Gold Bull Market Opposing Forces

Commodities / Gold and Silver 2012 Oct 06, 2012 - 07:06 AM GMTBy: Clif_Droke

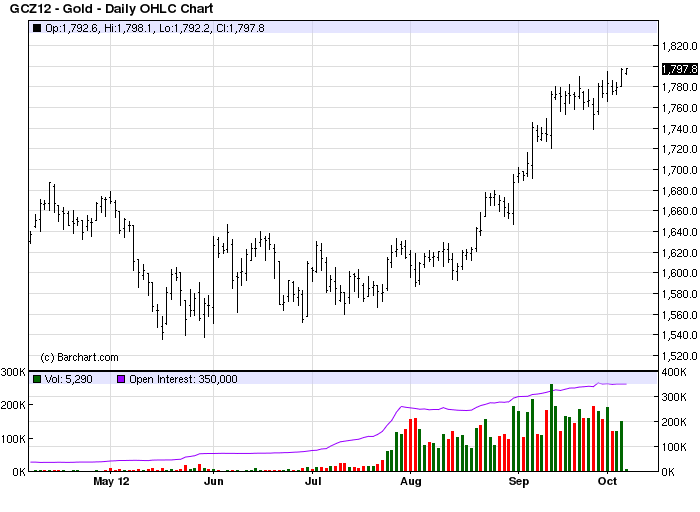

What accounts for gold's strong performance since the initial rebound in July? That's the question that many analysts are (belatedly) trying to answer. The first and most obvious answer is stimulus; specifically the stimulus provided by the world's leading central bank in the U.S. The Federal Reserve's latest bond-buying scheme known as QE3 is to date the biggest stimulus aid that has had an impact in boosting the gold price.

What accounts for gold's strong performance since the initial rebound in July? That's the question that many analysts are (belatedly) trying to answer. The first and most obvious answer is stimulus; specifically the stimulus provided by the world's leading central bank in the U.S. The Federal Reserve's latest bond-buying scheme known as QE3 is to date the biggest stimulus aid that has had an impact in boosting the gold price.

As we all know, gold loves inflation and any increase in monetary liquidity in the global financial system will be reflected in an increasing gold price sooner or later. Analysts have noted that the gold price has recently increased in, Euro, Swiss Franc and Indian Rupee terms, which indicates monetary stimulus particularly benefits gold. As bullion broker Sharps Pixley observed, "This is not just a weak dollar story."

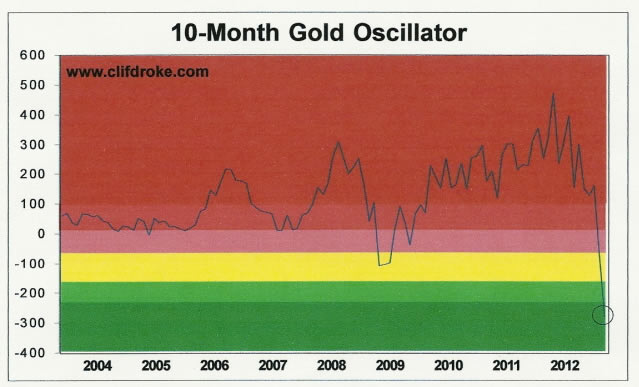

On a more technical level, the explanation you've heard me repeat since earlier this summer is that gold was oversold on a multi-year basis. According to the 10-month price oscillator for gold, gold reached its most sold out reading in at least 10 years a few months ago and this preceded the run-up in the gold price that has occurred since July. I've incorporated the 10-month oscillator in this report since at least 2003 and it has proven its merit as an intermediate-term gold price indicator time after time. Although it isn't used as a short-term turning point indicator, it has an unparalleled record for accuracy when it comes to predicting critical junctures in the gold price performance on a multi-month basis.

Another reason that some experts attribute to gold's strong performance lately involves China's economic outlook. According to Bloomberg, the August Chinese year-on-year industrial profit net income fell for the fifth month by 6.2 percent. As Sharps Pixley pointed out, "With the prospect of not hitting its 2012 growth target, the Chinese government may announce further stimulus and rate-cutting measures and IPO reforms to boost growth and rescue the stock market." The firm observed that such speculation has boosted gold prices in recent days.

It should also be pointed out that China, as a leading consumer of gold, would be likely to increase its gold consumption if its economy is revived through the monetary stimulus route. It's possible that gold's rally is, at least in part, an anticipation of this eventuality.

Despite all of this, gold's latest outperformance isn't merely a response to central bank stimulus. One of gold's primary roles in times of core economic deflation, which we've been experiencing in recent years, is that of a financial safe haven. Simply put, investors flock to gold in times of monetary chaos and economic uncertainty which gives gold a "fear premium." Gold feeds off fear in deflationary times since the "hot money" which flows from investors leaving the dollar helps to create sustained forward momentum on a longer-term basis for the yellow metal.

The latest round of global fear has been sparked by Spain and its refusal (to date) of the terms for a sovereign bailout. The bailout that Europe seeks to impose upon Spain is intended to help solve the country's debt crisis. As it turns out, Spain's refusal to seek the bailout is holding up the stimulus for the rest of the troubled euro zone. European Central Bank President Mario Draghi stated recently that the ECB won't start intervening in bond markets until Spain requests a bailout and agrees to the conditions imposed by the central bank.

Moreover, an ECB news release stated that request for help is only one "necessary condition" for receiving a bailout, implying that other conditions might also need to be met before the ECB is ready to intervene. What this means is that the global financial system isn't fully benefiting from the promised stimulus yet. That's one reason why investors are still panicky about Europe and are still piling into gold in spite of the lack of a coordinated global stimulus.

The opposing forces of illiquidity, and the fear it's breeding in Europe, and the liquidity provided by QE3 has conspired to create the "perfect storm" for a gold price rally. Thus we find that gold is being driven by two contradictory forces, namely fear and greed. Regardless of which of these two motive forces ultimately prevails, gold should continue to benefit at least until the long-wave deflationary cycle bottoms in late 2014.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.