The Real Threat of Global Deposit Confiscation

Commodities / Gold and Silver 2013 Apr 05, 2013 - 05:55 PM GMTBy: GoldCore

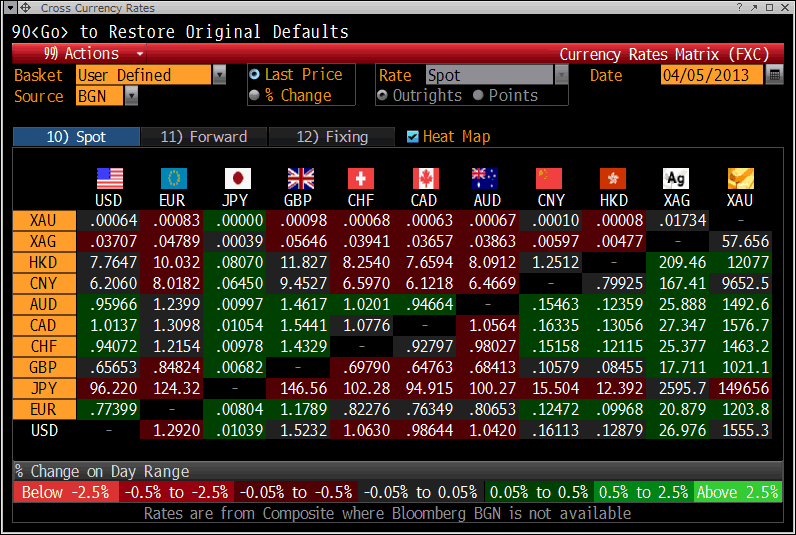

Today’s AM fix was USD 1,552.75, EUR 1,201.35 and GBP 1,019.60 per ounce.

Today’s AM fix was USD 1,552.75, EUR 1,201.35 and GBP 1,019.60 per ounce.

Yesterday’s AM fix was USD 1,545.25, EUR 1,207.42 and GBP 1,025,65 per ounce.

Gold fell $4.90 or 0.31% to $1,553.10/oz and silver fell 10 cents or 0.37% to $26.87/oz on the COMEX yesterday.

Cross Currencies Table – Bloomberg

Gold is higher in most currencies today except the Japanese yen. Gold surged over 3% to 0.149 million yen per ounce yesterday as markets shuddered due to the scale of currency debasement soon to be seen in Japan.

While the Nikkei has surged as expected, Japanese 10 year bonds sold off sharply with yields spiking from the all time record lows of 0.334% to over 0.6%.

The risks of a bond market crisis or currency crisis in Japan is something we have long warned of. The risk is now very high and hence strong demand for gold bullion in Japan with Reuters quoting sources in Japan who said that "the general public is buying."

Billionaire investor George Soros and Bill Gross, who runs the world’s biggest bond fund, said the Bank of Japan’s currency debasement risks weakening the yen. Indeed, Soros has warned of a currency "avalance".

“If the yen starts to fall, which it has done, and people in Japan realize that it’s liable to continue and want to put their money abroad, then the fall may become like an avalanche,” Soros said today in an interview on CNBC.

An interesting development in the precious metals market is the largest Dutch bank, ABN Amro, has said that they will no longer be providing physical delivery of precious metals including gold, silver, platinum, and palladium bullion coins and bars.

ABN AMRO, one of the largest banks in Europe announced in a letter to clients that it would no longer allow clients to take delivery of their metal and instead will pay account holders in a paper currency equivalent to the current spot value of the precious metal.

Thus, instead of legally owning a risk free, physical asset (a bullion bar or a bullion coin), the bank’s clients are now unsecured creditors and are now exposed to the bank and the financial system – somewhat defeating the purpose of owning precious metals.

The move highlights the importance of owning physical bullion either in your possession (be that be in a safe or vault in a house, in the attic, under the floorboards or elsewhere in your possession) or in a secure vault in a country that is stable and respects property rights.

