The Great U.S. Postal Fraud

Politics / US Politics Apr 14, 2013 - 03:33 PM GMTBy: James_Quinn

"One of the things the government can’t do is run anything. The only things our government runs are the post office and the railroads, and both of them are bankrupt.” – Lee Iaccoca

"One of the things the government can’t do is run anything. The only things our government runs are the post office and the railroads, and both of them are bankrupt.” – Lee Iaccoca

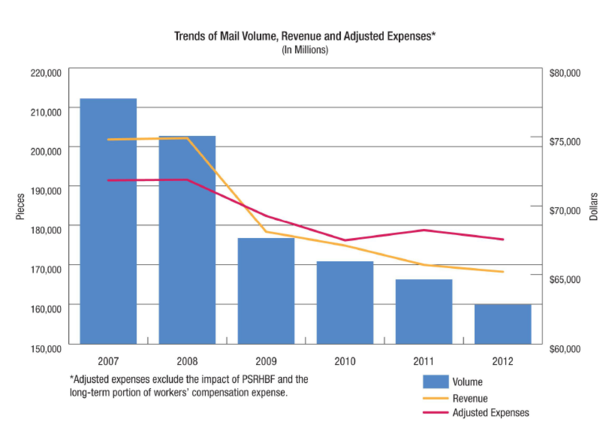

You may have heard that the U.S. Post Office lost $16 BILLION last year. You may also have heard that Congress snuck a requirement into a bill that had nothing to do with the Post Office, mandating that they must deliver on Saturdays, even though eliminating Saturday delivery would save the Post Office $2 BILLION per year. Congress evidently can’t read a financial statement or interpret a chart. I’m sure the trends detailed on this chart will reverse themselves shortly.

While reading an editorial today supporting the Post Office in its efforts to save money by eliminating Saturday delivery I saw another MASSIVE LIE perpetuated by the MSM and the government.

Here is the Orwellian statement:

“The U.S. Postal Service is an independent governmental agency that doesn’t take taxpayer funds.”

This is complete and utter bullshit. This statement also described Fannie Mae and Freddie Mac until 2008. They were just little old independent government agencies helping out the housing market – until the shit hit the fan!!! Then they became albatrosses around the necks of the American taxpayer. You own them now. They have lost $200 billion of your tax dollars, and will lose billions more before all is said and done.

You can access the U.S. Post Office financial statements online. Here is their December 2012 report:

http://about.usps.com/who-we-are/financials/financial-conditions-results-reports/fy2013-q1.pdf

The honesty of the people writing this report is refreshing. They essentially admit they are BANKRUPT and unable to meet their financial obligations. In other words, a truly INDEPENDENT entity admitting they can no longer operate. How is this for honesty:

“The Postal Service continues to suffer from a severe lack of liquidity. The Postal Service held total cash of $2.9 billion and $2.3 billion as of December 31, and September 30, 2012, respectively, and had no remaining borrowing capacity on its $15 billion debt facility (See Note 3, Debt, for additional information). The increase in cash balances for the quarter is largely attributable to the seasonal impact of holiday mailings, along with additional revenue resulting from this year’s political campaign and elections. Cash balances generally decline during the remainder of the fiscal year, as revenue is not as strong in the remaining quarters. By the end of this fiscal year, the Postal Service projects it will have a liquidity balance that will be less than its average weekly expenses of $1.3 billion. This low level of available cash means that the Postal Service will be unable to make the $5.6 billion legally-mandated prefunding of retiree health benefits due by September 30, 2013. Further, this level of cash could be insufficient to support operations in the event of another significant downturn in the U.S. economy.

Through the three months ended December 31, 2012, the Postal Service has suffered 5 quarters of consecutive net losses and net losses in 14 of the last 16 quarters. The net loss of $1.3 billion for the first quarter of the year included $1.4 billion of expense accrued for the legally-mandated prefunding payment for retiree health benefits. The requirement of the Postal Accountability and Enhancement Act, Public Law 109-435 (P.L. 109-435) to prefund its retiree health benefit obligations, a requirement not shared by other federal agencies or private sector businesses, plus the precipitous drop in mail volume caused by changes in consumers’ uses of mail, have been the two major factors contributing to Postal Service losses since the recession ended in 2009. Without structural change to the Postal Service’s business model, it will continue to be negatively impacted by these factors and, absent legislative change, it anticipates continuing quarterly losses for the remainder of 2013.”

The politicians that are mismanaging this country use governmental accounting fraud to cover-up the fact that the obligations of this bloated pig of an operation are going to be paid by YOU, the taxpayers of the United States. Today, none of the past, current, or future liabilities of this INDEPENDENT GOVERNMENT AGENCY are reflected in the Federal budget projections or the National Debt calculation.

Do YOU want to know how much YOU really owe? Brace yourself.

- In the past six years they have lost $41 BILLION and they have a cumulative deficit of $36 billion. How many INDEPENDENT organizations can run up deficits of $36 billion without going out of business? YOU are on the hook for these accumulated deficits, just like you were on the hook for all of the Fannie and Freddie backed toxic mortgages.

- The Post Office will lose another $10 to $15 billion this fiscal year. You will be on the hook for that too.

- They have $15 billion of debt on their balance sheet, with $9.5 billion payable in the next 9 months. How will this INDEPENDENT government agency that is losing $16 billion per year pay off $9.5 billion? They won’t. The government drones will pass a bill in the middle of the night extending the terms with no cash flow requirements or expectation of repayment. I wonder if I can get a loan like that?

- The really interesting stuff is buried on page 42 of their report. I wonder why it is all the way back there? In addition to their $15 billion of debt, they have another $70.5 BILLION of unfunded future obligations. The two biggest are:

- $33.9 Billion of payments for pension and health benefits for retirees, all due within the next 5 years. It’s not cheap providing gold plated benefits to government workers.

- $25 billion for workers compensation and sick leave payments. Yikes!!! It must be all that stress, because the mail never stops. It keeps coming and coming. It’s almost enough to make someone go postal, or at least file a stress related workers comp claim.

This really sounds like a promising story. Mail volumes continue to plummet. Someone should tell Congress the internet age has arrived. The Post Office has thousands of money losing, unneeded outlets. It has 637,000 employees when it only needs 300,000. Over 70% of Americans favor ending Saturday delivery, so Congress passes a law making that impossible to implement, ensuring $2 billion more losses per year. That’s par for the course. Over 70% of Americans were against passing TARP too. And according to your leaders in Washington, and parroted by the MSM, you are not on the hook for their losses.

It’s beyond laughable, but so is most of what is going on in this tragedy of a country, disguised as a comedy. The truth is that you are on the hook for the $36 billion of accumulated deficits, the $85 billion of debt and contractual obligations, and the annual $16 billion losses they continue to pile up. But what’s $120 to $150 billion among friends? Bennie can print that out of thin air in a few days. Why run an operation efficiently at a surplus, when you can keep hundreds of thousands of union government drones employed (until they go on workers comp) by sticking it to the working American taxpayer. I sure hope I don’t get a visit from the Postmaster General because of this article.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2013 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.