Gold is the Ultimate Crisis Barometer

Commodities / Gold and Silver 2012 Sep 06, 2012 - 02:32 AM GMTBy: Clif_Droke

Gold's latest rally - and the dollar's recent decline - has the investing world buzzing with speculation as to the meaning behind it. Convention wisdom says that gold senses another round of loose money on the part of the world's leading central banks. But what few investors have considered is that gold is most likely serving its role as a crisis barometer, warning of trouble ahead on the economic horizon.

Gold's latest rally - and the dollar's recent decline - has the investing world buzzing with speculation as to the meaning behind it. Convention wisdom says that gold senses another round of loose money on the part of the world's leading central banks. But what few investors have considered is that gold is most likely serving its role as a crisis barometer, warning of trouble ahead on the economic horizon.

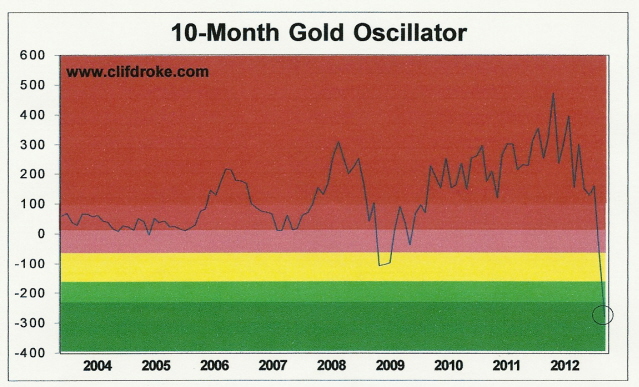

There's no denying that gold is riding a wave of momentum born of a deeply oversold technical condition from earlier this summer. As we discussed back in July, the 10-month price oscillator for gold hit an historic "oversold" reading of negative 227, which is the most sold-out reading in over 10 years for the metal. This more than any other factor set the stage for gold's explosive breakout in August.

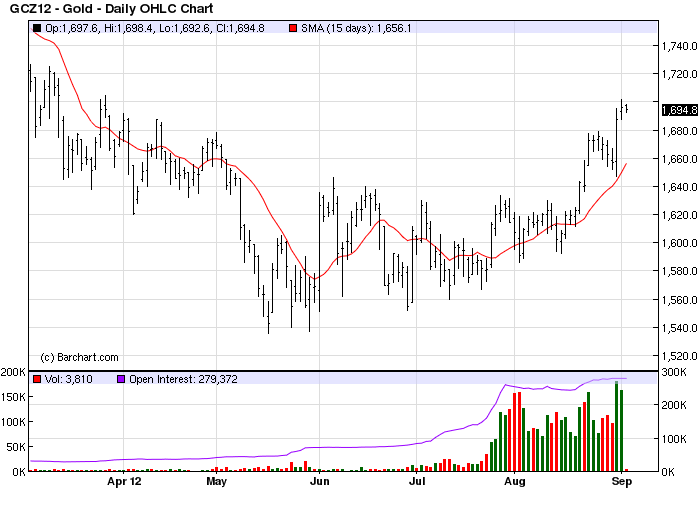

The oversold technical condition gold was in during July and August provided the pretext for the breakout, but the catalyst for the rally was a weak dollar. Investors have been trying to discern the reason for the dollar's weakness. The most likely explanation is that the market is being influenced by rumors of a third quantitative easing initiative (QE3) by the Federal Reserve. The Fed has done little to discourage these rumors; at last week's meeting of central bankers in Jackson Hole, Wyo., Fed chief Bernanke asserted the Fed stands ready to help stimulate the economy whenever necessary. He was short on specifics, however.

The QE3 rumor gained additional notoriety this week when PIMCO's Bill Gross stated his opinion that the Fed would announce more quantitative easing "relatively soon." This naturally attracted the attention of resource investors, who expect that another Fed intervention will dramatically inflate resource prices even further.

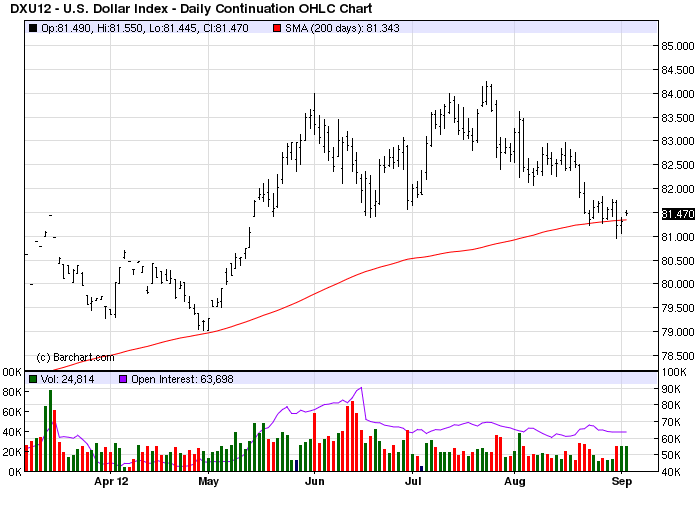

Between rumors of QE3 and a bond-buying plan on the part of the European Central Bank (ECB) to help save the euro zone, both the dollar and the euro currency have responded as if the rumors were gospel truth. The dollar has plunged from its 2-year high in July and is struggling to remain above the widely watched 200-day moving average (see chart below). Since gold tends to trade inversely to the dollar, the dollar's weakness has benefited gold.

Meanwhile the euro has gradually strengthened in recent weeks as talk of another euro zone bailout gains credibility with investors. Investors on both sides of the Atlantic are acting as if a bailout for both the U.S. and the euro zone economies is a foregone conclusion. Market empiricists interpret the action of gold, the dollar and the euro as undeniable proof that a third round of monetary stimulus is coming. "The tape doesn't lie!" they like to quote from the old Wall Street bromide. These investors would do well to remember Jesse Livermore's retort to this platitude: "The tape doesn't always tell the truth on the instant."

Rather than anticipating QE3, is it not possible that gold's rally is instead the result of "smart money" investors foreseeing economic trouble on the horizon after the election is over and the 4-year cycle has peaked? Indeed, gold could be fulfilling its safe haven status in typical preliminary fashion as savvy investors foresee the end of the financial market and economic recovery by early 2013. This is when the market enters the final "hard down" phase of the Kress economic long-term cycles.

Such a preemptive rally on gold's part is not without precedent. A similar rally occurred in 2001 as gold responded to the bear market and economic recession brewing at that time by commencing a new bull market.

It's no secret that one of gold's best attributes is as a barometer of economic crisis. It would appear that the yellow metal is once again serving this function.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.