Blood In The Streets Of Gold Market. Repeat Of 1970s Bull Market?

Commodities / Gold and Silver 2013 Jun 28, 2013 - 03:24 PM GMTBy: GoldCore

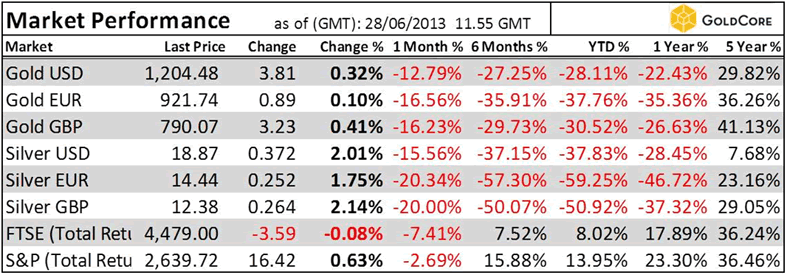

Today’s AM fix was USD 1,203.25, EUR 921.89 and GBP 789.33 per ounce.

Today’s AM fix was USD 1,203.25, EUR 921.89 and GBP 789.33 per ounce.

Yesterday’s AM fix was USD 1,232.00, EUR 945.51 and GBP 806.07 per ounce.

Gold fell $25.00 or 2.04% yesterday and closed at $1,199.10/oz. Silver finished the day with a slight loss of 0.11% at $18.50/oz.

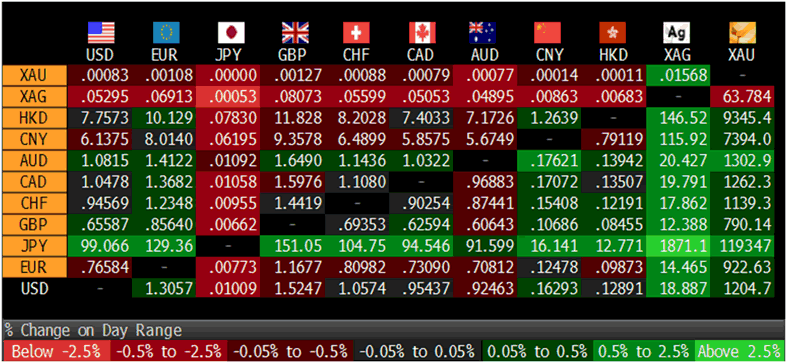

Cross Currency Table – (Bloomberg)

Gold has inched up this morning after it dropped under $1,200/oz yesterday, which triggered stop loss selling and additional pressure from funds quarter end selling. Although bargain physical buyers in the Middle East and Asia continue to scoop up gold, it has not been enough as of yet to put a floor under prices.

Very little has changed regarding the positive supply demand dynamics of the gold market and much of the recent weakness is due to panic liquidations by speculators, technical trading and momentum.

The 25% price fall this quarter appears to be the biggest price fall ever.

There is blood on the streets of the gold market with many speculators having been badly burnt. The smart money such as Einhorn, Paulson and Bass have not liquidated and have maintained their positions. Indeed, we expect that big money internationally will be licking their lips at the prospects at accumulating gold at these price levels.

As per the unfortunate words of Rothschild - "the time to buy is when there is blood in the streets."

Bloomberg Poll: Gold And Silver To Rise 25% And 43% By Year End

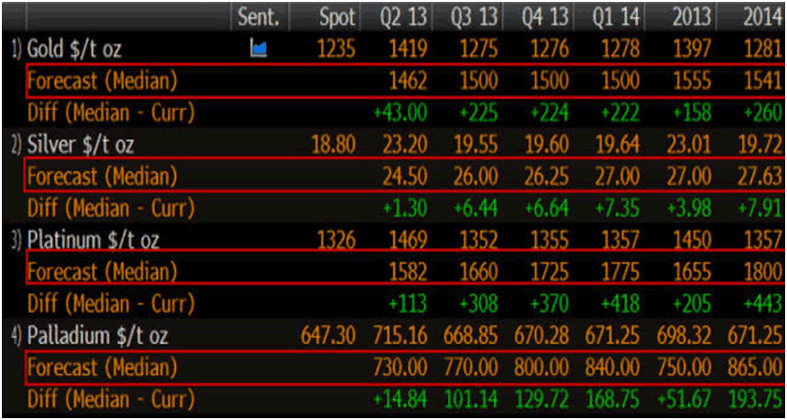

Analysts surveyed by Bloomberg, including GoldCore, are positive on the direction of precious metals prices for the rest of 2013, despite the recent plunge.

