Poland Confiscates Private Pensions - Yours Are Next

Personal_Finance / Pensions & Retirement Sep 11, 2013 - 01:26 PM GMTBy: Jeff_Berwick

We have been saying for the last four years that as Europe, the US and other Western and global nation-states continue their debt-fueled collapse the governments of these countries will continue to consider their citizens' wealth to be their own and seize more of their assets.

We have been saying for the last four years that as Europe, the US and other Western and global nation-states continue their debt-fueled collapse the governments of these countries will continue to consider their citizens' wealth to be their own and seize more of their assets.

We have, unfortunately, been vindicated already numerous times.

- In March, 2009, Ireland seized €4bn from its Pension Reserve fund in order to rescue its banks. In November 2010, the remaining savings of €2.5bn was seized to support the bailout of the rest of the country.

- In December, 2010, Hungary told its citizens that they could either remit their private pension money to the state or lose their state pension funds (but still have to pay for it nonetheless)

- In November, 2010, the French parliament decided to earmark €33bn from the national reserve pension fund FRR to reduce the short-term pension scheme deficit.

- In early January 2011, $60 million in private retirement funds were transferred to the state's pension scheme in Bulgaria. They wanted to transfer $300 million, but were denied on their first attempt

And, of course, this spring, Cyprus took it a step further and outright confiscated up to 50% of the funds from bank account holders in that country.

Last week the Polish government announced it would transfer to the state (aka. confiscate) the bulk of assets owned by the country's private pension funds (many of them owned by such foreign firms as PIMCO parent Allianz, AXA, Generali, ING and Aviva), without offering any compensation.

BUT IT CAN'T HAPPEN HERE

Think again if you don't think this will occur all across the Western world until The End Of The Monetary System As We Know It (TEOTMSAWKI).

To begin, the Social Security (or as I call it, the Socialist Insecurity) program in the US is, by dictionary definition, a ponzi scheme.

According to Investopedia: "The Ponzi scheme generates returns for older investors by acquiring new investors. This scam actually yields the promised returns to earlier investors, as long as there are more new investors. These schemes usually collapse on themselves when the new investments stop."

In fact, Social Security is even worse than a ponzi scheme. At least with a ponzi scheme you have the choice whether or not to "invest" with someone like Robert Madoff. You aren't forced into it.

Plus, completely fraudulently, the US government shows all Social Security (SS) incoming funds as actual revenue and then immediately spends the money and gives an IOU (unpayable, bankrupt US Treasuries) in return to the SS system. Let me repeat that: they immediately spend the money and deposit an IOU into what is already a Ponzi scheme. And in past years Congress has held committees to consider nationalizing private pension funds, just as Poland did last week (and held committees on doing it in 2010).

What was the main reason that all these governments such as Ireland, Hungary, France, Bulgaria and Poland began stealing with their citizen's private wealth? It was because their governments were too indebted vis-a-vis their economy and in order to continue operating (and borrowing) they reached out and just took their own citizens' retirement savings and, in almost every case, mandated that the only assets they can hold is government debt (which will collapse or pay 0-3% at a time when inflation often is running over 10%, meaning a net loss of 4-6%+ per year).

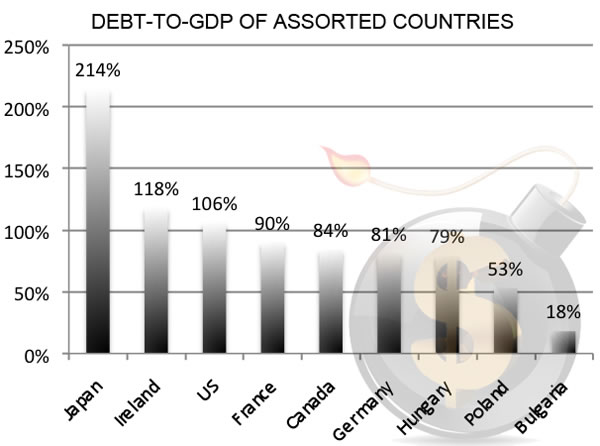

So, let's take a look at the debt-to-GDP of all these countries and a few other Western countries.

As you can see, with the exclusion of France, all the other countries who have outright stolen private pension funds are all in less debt than the Western countries (or those who have bought into Western-style Keynesian central banking democracies like Japan) who have yet to do so.

Why? It's mostly because the larger Western countries have yet to lose the confidence of the market. While the smaller countries with tinier economies and less ability to float their currencies as reserve currencies get the attention of the market first.

But, this is very rapidly changing. Here is the interest rate change of US government debt in the last few months (yearly chart).

.jpg)

The interest rate has nearly doubled in the last four months. This will have massive repurcussions in all markets... and it will also mean that as interest rates rise the US government will look more and more insolvent by the day. With $17 trillion in current debt (not GAAP adjusted - GAAP adjusted is over $85 trillion) an interest rate of 10% will mean $1.7 trillion in interest payments alone. The total tax (theft) revenue base of the US was only $2.4 trillion in 2012. If interest rates were to rise to 10%, that would mean over 70% of the taxation revenue of the US government would go to paying interest alone.

But, remember, $841 billion of that "revenue" was payments into the Social Security scheme. No company on Earth would include payments into an employee pension plan as income. So, the more realistic revenue of the US government was $2.4 trillion minus $841 billion in 2012... or approximately $1.55 billion. In other words, an interest rate nearing 10% would mean that every semi-legitimate cent of tax revenue for the US government, and more, would go to interest payments on the debt alone.

And so expect the US government and most if not all Western governments to do what has happened in places like Hungary, France, Cyprus, Poland and more... attempt to stay alive a little while longer by taking the assets of their citizens. And tax-sheltered retirements will be the easiest pickings.

HOW TO PROTECT YOURSELF

Since retirement/pension savings will be the easiest target, immediately divest yourself of as much of those assets as possible -- while they are still assets -- and internationalize them. Get as much outside of the country with the government that purports to own you and your assets as possible. I did that in 2008 in Canada and have never regretted it.

If you are not willing or able to cash in retirement/pension savings, look to alternative options. In the US, for example, you can easily convert your IRA into a self-directed IRA for a few thousand dollars and then you are able to invest in almost any asset worldwide. You can buy racehorses in Dubai, gold in Switzerland or real estate in Galt's Gulch Chile, just as example. For advice/info or to turn your current IRA into a self-directed IRA, contact TDVSelfDirectedIRA.com.

A self-directed IRA makes sense for anyone with IRA assets over $20,000. Below that level it becomes debatable in terms of the cost/benefit ratio.

For those with assets inside or outside (total assets) of an IRA of more than $1 million you should contact TDV Wealth Management for an initial consultation about your options.

And, of course, you can always subscribe to The Dollar Vigilante for the latest news, information and actionable intelligence on surviving the coming dollar (and all other fiat currency) collapse.

Because this collapse is going to be messy.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.