Why AAON Should Be a Case Study in Business Schools

Companies / Corporate News Jan 07, 2014 - 05:28 PM GMT Mitchell Clark writes: In the pursuit of reliability and consistency in business performance, AAON, Inc. (AAON) came through once again by reporting another record quarter.

Mitchell Clark writes: In the pursuit of reliability and consistency in business performance, AAON, Inc. (AAON) came through once again by reporting another record quarter.

I’m absolutely convinced that any equity market portfolio is well served by having at least some exposure to what I refer to as “old economy” types of businesses. AAON is a Tulsa, Oklahoma-based company that manufactures and sells heating, ventilation, and air conditioning (HVAC) equipment to industrial customers.

In the third quarter of 2013, the company generated record revenues and earnings—the strongest AAON has seen in its 25-year history.

Third-quarter sales were $89.7 million, representing a gain of 17% over the third quarter of 2012. Earnings came to $10.5 million, or $0.28 per diluted share, compared to $6.0 million, or $0.16 per diluted share, representing an impressive gain of 75% over last year’s third-quarter earnings.

While the company’s backlog declined slightly in the third quarter of 2013, management noted that an increase in its market share, rising selling prices, and lower costs for materials were all reasons for the earnings gain.

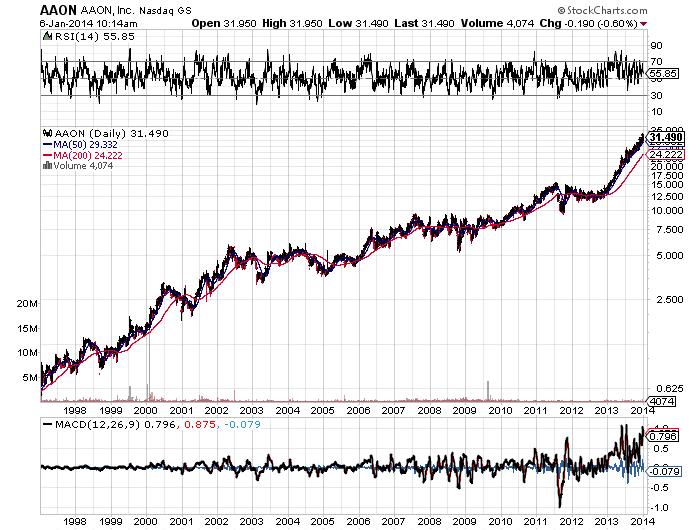

This stock has had an exceptional breakout from its long-term trend. But even before the recent positive trading action, it was still a consistent winner and a very good enterprise in terms of generating sales and earnings growth. The company’s stock chart is featured below:

Chart courtesy of http://stockcharts.com/

Arguably, investing in the HVAC industry is a long-haul proposition, as AAON’s share price performance in the above chart illustrates. But consistent stock market winners, as far as I’m concerned, are absolutely golden, especially given the inherent volatility with equity securities and the business cycle.

Stocks that trade sideways when the broader market is trending lower are often good indicators of the types of businesses that will hold up well over time.

When we looked at AAON in June of last year (see “How the Old Economy Can Pay More Than You Might Think”), the company reported record 2013 first-quarter results. Sales grew three percent to $66.8 million, while earnings grew 56% to $7.1 million, or $0.29 per diluted share.

With so much media emphasis on technology and those companies generating the fastest growth, great old economy enterprises like this company are easily overlooked, which is a mistake, because AAON is a very good business.

The company might be too small for a Berkshire Hathaway, Inc. (BRK-B) acquisition, but I wouldn’t be surprised at all if a larger corporation decides someday that it wants to add this little business to its portfolio.

With its recent breakout, this stock has been well bid and is fully priced like most other equities. But AAON serves as a great example of an enterprise that’s done a very good job of managing a cyclical business with the purpose of delivering consistent growth to shareholders.

There aren’t a lot of businesses out there that are able to deliver consistent results, even if the growth is only modest. A company like AAON is a model for other public companies, because management wants deliberate growth, not grandiose outperformance. It’s also a model of a great stock market investment. It should be a case study in business schools.

This article Why This Company Should Be a Case Study in Business Schools was originally published at Profit Confidential

Mitchell Clark, B.Comm. for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.