The Gold Cycles: Short and Long Term Outlook

Commodities / Gold and Silver 2012 Aug 31, 2012 - 06:35 AM GMTBy: Submissions

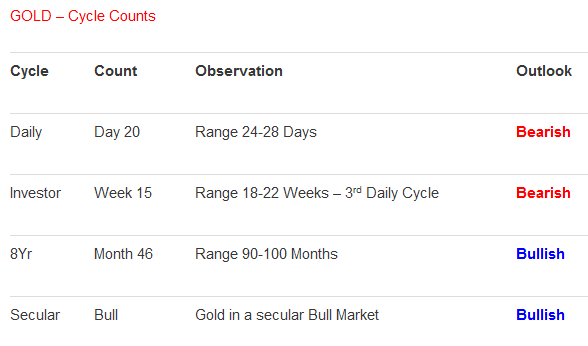

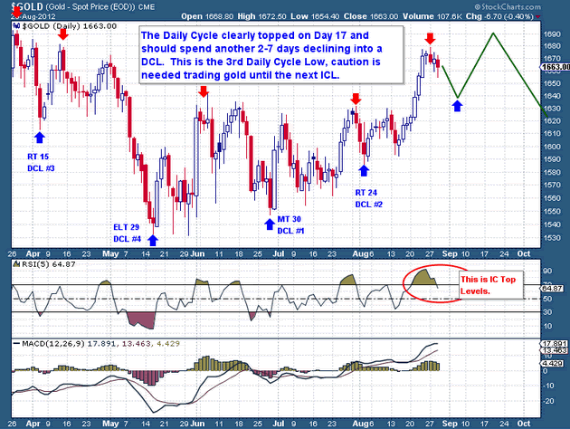

Kudos to gold and its ability to rally after what had been a stretch of fairly average action. The mini breakout by gold has broken the long running series of lower Daily Cycle tops, a positive development that will need to be sustained if we’re to see Gold begin to move higher over time. For now though, Gold has pushed into the extreme overbought areas which most often result in a decent sell-off and retracement into a Cycle Low. Especially as this is the 3rd Daily Cycle, these tend to be volatile and erratic Cycles with significant gains, but with a tendency to give back much of the gains.

Kudos to gold and its ability to rally after what had been a stretch of fairly average action. The mini breakout by gold has broken the long running series of lower Daily Cycle tops, a positive development that will need to be sustained if we’re to see Gold begin to move higher over time. For now though, Gold has pushed into the extreme overbought areas which most often result in a decent sell-off and retracement into a Cycle Low. Especially as this is the 3rd Daily Cycle, these tend to be volatile and erratic Cycles with significant gains, but with a tendency to give back much of the gains.

Unless this is the beginning of a lockout like rally or clandestine new Investor Cycle, we should respect the current Day 17 top that pushed the oscillator needles into much overbought territory. In almost every case where a 3rd (or any) Cycle finds itself at these levels on Day 17, it has marked the top of that Cycle. From here the most logical DCL levels to watch are the $1,633 (prior DC High) to the $1,642 (Prior IC High) area; this would be my minimum DCL retracement area.

The real bright spot coming from the breakout is what we see on the weekly (Investor) charts. If you recall (old chart below) Gold was sitting on a Week 3 high with Daily Cycles forming lower than the prior Cycles. I presented two possibilities, the one where new highs above $1,642 were not made; this would send Gold down in a Left Translated Cycle (black line) and bring the D-Wave scenario back on the table. But if the Weekly Cycle could close comfortably above the $1,642 area, it would create a Right Translated Cycle and with it “a real hope” that we’re embarking on a set of Right Translated Investor Cycles. This positive breakout has resulted in an Investor Cycle with a Week 15 Top, the type of RT Cycles you see during C-Waves. In fact this is the most Right Translated Cycle we have seen since 2010 and it could be setting the scene for a new wave of C-Wave Cycles to come.

I really cannot tell you what this means for this current Gold Investor Cycle. Typically the coming 4thDaily Cycle should be a non-event, a true Left Translated Cycle. It’s where Investor Cycles typically burn the later-comers and speculators in preparation for the next wave of Right Translated Daily Cycles. But the FED and ECB have the power to influence the Gold Cycles here and the Dollar could well have one big drop to come. The Gold Cycle could run well into the Week 22-25 area which would comfortably support a 5th Daily Cycle sometimes seen in Right Translated Cycles. If that were to occur, there is no reason why a powerful $100 move could not come out of the 4th DC.

Trading Strategy – Gold/Silver

This is a tricky environment here my fellow members, Gold is not going to simply get on all 4’s and invite you to ride this bull market. We’re going to miss some moves, get stopped out early, or be late to the party. That’s the simple truth of investing, the sooner we accept this fact, the more of our mental capital we could have focused on what lies directly ahead, not what could have, would have or should have occurred!

As for this current action, I’m going to break my own trading rule here and plan to buy the coming 3rdDCL. I always advocate not buying the 4th Daily Cycle as they typically fail quickly. But for reasons outlined in the Cycle Analysis portion, this is not a normal environment and it compels me to override the “automatic pilot” features of this plan to some degree. My plan is to buy a coming recognizable DCL as quickly as possible and then place a stop at a safe distance below. The trade will not be large and I will strive to raise the stops to the point where breaking even is the worst case. I know stopping out of larger positions is becoming a real drag on gains, so we’re going to position to capture a strong surge, but avoid getting cut deeply from a stopped trade. This is not a significantly leveraged trade and timing could become the difference here. If you’re not “available” to move quickly on this one, it might just be best to wait it out or up your “core holdings”.

This is an excerpt from the midweek premium update from the The Financial Tap, which is dedicated to helping people learn to invest and grow into successful investors. They provide cycle research on a number of markets through mid/weekend updates and trade alerts with entries and exits. Click here to learn more about how The Financial Tap can help you have success in the markets.

Source - http://goldsilverworlds.com/gold-silver-price-news/the-gold-cycles-short-and-long-term-outlook/

© 2012 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.