Gold & Silver vs. Hope & Change. Place Your Bets!

Commodities / Gold and Silver 2013 Nov 13, 2013 - 02:45 PM GMTBy: DeviantInvestor

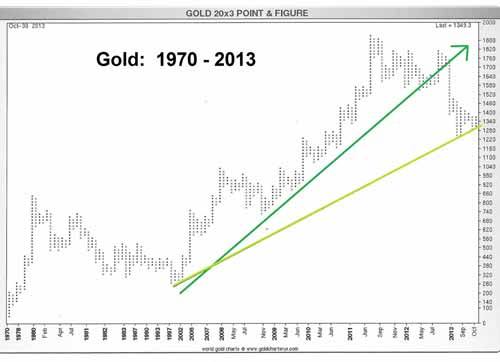

The BIG Perspective: Examine the following “Point & Figure” chart from Ron Rosen. This type of chart plots price on the “y” axis while the “x” axis shows time but without uniform distance between years. The long term trend has been up since 1970 and 2001, while the intermediate trend has been down for the past 26 months.

The BIG Perspective: Examine the following “Point & Figure” chart from Ron Rosen. This type of chart plots price on the “y” axis while the “x” axis shows time but without uniform distance between years. The long term trend has been up since 1970 and 2001, while the intermediate trend has been down for the past 26 months.

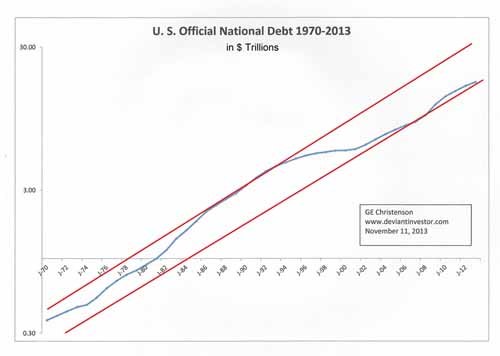

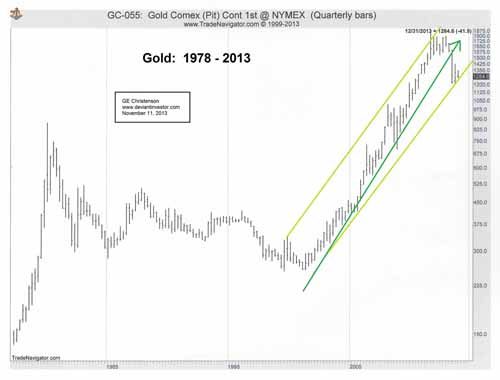

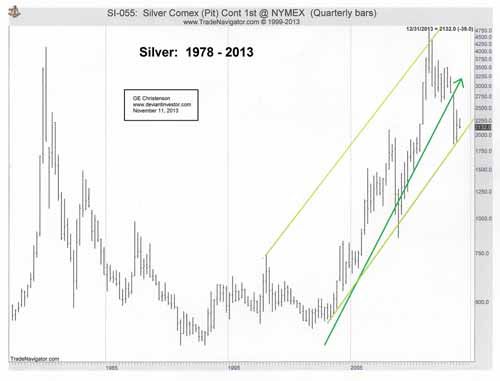

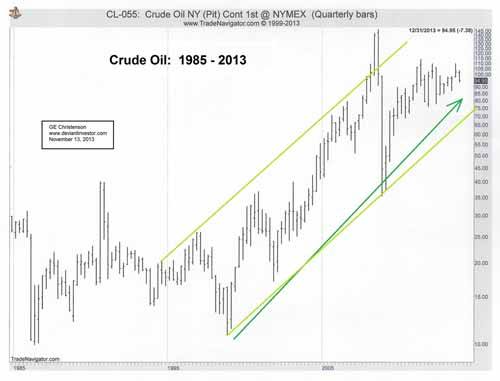

The following are logarithmic charts of the official U.S. national debt, gold, silver, and crude oil for the past three to four decades.

