus coming into the economy from lower Fed Fund rates and tax rebates. That is considered inflationary and not friendly to bond investors.

Power shortages push gold higher.

Gold and platinum futures soared as power shortages forced the shut-down of South African mines. The mines are struggling with an aging infrastructure and coal shortages. The problems have no quick fix and may not be resolved for quite some time. South African mines are very deep, so they are at risk for the safety and productivity of their employees. Is this an opportunity for investors?

Gold and platinum futures soared as power shortages forced the shut-down of South African mines. The mines are struggling with an aging infrastructure and coal shortages. The problems have no quick fix and may not be resolved for quite some time. South African mines are very deep, so they are at risk for the safety and productivity of their employees. Is this an opportunity for investors?

The Nikkei rallies on Fed Rate cut…

..but the index is still down nearly 2% this week. The fears of a global economic slowdown were somewhat allayed when the Federal Reserve cut rates in an unscheduled meeting on Wednesday morning. On Thursday the White House announced that the Bush Administration and Congress had reached an agreement on an economic stimulus package . Now, if only the markets agree that the stimulus will work.

..but the index is still down nearly 2% this week. The fears of a global economic slowdown were somewhat allayed when the Federal Reserve cut rates in an unscheduled meeting on Wednesday morning. On Thursday the White House announced that the Bush Administration and Congress had reached an agreement on an economic stimulus package . Now, if only the markets agree that the stimulus will work.

Shanghai Express down 19% in two weeks!

The rally is barely clawing back a portion of the losses. This morning, the Chinese markets rallied only slightly, indicating no clear resolve by investors to jump back in after the hair-raising losses. China 's National Bureau of Statistics reports that the country's Gross Domestic Product grew by 11.4%. The risk of inflation overheating is a top concern for China 's central planners. The pattern suggests more declines coming soon.

The rally is barely clawing back a portion of the losses. This morning, the Chinese markets rallied only slightly, indicating no clear resolve by investors to jump back in after the hair-raising losses. China 's National Bureau of Statistics reports that the country's Gross Domestic Product grew by 11.4%. The risk of inflation overheating is a top concern for China 's central planners. The pattern suggests more declines coming soon.

Not everyone agrees with our economic recovery plan.

Eurozone bankers are dismissing the U.S. economic recovery plan and sticking with higher rates to combat inflation in the European community. This is putting some pressure on the dollar, since money invested in U.S. based interest-bearing paper is now seeing lower rates. Currency traders consider the Fed rate cut as an effective circuit breaker for the decline. However, it may not stop the market declines and global flight to the U.S. dollar.

Eurozone bankers are dismissing the U.S. economic recovery plan and sticking with higher rates to combat inflation in the European community. This is putting some pressure on the dollar, since money invested in U.S. based interest-bearing paper is now seeing lower rates. Currency traders consider the Fed rate cut as an effective circuit breaker for the decline. However, it may not stop the market declines and global flight to the U.S. dollar.

Meet a subprime poster child.

You've probably seen her on TV, or read about her in this newspaper. She's the single mom with three kids who just wanted to “ live the American dream, ” as she puts it. In December 2004, with no down payment and working as an assistant teacher, she signed on the dotted line for a $470,000 subprime mortgage on a house in Dorchester. Now it is in foreclosure. Should we support people like this?

You've probably seen her on TV, or read about her in this newspaper. She's the single mom with three kids who just wanted to “ live the American dream, ” as she puts it. In December 2004, with no down payment and working as an assistant teacher, she signed on the dotted line for a $470,000 subprime mortgage on a house in Dorchester. Now it is in foreclosure. Should we support people like this?

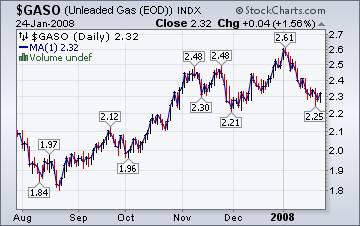

Gasoline prices lower in real and inflation-adjusted dollars.

The Energy Information's Weekly Report reports easing gasoline prices nationwide. The U.S. average retail price for regular gasoline fell for the second consecutive week to 301.7 cents per gallon as of January 21, 2008 , 5.1 cents lower than last week but 85.2 cents above a year ago. All regions showed price drops with the East Coast losing 4.6 cents to 306.2 cents per gallon. The Midwest fell 5.2 cents to 295.8 cents per gallon, 96.6 cents per gallon more than last year.

The Energy Information's Weekly Report reports easing gasoline prices nationwide. The U.S. average retail price for regular gasoline fell for the second consecutive week to 301.7 cents per gallon as of January 21, 2008 , 5.1 cents lower than last week but 85.2 cents above a year ago. All regions showed price drops with the East Coast losing 4.6 cents to 306.2 cents per gallon. The Midwest fell 5.2 cents to 295.8 cents per gallon, 96.6 cents per gallon more than last year.

Prices for natural gas remain flat.

The Natural Gas Weekly Update reports, “Despite the seasonably cold weather across much of the Lower 48 States, natural gas spot prices decreased at most markets on the week. Price decreases ranged between 1 and 48 cents since last Wednesday.”

The Northeast, however, reported a 22% increase in prices due to unseasonably cold weather.

We are now witnessing the unwinding of excessive leverage and speculation.

Alan Newman recently came out with the most researched article of late about the influence of leverage on the market. This is a must read.

“There is nothing the stock market hates more is uncertainty. At present, there is as much uncertainty as this writer has seen in more than forty years. The questions are many. Has the derivative crisis peaked? Is the table on page one simply a list of risk exposures or will some of the major players completely implode? Will the damage extend to money market funds? If so, how much pension money is at stake? How much of the average investor's cash reserves will be impacted?”

Weighty questions, indeed!

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I pre-recorded our weekly session on Wednesday about the markets. It was shockingly prescient. You will be able to access the interview by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.