US Dollar: Wave Counts, Flight-to-Safety?

Currencies / US Dollar Jun 28, 2012 - 03:37 AM GMTBy: Joseph_Russo

In light of how political systems have so utterly ruined the purpose and utility of the modern worlds essential and fungible units of exchange, and despite the oxymoron in our alluding to a flight-to-safety, we shall nonetheless endeavor to add a meaningful level of clarity to the disposition of the US dollar.

In light of how political systems have so utterly ruined the purpose and utility of the modern worlds essential and fungible units of exchange, and despite the oxymoron in our alluding to a flight-to-safety, we shall nonetheless endeavor to add a meaningful level of clarity to the disposition of the US dollar.

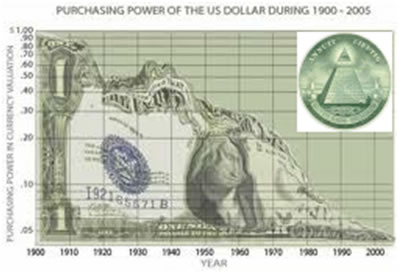

As graphically inferred by the articles introductory image, there is no doubt whatsoever that since its general inception, the US dollar remains by politically exploitive design, enmeshed in a long-term secular decline toward oblivion.

The end game will play out like those of all other fiat currency throughout humankind’s history, which shall of course lead to an outright failure and the existential necessity for the country (or world) inevitably to

manufacture and adopt a suitable replacement.

Perhaps one day in the distant future, if we survive in a superior form of existence beyond that which we have thus far achieved, humankind might somehow be able to transcend and civilize itself in such a manner that would not require a medium of exchange, at least as we currently know it.

If at all plausible, it will be a long, long, time from now before such a civilization could manifest. Until then, we have no choice but to deal with the numerous factions of failing and damaged paradigms that define the world and the immediate future that lies ahead of us.

The larger question relative to the recent dollar strength, which is arguably invoked by a false sense of safety (due to no other recourse of widespread merit) - is how far such perceptions of safety might carry the rebound in the value of the world currency.

This is a valid question to ponder, especially amid the uncertain backdrop of plausible contagion sparked by global failures unfolding from the inevitable result of corrupt, centrally planned political economies based on infinite debt and infinite growth across the globe.

Because of its reserve currency status established in part from the spoils of World War I and World War II, the US has had, and is still clinging to an inordinate competitive advantage over the rest of the world; hence, the rational reflexive stampedes toward the US dollar and US treasury bonds as ports of safety.

Similar to the way in which no one can know the approximate time or exact tic where a bubble will crest its print high, nothing and no one can know how high the safety trade will carry the US dollar.

Only time in concert with the price action as it responds to the dynamism of unfolding events shall be the ultimate arbiter of just how high the dollar might rise in the near and distant future.

Rather than torturing our subscribers, you the reader, or ourselves with the plethora of unnecessary hair-splitting minutia associated with the multitude of possible wave counts, rules, etc., we instead use the theories general and most practicable tenets along with other such tools in order to simplify our delegated tasks. The result of such sanity enables one to keep their primary focus on what really matters most.

For those who wish to peruse our Elliott Wave thesis on the chart above, you can click here and again here, to open articles penned in 2007 and 2010, both of which express wave counts formulated several years prior that are still applicable, valid, and currently in force until the reality of future price action dictates otherwise.

A properly assembled Elliott Wave framework empowers one to generate a broader visual structure for observing the more important behavior of the price action as it unfolds in response to fundamentals and various levels and degrees of statist interventions, and the effects of such on economic agents responding to the price mechanism.

Success in “letting go” of splitting hairs about the multitude of nuances of the “theory,” empowers those who observe such work to more confidently monitor the evolution of the price action relative to the framework provided without freaking out about the character and degree of importance given to a reference label placed atop or beneath a given price pivot.

Instead of making matters more complicated than they need to be by placing too much emphasis and misguided focus on “getting the wave count right,” we much prefer to use the theories dynamic and flexible tenets in an anticipatory fashion that is one step removed from such distracting, wasteful, and energy draining minutia.

Simply put, we maintain an impartial though subjective framework of wave counts until the price action dictates that we modify it. As such, the predictive aspects of Elliott Wave theory remain such only so long

as the price action generally conforms to ones subjective framework.

The chart above exemplifies our approach. We inherit the daily wave analysis by way of the larger structures we have already established from the long-term secular chart. This daily chart and the descriptions that follow focus upon the most recent fluctuations in the price level from the cash print low of 72.70 produced on May 4, 2011.

You may read the balance of this article here…

Until then,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.