Clearly the long term trends are up. Why?

- A debt based paper currency system must expand to survive!

- The Fed needs an increasing money supply and more debt.

- Congress and the administration aggressively spend money, borrow money, and increase the national debt. It will take a real crisis to change this – much worse than a phony debt ceiling crisis.

- The financial industry wants to churn more paper assets, debt, derivatives, and volatility to increase their profits.

The inevitable conclusion is that, over the long term, money supply, debt, and prices will increase until there is a systemic reset or crash. What will endure throughout the inevitable inflation, deflation, and crash? Gold and silver will endure. Paper assets are only as good as the collateral backing them, and many of those assets could vaporize in a systemic reset. Gold and silver will survive and maintain their value, while the dollar and Treasury Debt may lose a good portion of their value and purchasing power.

Hope & Change

Hope is not a good basis for an investment plan. Hope is not a viable foundation for a political philosophy or for the actions of a government. Hope will not pay the bills, reduce the debt, or return sanity to an out-of-control spending process.

Ask yourself how well these are working:

- We spent the rent money on lottery tickets and booze. We hope something good happens soon.

- We spent a few $Trillion on useless wars in the middle-east. We hope it helped.

- We spent $17,000,000,000,000 more than our revenue. We hope it is not a problem.

- We sold or “leased” much of our accumulated gold and sent it to China. We hope nobody noticed and that it will not matter.

- We hope we don’t have another stock market or bond market crash.

- We hope to increase taxes and reduce benefits while increasing consumer prices and we hope to keep the people happy and voting for the incumbents. (This is also change.)

- We hope to actually pass a budget real soon. (Congress has not passed a budget in the past five years. Did anyone notice or care?)

- We hope to reduce the deficit real soon.

- We hope the Federal Reserve and the politicians will make it all better.

- We hope that hope and change will begin to work real soon.

As for “CHANGE” – it can be positive or negative. Not all change is good. We “HOPED” for better government and we received Obamacare. Was that a positive change?

Gee, we hope that the 10 Million or so people whose insurance plans will be cancelled and who will be forced to purchase new health insurance policies at much higher rates are okay with the change, increased deductibles and the increased costs. We hope they don’t get upset or angry or think someone lied to them.

Gold and Silver!

Dr. Phil says that the best predictor of future behavior is relevant past behavior. Using that thought it seems clear that:

- The official national debt will continue to exponentially increase like it has for more than four decades.

- The dollar will continue to decline in purchasing power like it has for the past 100 years.

- Gold and silver will continue to (erratically) increase in price like they have for the past 40 years.

- Gold and silver will hold their value and purchasing power like they have for 5,000 years.

- Government deficit spending and borrowing will continue.

- There will be another budget crisis, and another, and another.

- Politicians will talk, make promises, and become much wealthier while the middle and lower classes find their expenses increasing far more rapidly than their incomes. We will re-elect those politicians.

- Hope and change will continue to produce what they have so far – nothing but more debt.

- Gold and silver will outlast hope, change, paper money, treasury debt, and political promises. Most people do not and will not understand why!

So, place your bets!

| Paper currency | or | gold and silver. |

| Debt based paper assets | or | real money – gold and silver. |

| Political promises | or | something of lasting value. |

| Futures contracts on a corrupt exchange | or | land. |

| Credit card debt | or | stacked silver in a safe. |

| Social security income in a decade | or | gold in hand now. |

| Obamacare | or | good health. |

| Nutritionally empty fast food | or | healthy nutritious food. |

| Artificial and phony | or | real and valuable. |

| Reality television | or | the Holy Bible. |

Most people will stick with what they know – paper currency, debt based paper assets, political promises, hope and change, and reality television. The choice is yours, but you will have a better financial future and more peace of mind if you invest in something real and valuable.

More to consider:

Created Currencies … Are Not Gold!

We Have Been Warned – Part 3

What You Think Is True Might Be False and Costly

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.