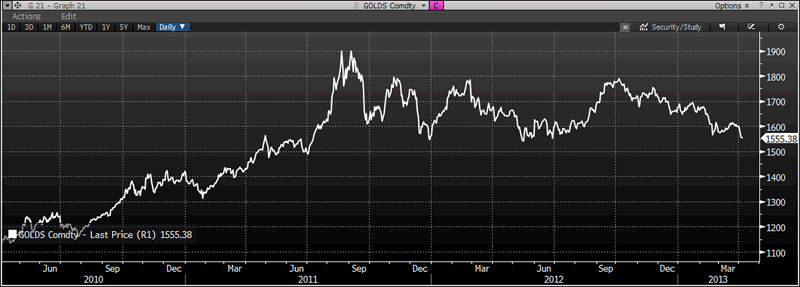

Gold in USD (3 Year) – Bloomberg

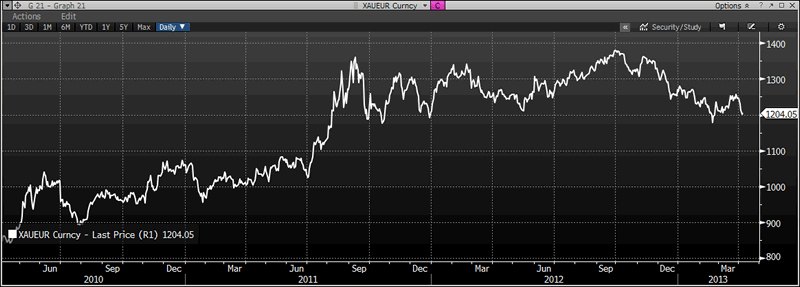

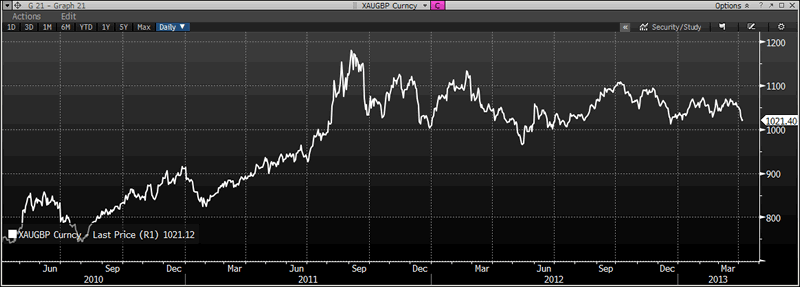

Gold is again testing long term support at the $1,540/oz level and at the €1,200/oz and £1,000/oz levels (see charts).

While further weakness is possible and the short term trend remains down, current price levels will be seen as cheap in the coming years as fiat currencies continue to be devalued versus store of value gold.

Gold looks oversold and gold’s 14-day relative strength index has fallen to 28.4, below the level of 30 that indicates to some analysts who study technical charts that a rebound may be imminent.

Markets and many experts remain in complete denial about the ramifications of the EU, IMF, ECB deposit confiscation in Cyprus. The mantra is that Cyprus is different and unique. This is the same complacent and irresponsible mantra that was heard when the subprime crisis in the U.S. reared its ugly head and when Greece began to implode in 2009.

The CEO of Unicredit Federico Ghizzoni said yesterday that it is “acceptable to confiscate savings to save banks.” He said that the savings which are not guaranteed by any protection or insurance could be used in the future to contribute to the rescue of banks who fail and that uninsured deposits could be used in future bank failures provided global policy makers agree on a common approach.

Gold in EUR (3 Year) – Bloomberg

He called for “a common solution in Europe” saying that the “EU should pass laws identical and shared in different member states”. Indeed he went a step further and called for a global coordination of deposit confiscations to rescue failing banks.

Including deposits “is acceptable if it becomes a European solution,” said Ghizzoni, 57.

“What we cannot accept is differentiation country by country inside the same area. I would strongly suggest to make this decision not only within Europe but within the Basel Committee, where all countries are represented.

Ghizzoni is also a Member of the Board of Directors of Institute of International Finance in Washington, Member of the International Monetary Conference in Washington and Member of the Institut International d'Etudes Bancaires in Brussels. He attended the powerful Bilderberg Group meeting in Spain in 2010 and he a frequent attendee at Davos.

It is important to realise that the Cypriot deposit confiscation was not a "haircut" rather this is a confiscation of people's deposits - 60% of individual and companies hard earned cash saved in a bank.

Cyprus is not a tax haven or offshore. It is in the EU and the majority of the deposits were held by EU citizens - Cypriots, Greeks, British, German, Italian and citizens and companies of other nations.

Russian deposits made up just 8% of the total and of that only a tiny fraction was 'Oligarch money'.

This is an attack on capitalism itself and something that one would expect in North Korea. It is a very dangerous precedent and what is more concerning is that there are policy papers calling for similar confiscation of deposits in the UK, Canada and New Zealand in future "banker bail outs" or “bail ins”.

We do not have a “crystal ball” however we are keen students of economic history and of the history of debt and financial crises. This clearly shows that sovereign nations, be they led by kings and queens or democratically elected governments usually resort to printing money and debasing the currency or expropriating assets.

Gold in GBP (3 Year) – Bloomberg

Today, we have powerful supranational institutions who have little loyalty or affinity with ordinary people or businesses and whose primary aims seem to be to protect failing banks and a failing currency union.

The confiscation of deposits, especially deposits over the €100,000 level seems likely in other European countries and could be seen in indebted nations globally.

Individuals, families and companies need to diversify their assets and not have all their life savings and capital in banks.

For breaking news and

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.