Global Grain Prices Reach Record Levels– Fuel Boom In Agricultural Sector

Commodities / Agricultural Commodities Apr 21, 2008 - 12:40 PM GMTBy: Joseph_Dancy

The upward trend in grain and food prices continued last month. Many exporting countries limited agriculture exports, or raised export taxes, to insure adequate domestic supplies. Global inventories of most grains remained at low levels – levels not seen in decades.

The upward trend in grain and food prices continued last month. Many exporting countries limited agriculture exports, or raised export taxes, to insure adequate domestic supplies. Global inventories of most grains remained at low levels – levels not seen in decades.

Should adverse weather in any of the major global grain producing regions impact this summer's crop, a crisis may erupt in the agriculture sector – which is already under enormous strains. Last month the following developments occurred:

All-time high prices for soybeans and wheat, and near-record high prices for corn, have pumped up farm incomes by 50 percent since 2006. The value of Indiana farmland has soared from an average of $3,500 an acre to more than $4,000 in the past two years. Jon Castongia can't keep enough farm equipment in his John Deere dealership. "I've got nothing that's not sold," he says. "Across the board, new and used, everything's popular right now." Castongia's business boom is evidence of a new golden era for farmers. The boom is expected to plow billions of dollars of extra income into Indiana 's economy in the next few years. (Indystar.com)

All-time high prices for soybeans and wheat, and near-record high prices for corn, have pumped up farm incomes by 50 percent since 2006. The value of Indiana farmland has soared from an average of $3,500 an acre to more than $4,000 in the past two years. Jon Castongia can't keep enough farm equipment in his John Deere dealership. "I've got nothing that's not sold," he says. "Across the board, new and used, everything's popular right now." Castongia's business boom is evidence of a new golden era for farmers. The boom is expected to plow billions of dollars of extra income into Indiana 's economy in the next few years. (Indystar.com)

- Record-high grain prices are fueling a rural economic boom in U.S. farm states such as Kansas . Farm equipment dealers have a backlog of several months in orders for new machinery. Cropland rents are rising, along with agricultural land prices. While cities struggle with foreclosures and fears of a recession, a lot more money is circulating in rural Kansas . Kansas Corn Growers Association director Jere White said after several lean years, many Kansas farmers are putting money they're making from grain into their farms, their homes and elsewhere. A telling barometer of the farm economy is the rising number of orders for new farm machinery. New combine sales were up 15% nationwide in 2007, sales of 4-wheel-drive tractors rose 23%, and sales of large-scale, two-wheel-drive tractors were up 26%. (Associated Press)

- The Russian government plans to extend export duties on grain until July 1, 2008 . The government earlier fixed export duties on barley and wheat at 30% and 40%, respectively, rates that were set to expire in late April. Global grain prices continued to rise while domestic grain prices were considerably lower, which compelled the government to introduce prohibitive export duties. (RIA Novosti)

- Rising prices and a growing fear of scarcity have prompted some of the world's largest rice producers to announce drastic limits on the amount of rice they export. The price of rice, a staple in the diets of nearly half the world's population, has almost doubled on international markets in the last three months. Price increases have pinched the budgets of millions of poor and raised fears of civil unrest. Shortages and high prices for all kinds of food have caused tensions and even violence around the world. Food riots have erupted in recent months in Guinea , Mauritania , Mexico , Morocco , Senegal , Uzbekistan and Yemen . The moves by rice-exporting nations — meant to ensure scarce supplies will meet domestic needs — have driven prices on the world market even higher. (AP)

- Northern and northeastern China is suffering from the worst drought in decades. "We are facing the most severe challenges in spring farming in recent years," said the Ministry of Agriculture in Beijing on Friday. This will have a major effect on agricultural production, especially in the province of Heilongjiang , a region that is the country's largest supplier of commodity grains, including corn, soybean, rice and wheat. Up to 51% of the province's total planted area could face severe drought during the spring plowing season.

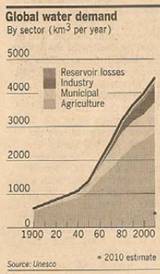

Saudi Arabia announced last month it would start importing wheat in 2009 and end a massive grain self-sufficiency program launched more than two decades ago. The Gulf Kingdom said it would move to 100% reliance on wheat imports by 2015. Demand is estimated at 2.7 million tons. The import plan was adopted to conserve water after reports of alarming declines in their underground water resources. In addition to ground water, the Kingdom's 30 desalination plants supply about 50 cities and distribution centers. Due to the agricultural use per capita water consumption in Saudi Arabia is among the highest in the world. Cereal and dairy farms across the country account for 85 per cent of water consumption. Water is heavily subsidized in Saudi Arabia - while one cubic meter of water costs about $1.08 to produce, it is sold for only about three cents.

Saudi Arabia announced last month it would start importing wheat in 2009 and end a massive grain self-sufficiency program launched more than two decades ago. The Gulf Kingdom said it would move to 100% reliance on wheat imports by 2015. Demand is estimated at 2.7 million tons. The import plan was adopted to conserve water after reports of alarming declines in their underground water resources. In addition to ground water, the Kingdom's 30 desalination plants supply about 50 cities and distribution centers. Due to the agricultural use per capita water consumption in Saudi Arabia is among the highest in the world. Cereal and dairy farms across the country account for 85 per cent of water consumption. Water is heavily subsidized in Saudi Arabia - while one cubic meter of water costs about $1.08 to produce, it is sold for only about three cents.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2008 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.