Why Buy Gold?

Commodities / Gold and Silver 2013 Jan 31, 2013 - 08:20 PM GMTBy: DeviantInvestor

Gold has been real money (medium of exchange and a store of value) for over 3,000 years. It is still real money.

Gold has been real money (medium of exchange and a store of value) for over 3,000 years. It is still real money.- Gold has no counter-party risk. It is not someone else’s liability. It has intrinsic value that is recognized around the world.

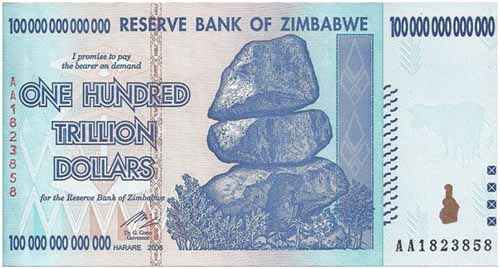

- ALL paper money systems have eventually failed. The intrinsic value of paper money is effectively zero; and all paper money has, throughout history, eventually devalued to zero.

- Paper money is a liability of a central bank or a government that may be insolvent. The money issued by a central bank or government has value based NOT on its intrinsic value, but only upon people’s faith, trust, and confidence in that money. Occasionally that faith and confidence is misplaced. For example:

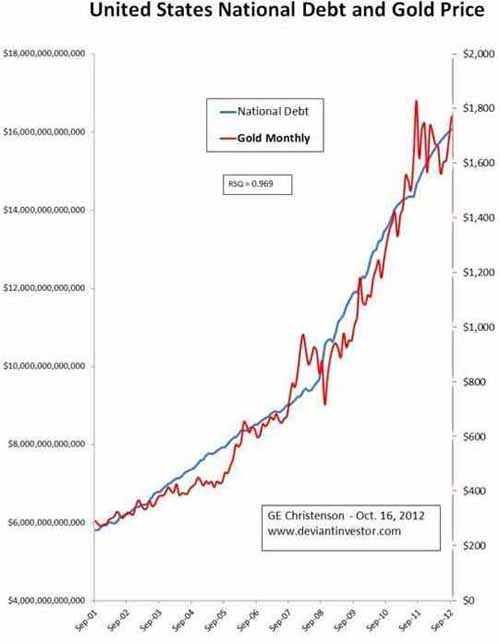

- The price of gold in US dollars since the year 2001 has been strongly correlated with the ever-increasing official national debt of the United States. Read $4,000 Gold! Yes, But When? Does anyone believe that the national debt will decrease or even remain constant over the next several years? NO! The national debt will increase even more rapidly over the next four years and so will the price of gold. Skeptical? Then look at the chart of national debt and the nearly parallel price of gold. Still skeptical? Do you remember gasoline selling for less than $.20 per gallon and gold selling for about $40? They have increased in price because there are currently many more dollars in circulation than in the 1960s – hence, it takes more dollars to buy an ounce of gold, a gallon of gasoline, a loaf of bread, a cup of coffee, or a fighter jet.

- Because governments and central banks issue paper money backed by nothing but faith and credit, they are in competition with gold which is real money. Should we be surprised when they discount the importance of gold and discourage ownership? Should we be surprised when the “Oracle of Omaha” denigrates gold ownership? (Berkshire Hathaway holds huge positions in banking stocks and Goldman Sachs stock.) Should we be surprised when news stories are heavily slanted against gold ownership?

- Groucho Marx once said, “Who are you going to believe, me or your own eyes?” Who are you going to believe – the history of gold as valuable money while paper money failed, or the pronouncements of politicians, central banks, and the owners of bank stocks?

- Who and what do you believe? It will be important to your financial well-being if (when) paper money accelerates its journey toward an intrinsic value of zero. Read Ten Steps to Safety.

- Are you going to believe history and current facts or less reliable information from politicians, central banks, and the owners of bank stocks?

GE Christenson

aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.