Gold is expected to rise from $1,200 to average $1,500 in Q1, 2014 or 25%.

Silver is projected to rise 43.6% from $18.80 per ounce to $27.00 per ounce.

Platinum is expected to gain 39.5% and palladium 27.6%.

Bloomberg Survey of Precious Metal Analysts

Russia Launches Ruble Gold Exchange

The COMEX is set to have a new competitor in Russia after the Russian stock exchange announced that they plan to launch ruble denominated gold, silver, platinum and palladium exchanges according to Russia Today.

Russia has so far only been trading futures on gold and silver, not dealing with real physical metal and not allowing participants to take delivery of their metal.

The Moscow stock exchange plans to transport precious metal bullion from production companies, keep them in its own warehouses and deliver to the buyer the next day.

The stock exchange is going to start trading gold and silver by the end of this year, and platinum and palladium in 2014.

Middle East and Asian “Gold Rush” Continues

Physical demand remains robust globally and especially in the Middle East where concerns about inflation and geopolitical risk with regard to Syria and Iran is leading to very robust demand.

There is not enough space on airlines flying to Dubai to meet the rapidly rising demand for physical gold in the Emirates since the price plunge according to The National in Dubai.

The price drop led to a rush of buyers for Dubai gold from the Middle East, South East Asia, the Balkans, Turkey and parts of Europe according to Tarek El Mdaka, the managing director of Kaloti Gold in Dubai.

"I cannot find a place for transporting gold on Emirates, on BA on Swiss Airlines this weekend," Mr El Mdaka said. "I am shipping in one-and-a-half to two tonnes of gold every day and it is going straight out."

Mr El Mdaka added that gold is in such short supply in Dubai that he is able to charge a US$3 premium per ounce. "In the last week or so that has gone up from $1.25, $1.50 to $1.75. But now it is $3. We are really squeezed."

Certain types of gold popular in India were available in quantity according to Mr El Mdaka who said that "the squeeze on physical gold in India would have a big effect on Dubai. Luckily though, there is a lot of demand coming from the rest of the world to soak it up," he said.

Gold Rush In Laos

Gold demand remains robust in India despite prohibitions and China and much of East Asia and South East Asia. Gold shops in Bangkok’s Chinatown are seeing robust demand as people continue to buy gold at these lower prices.

The recent drop in gold prices on the Lao market has brought buyers out in droves to purchase gold while it remains cheap according to the Vientiane Times and picked up by Yahoo News.

According to gold shops in Vientiane, sale prices yesterday were at 5,060,000 kip (US$655) per baht-weight for gold jewellery - down about 500,000 kip per baht-weight on previous months.

Large numbers of buyers have visited gold shops in Vientiane to purchase gold jewellery, coins and bars as in investment and in order to protect from currency devaluation.

Some shops in Laos’ capital were stripped bare of all of their gold as a result of the gold rush - or rush out of cash as it might better be known as.

Blood In Streets Of Gold Market But 1970s Bull Market To Repeat

Sentiment is as bad as we have seen it in the gold market – worse than after the 30% fall in 2008.

However we remain confident that the recent price falls are just a mini bear market within a larger secular gold bull market that will propel prices much higher in the coming months and years.

We will cover this more closely in our “Gold Bubble Burst Or Is This Another Buying Opportunity?” report on Monday and our Webinar on Tuesday.

The recent price falls were not a surprise. We said in an interview when gold was near $1,900 that there was going to be a correction and that in a worst case scenario gold could replicate the 1970s bull market when gold fell nearly 50%.

It is always worth looking at gold’s last bull market in the 1970s when gold rose from $35/oz in 1971 to over $197/oz by January 1975. In the next 21 months, gold fell in value by nearly 50% to $103/oz by late August 1976.

This led to many pronouncements that gold’s bull market was over and the bubble had burst.

Gold 1970-1980

.png)

In the next 40 months from August 1976 to January 1980, gold rose 8 fold from nearly $100/oz to $850/oz.

We see think there is a real possibility of the same pattern playing out in the coming months.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.