Farm Supports and Social Welfare

Politics / Food Crisis Apr 24, 2013 - 03:51 PM GMTBy: BATR

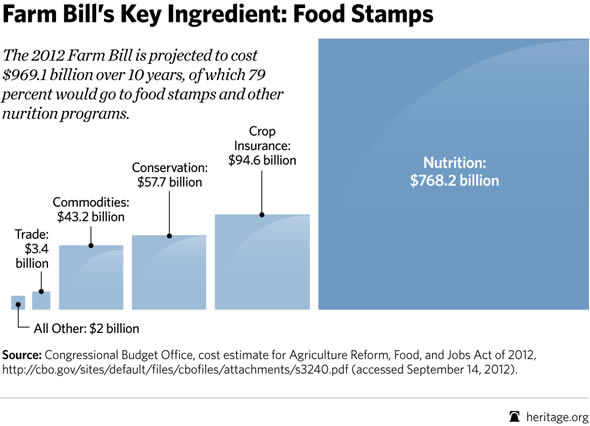

The planting season is in full swing as is the transfer of subsidies to big agriculture and social welfare food stamps. Which has more worth, paying the Monsanto and property tax bill or running a public assistance program that allows for the buying of lottery tickets? Well, if you are Congress, both have benefit, but mostly for their political value. Why are food stamps part of the Farm Bill? Nancy Marshall-Genzer makes a shrewd observation.

The planting season is in full swing as is the transfer of subsidies to big agriculture and social welfare food stamps. Which has more worth, paying the Monsanto and property tax bill or running a public assistance program that allows for the buying of lottery tickets? Well, if you are Congress, both have benefit, but mostly for their political value. Why are food stamps part of the Farm Bill? Nancy Marshall-Genzer makes a shrewd observation.

"There's been an explosive expansion of the food stamp program. To understand why, you have to go back to the '90s and President Clinton's welfare reform, which trimmed welfare rolls. To help those cut off, Congress and President Bush made it easier to qualify for food stamps. That was in 2002. Since then, the food stamp program has more than doubled.

That's about one in seven Americans. Many of them lost their jobs during the great recession. But why is the food stamp program in the farm bill, anyway? Like most things in Washington, it all boils down to politics.

Chad Hart is an economist at Iowa State. He says farm-state legislators needed a way to connect with more urban members of Congress, so the city slickers would support farm subsidies."

Is it necessary to expand exponentially the Supplemental Nutrition Assistance Program (SNAP), to relieve starvation when a "Happy Meal" can be purchased at every turn? Yet the socialization culture boasts of the dietary benefits of being on the government dole, as the urban society continues to consume every cuisine of fast foods.

The Washington Times notes that under the Food stamp president: Enrollment up 70 percent under Obama and that present legislation "allow for those with higher incomes to take food stamps — the logic being that helping people before they reach crisis financial level will actually stimulate the economy."What did people do for food before the era of the "Great Society"? Farming was a way of life for rural America from the inception of the country. In spite of struggling out a livelihood from an often-harsh pastoral environment, agriculture capacity grew into the breadbasket of the world. Today, the gentleman farmer needs to master the skills of trading future contracts and applications for assistance.

A starting point for subsidies "can supplement a farmer's income and as well as provide funds for rental payments for land and assistance when the market price of a crop is low. Farm subsidies also play a role in the cost and availability of certain agricultural commodities."1 Contact the Farm Service Agency office in your state

2 Determine which farm subsidy you will apply for

3 Find out what type of government subsidized crop and animal insurance is available in your area

4 Determine if your farm is eligible for the Direct Payment subsidy program

5 Ask about the special loan programs the federal government has available for new farmers and ranchers who have been in business for at least three years but less than ten years

Farming as a productive enterprise is rapidly becoming big business. The family farm is no longer an independent endeavor based upon market prices and ingenious management. The quasi-government debt and subsidy cycle, demands a public partnership with federal and state agencies that distort production and consumer prices at every level. Economy of scale seems to be the only path left to plow the fertile fields of government subsidies.

The corporate agriculture conglomerates have become integral constituents of the seed, fertilizer and chemical industry. Both collaborators hire their political lobbyists to expand financial supports, resistive food labeling disclosures and apply economic pressure to stamp out holistic food competition.

The taxpayer should be concerned over the institutionalization and dependency of the SNAP mentality that eats at the fabric of a viable market economy. However, even more diabolical is the destructive subsidization of farming that dramatically benefits corporatist agriculture at the expense of organic agrarian alternatives.

US News takes the position that the Farm Bill's Corporate Welfare Is Unacceptable."Under current law, businesses that produce commodity crops-corn, soy, cotton, or wheat for example-receive a variety of federal supports. One of these, direct payments, provides a per-acreage subsidy for certain farmland owners, regardless of prices, crop yield, or profitability. As a result some farm businesses making hundreds of thousands or even millions of dollars each year also receive a generous annual check from the federal government even if they don't grow a crop.

Federal crop insurance is out of control. In fiscal year 2012, the total cost of the crop insurance program set a new record at $14 billion-$3 billion more than FY2011. And here's the kicker-2012 was a year of near record profits for agriculture, even before crop insurance payouts, despite and in part because of the drought many parts of the country experienced this past summer. In every state, participants in the crop insurance program have received more in claims payments than in premium dollars put in over the past 15 years. And remember, for every $1 in premiums, agribusinesses only chip in 38 cents to insure their own crops while taxpayers pick up the remaining 62 cents. That is not insurance or a safety-net, that's a hand out."

A comprehensive overhaul of government agriculture policy may not seem very probable from a political will perspective. Nevertheless, the gravy train of public money cannot be a substitute for tilling the soil and weeding the crops. When government legislation attempts to maintain an inexpensive retail food price with public grants, loans and subsidies, the true cost of national nourishment is unsustainable.

The urbanization of the political electorate dictates that the bottom feeders expect their groceries be delivered from a full service supermarket. As any rural resident knows, the nature of the land has its own set of rules and demands. Famine and undernourishment applies to much more than the food supply. It resides in the destructive and distorted government protection racket that leaves the public with a deep hunger in their belly.

James Hall

Source : http://www.batr.org/negotium/042413.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2013 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.