Google vs Facebook Fighting for Global Internet Dominance

Companies / Internet Oct 06, 2013 - 01:29 PM GMTBy: EconMatters

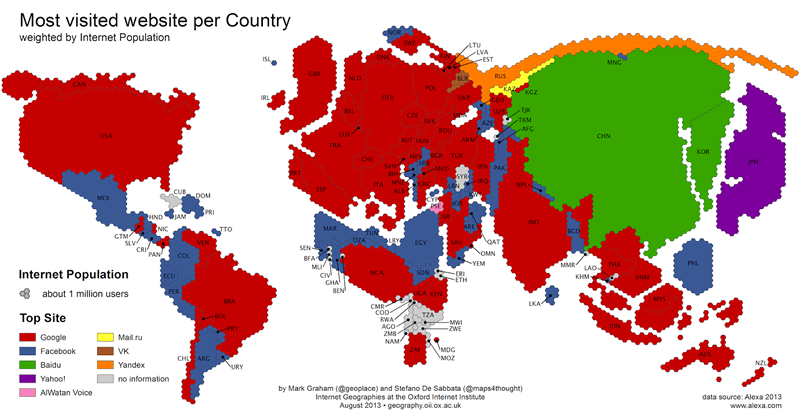

NPR published an interesting map of the most visited websites around the world by the Oxford Internet Institute in UK, which compiled the data from Alexa on August 12th, 2013. While it is not surprising that the Institute found "The supremacy of Google (Nasdaq:GOOG) and Facebook (Nasdaq:FB) over any other site on the Web is clearly apparent,' there are some other interesting findings as well.

NPR published an interesting map of the most visited websites around the world by the Oxford Internet Institute in UK, which compiled the data from Alexa on August 12th, 2013. While it is not surprising that the Institute found "The supremacy of Google (Nasdaq:GOOG) and Facebook (Nasdaq:FB) over any other site on the Web is clearly apparent,' there are some other interesting findings as well.

| Graphic Source: Oxford Internet Institute |

And here are the more country detail:

- Google tops in Europe, North America, and Oceania.

- Facebook rules in most of the Middle East and North Africa, as well as much of the Spanish-speaking Americas.

- Kenya, Madagascar, Nigeria, and South Africa fall within Google’s empire.

- Ghana, Senegal, and Sudan are under Facebook’s dominion.

- Baidu (Nasdaq: BIDU) dominates in China and South Korea

- Yandex (Nasdaq:YNDX) ranks the top in Russia

- Social-networking service VK is the leading site in Belarus

- Email service Mail.ru is the leader in Kazakhstan

- Yahoo! (NYSE:YHOO) also has its own internet empire in Asia: Yahoo is the most popular website in Japan with Yahoo! Japan (a joint venture between Yahoo! and Softbank), and in Taiwan with Yahoo! Taiwan.

It is worth noting that although Facebook seems to have gained some real estate on Google, Facebook can't really challenge Google's dominance. As the Institute noted:

The countries where Google is the most visited website account for half of the entire Internet population, with over one billion people.... Baidu is second in this rank, as [China and South Korea] account for more than half a billion Internet users, whereas the 50 countries where Facebook is the most visited website account for only about 280 million users, placing the social network website in third position.

...... among the 50 countries that have Facebook listed as the most visited visited website, 36 of them have Google as the second most visited, and the remaining 14 countries list YouTube (currently owned by Google).

This is likely just a very early schematic of which companies will end up controlling our communication and information access in the future. With this massive global user base, information is power, along with the potential of power abuse.

Google is already facing various privacy cases. Facebook, a social networking site not known for its search capability, apparently is not sitting idly as well. Facebook's new Graph Search where reportedly "most everything shared on Facebook is now easily searchable" even for something deleted or marked as "private" by users. A recent WSJ report also said Facebook would start selling shared user data to TV networks.

The takeaway, in my view, is that while it is exciting to see how technology has evolved enhancing our day-to-day life, work and play, the more important question is data privacy, and what measure and process (on a global basis) should be in place before the world could safely embrace this New World of Big Data.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2013 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.