Your Golden Worth

Commodities / Gold and Silver 2012 Oct 15, 2012 - 12:24 PM GMTBy: DeviantInvestor

Gold has been wealth and money, a store of value, and a means of exchange for more than 3,000 years. Only recently has debt been widely considered wealth. A US government T-Bond is considered “wealth” because the government promises to repay the loan with interest. Similarly, a corporate note is “wealth” because the corporation has promised to repay the note with dollars, and those dollars are still considered valuable. (Dollars are accepted because dollars are accepted.)

Counterparty (the other party in the transaction) risk to your net worth and purchasing power is now more important than ever before! The counterparty to your investment could be the US government, the corporation that issued a bond, the Federal Reserve, a bank, a broker, a clearing house, or other financial business.

What happens if the government refuses to honor the T-Bond debt? What happens if the corporation becomes insolvent and can’t pay its debts? What happens if MF Global takes “segregated” customer funds and pledges them to a bank? MF Global may owe its customers money. However, if MF Global can’t or won’t pay, then the customer has experienced an unfortunate counterparty risk that was previously unknown or misunderstood. Counterparty risk can destroy your wealth and net worth.

Paper assets, such as stocks, bonds, derivatives, brokerage accounts, certificates, $100 bills, and other promises to pay, can become worthless. The government can devalue the currency and diminish the purchasing power of those paper assets to a tiny fraction of their previous value. The government could also collapse, and all previous government debts could be repudiated by the new government. These things have happened in other countries.

Many countries have replaced severely inflated currencies with “new” currencies worth 1,000 of the previous currency. Knocking off zeros from a national currency is common. The United States has not experienced severe inflation in over 100 years, so we forget that it is actually not unusual. But, severe inflation and/or hyperinflation in the United States are becoming more likely since all such inflations start with excessive government spending and “money printing” (Quantitative Easing – injecting liquidity into the financial system) and accelerate toward lost confidence in the currency. Your purchasing power and your real net worth in an inflating currency can diminish rapidly.

We can also lose net worth the old-fashioned way – our assets become less valuable. When the NASDAQ crashed in early 2000 from about 5,000 to about 1,000, many people lost a substantial portion of their paper assets. When gasoline subsequently increased in price from about $1 to $4, our paper assets lost much of their purchasing power for most other commodities. During such inflation, the purchasing power of our net worth will severely decline.

What if we measured our wealth, our purchasing power, or our net worth in ounces of gold, not dollars? This is an ancient idea based on the concept that gold has universal value while paper assets come and go and eventually decline in value to zero.

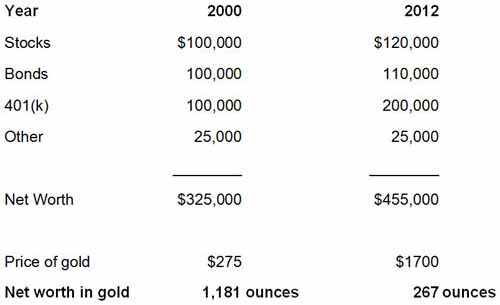

Simple Example

In this example, our net worth in dollars increased. However, when measured in ounces of gold, it decreased.

So what is your net worth when measured in gold? Is it increasing or decreasing? Are you confident that your paper assets are safe from both inflation and counterparty risk? Could those paper assets or the currency they are denominated in (dollars, euros, etc.) collapse in value? Would you feel safer if more of your net worth was invested in gold, which has NO counterparty risk?

Central Banks around the world and especially in the United States and Europe are creating a huge number of new dollars and euros in their efforts to reflate the banking systems and “paper-over” the insolvency of sovereign nations. Those newly created dollars and euros reduce the value of all previously existing dollars and euros, so we can be confident our dollars and euros will purchase less in the future. Similarly, we can be confident that more dollars and euros will be required to purchase an ounce of gold in the future.

What is your net worth when measured in ounces of gold? What is your golden worth?

Further information on gold and silver:

Debt Monetization: Legal Counterfeiting

Gold is TOO Expensive! I Can’t Buy Now. WRONG!

Dollar Depreciation – Slow or Rapid? What it Means for YOUR Purchasing Power!

GE Christenson

aka Deviant Investor

© 2012 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.