Fifty Shades of Gold

Commodities / Gold and Silver 2013 Sep 24, 2013 - 06:06 PM GMTBy: Frank_Holmes

Goldman Sachs created a stir recently when it forecasted that gold would fall to $1,000 an ounce by the end of 2014, as the firm expected the Federal Reserve to reduce its bond buying program. Goldman also suggested that gold miners might want to hedge their output, locking in 2013 prices.

Goldman Sachs created a stir recently when it forecasted that gold would fall to $1,000 an ounce by the end of 2014, as the firm expected the Federal Reserve to reduce its bond buying program. Goldman also suggested that gold miners might want to hedge their output, locking in 2013 prices.

HSBC analysts have also been bearish on gold, although the firm admits that lower gold prices tend to draw out tremendous demand from emerging markets, especially China. Because of that demand, HSBC believes gold will end 2014 at around $1,435 an ounce, says MarketWatch.

HSBC analysts have also been bearish on gold, although the firm admits that lower gold prices tend to draw out tremendous demand from emerging markets, especially China. Because of that demand, HSBC believes gold will end 2014 at around $1,435 an ounce, says MarketWatch.

Keep in mind that "Goldman Sachs does things that are good for Goldman, not you," says Bryon King from Agora Financial. Things can change quickly in the gold market, as investors saw when, only days after Goldman's assertion, the Federal Reserve surprised everyone by announcing it would continue purchasing $85 billion worth of bonds. Gold investors cheered as the precious metal shot up the most in 15 months.

Unlike many commodities, there are many shades to gold, such as the Love Trade's buying gold for loved ones and the Fear Trade's purchasing gold as a store of value. An additional "shade" investors need to be aware of is how the Fed interprets the recovery of the U.S. economy.

I had a few reasons to believe Ben Bernanke was going to pull the rug out from under the market's feet. Before word came out, I told Canada's Business News Network that the ending of quantitative easing was not going to be abrupt because it's not a black and white issue.

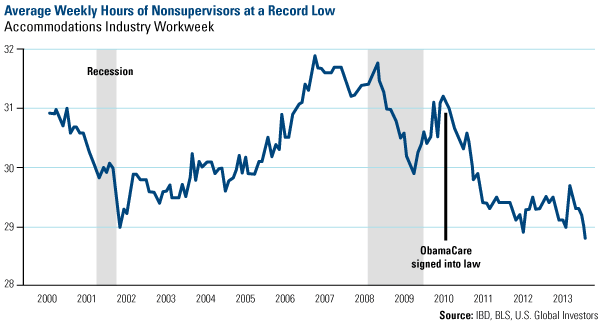

Consider the lack of significant job growth in the U.S., as many of the jobs that have been created in recent history were part-time positions. Investor's Business Daily (IBD) links this lackluster employment situation to President Barack Obama's Affordable Care Act. According to the publication's scorecard, "more than 300 employers have cut work hours or jobs, or otherwise shifted away from full-time staff, to limit liability under ObamaCare." While providing affordable health care to Americans sounds honorable, the loss of full-time jobs seems to be an unintended consequence from the onerous regulations placed upon a business.

Take a look at IBD's chart, which shows the accommodations industry's average weekly hours that nonsupervisors put in since 2000. During each recession, in 2001 and again in 2008 to 2009, the hours dropped. But since ObamaCare was signed into law, which mandated that employers would need to provide health care coverage for staff who work more than 30 hours a week, the average plummeted. As of July, the accommodations industry workweek hit 28.8 hours, "at a record low," according to IBD.

It's not only about job growth. Housing is also not rebounding as strongly as some people think. I told Reuters that many people don't realize that the real estate market boom has been narrowly focused. According to USA Today, almost half of the homes purchased in July were bought with cold hard cash. In places like Florida, "nearly two-thirds of home sales were completed without a mortgage loan," says USA Today. In Nevada, about 65 percent of buyers paid with cash, followed by Maine, where nearly 60 percent of house sales were cash. Perhaps regulation in the banking industry has made the process of getting a mortgage too burdensome for families?

Housing is one of the biggest multipliers for jobs, where $1 spent in housing results in about $16 in related economic activity. When interest rates are low, more people apply for mortgages. They build houses, employ moving services and buy new furniture, which in turn employs more people in multiple industries.

But after interest rates rose quickly, the housing market came to a halt. People who once qualified for a mortgage to build a new home no longer qualify at the higher rates, meaning a potential inventory of new housing may quickly build.

At the same time, big banks are announcing layoffs in mortgage lending. Just today, Wells Fargo announced it was going to lay off 1,800 employees as refinancing activity continues to slow. The company had already told 2,300 workers to stop coming to work as rising interest rates curtail demand for new mortgages and refinancing.

So instead of the Fed quickly tapering its bond purchases and raising rates, this process will likely be very gradual. I believe the government will have to keep interest rates low to stimulate the economy.

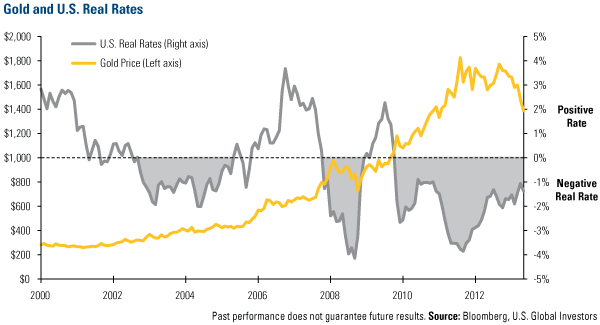

And that's positive for equity markets as well as for gold. If interest rates remain low, real rates could remain in negative territory. In my presentation on opportunities in resources and emerging markets, I told the crowd at the Toronto Resource Investment Conference that 2 percent has been the tipping point for gold. Historically, gold and silver performed well in a low or negative real interest rate environment.

Regardless of where analysts think the gold price will be a year from now, we believe gold and gold stocks can be an excellent portfolio diversifier. We'd rather hold quality gold companies that are experiencing a growth in resource base, growth in production and growth in cash flow instead of trying to time the market. Our in-depth analysis helps our team seek the best returns for our shareholders.

In-depth analysis is why we're headed to the Denver Gold Forum. Portfolio managers Ralph Aldis and Brian Hicks as well as one of our analysts, Sam Palaez, will be attending, meeting with some of the new CEOs about the state of the gold mining industry. I look forward to sharing updates from the conference with you.

The Love Trade and the Fear Trade surrounding gold is something I’ve talked about before on my blog, Frank Talk. To see more on this subject, provide me with your email address and we’ll send you a note every time the blog is updated. You can also connect with U.S. Global on Twitter, Facebook or LinkedIn.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.