Stock Market No Worries – Dammit Janet, We Love You!

Stock-Markets / Stock Markets 2014 Feb 12, 2014 - 02:31 PM GMTBy: PhilStockWorld

The river was deep but I swam it, Janet

The future is ours so let's plan it, Janet

If there's one fool for you then I am it, Janet

Now I've one thing to say and that's

Dammit, Janet, I love you…

The markets are loving our fiesty new Fed Chairwoman!

The markets are loving our fiesty new Fed Chairwoman!

And why shouldn't they? Like the Joker in that first Batman movie - she's giving away free money – what could possibly go wrong? For almost 6 hours yesterday, Janet yellen testified before Congress and essentially said it would take an EXTREME change is circumstances for her Fed to take the foot off the economic gas pedal:

"Let me emphasize," she said, "I expect a great deal of continuity in the [Fed's] approach to monetary policy. I served on the committee as we formulated our current policy strategy and I strongly support that strategy."

Ms. Yellen was the Fed's Vice Chairwoman for more than three years before being sworn in last week as its new leader. From the #2 spot she pushed aggressively for the Fed to adopt easy-money policies, including the third round of bond buying launched at the end of 2012, to encourage borrowing, spending, investment and hiring. Her comments left little doubt that her plan - as was Bernanke's – is to tiptoe away from those policies only gradually as the economy improves.

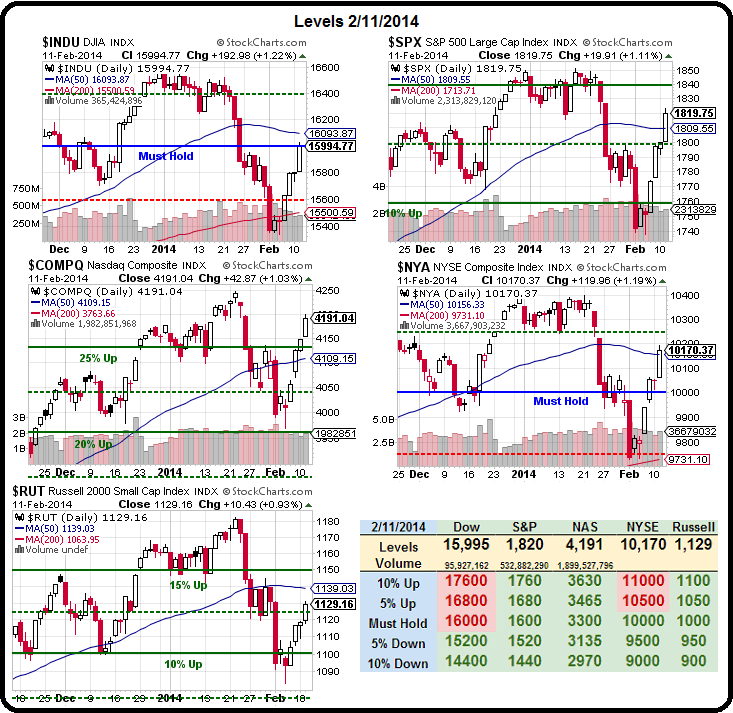

As noted in Dave Fry's charts, we've made a very impressive rebound but, so far, it's been a low-volume affair with narrow participation and there is a danger that we're simply forming the right shoulder of the dreaded "head and shoulders" pattern that will take us back to 1,650 on the S&P.

Nonetheless, we did get over all 4 of our strong bounce lines at: Dow 15,900, S&P 1,806, Nasdaq 4,135,NYSE 10,100 and Russell 1,126, which signaled "game on" for our upside hedges (see Monday's post). Fortunately, we only needed 2 of those lines to cross to enter the trades (see yesterday's post) and we got those at the open and already our trades are doing a very nice job of covering the upside:

- 10 SSO March $92/97 bull call spreads at $3.30 ($3,300) covered by 5 short AMZN April $325 puts at $5.60 ($2,800) was net $500 and closed yesterday at net $1,500 - up 200% already.

- 10 SSO March $92/97 bull call spreads at $3.30 ($3,300) covered by 3 short IBM 2016 $150 puts at $10.40 ($3,120) was net $180 and closed the day at net $920 - up 411%

- 10 SLW Jan $20/25 bull call spreads at $2.35 ($2,350) covered by 5 short CI 2016 $60 puts at $5 ($2,500) was a net $150 credit and finished the day at $275 - up 283%

We discussed these trades and other bullish trade ideas in yesterday's Live Webcast (replay available here) and we'll be able to layer on additional bullish trade ideas should the markets hold up this morning in our Member Chat Room.

Of course, the SLW trade has an upside potential of $5,150, so being up 283% in a day is reallly only "on track". This is how the rich get richer folks – highly leveraged upside bets on a market that is guaranteed by our Central Bank. What can possibly go wrong?

I'm sure our Members are well aware that I can rattle off dozens of things that can go wrong (and some that are going wrong, even as we speak), but I've written about all that before, so let's just say we remain skeptical but that shouldn't prevent us from taking the FREE MONEY – while it's being handed out….

We already added PLENTY of long positions on 1/29, when we took a poke at some bottom-fishing. Alerts went out to our Members on these stocks at 10:20 am:

As you can see, it was a pretty good group of picks and, of course, our Members used option trades to leverage those gains tremendously. We also added RFMD at 10:43, T at 11:07 and at 11:36, we added SHLD, BTU and a short on WYNN to our portfolios and RRD at 12:09 and AAPL ($475!) at 12:58 and DIA at 1:11 and F at 2:17 and, at 2:52, we calculated our lines for the 5% Rule as follows:

- Dow 16,600 to 15,700 is 900 so 15,880 (weak) and 16,060 (strong)

- S&P 1,850 to 1,770 is 80 so 1,786 (weak) and 1,802 (strong)

- Nas 4,225 to 4,060 is 165 so 4,100 (weak) and 4,133 (strong)

- NYSE 10,400 to 9,950 is 450 so 10,040 (weak) and 10,130 (strong)

- RUT 1,180 to 1,120 is 60 so 1,132 (weak) and 1,144 (strong)

So, as you can see, this is just about the bounce we were expecting and we'll be taking SHORT positions in our already-suffering Short-Term portfolio because we're not out of the woods yet – just at the bounces we predicted when we went long on 1/29 (when others were panicking).

Already, this morning in our Member Chat Room, we played the Dow short at 15,950 (/YM) and we got a nice, little 25-point drop so far. Oil was better as we caught a ride from $100.66 back to $100.30 for $260 per contract and now we're back at $100.75 and ready to short them again (but carefully with inventories at 10:30).

As the market opens, we expect gold (/YG) to fail the $1,290 line (short-term, we're long on gold) and that's a good shorting spot if the Dollar is over 80.85. Today is only day one over our major lines and we don't get any more bullish than this until we have two full days over. Keep in mind, we don't even have a strong bounce from the Dow or the Russell – that's pathetic!

Giving away free money only gets you so far, now that they Yellen celebration is over, attention will turn back to earnings and the very heavy data week ahead.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2014 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.