Bernanke Exit, Yellen Entry - Federal Reserve Continuity of Committing Fraud

Politics / US Federal Reserve Bank Mar 24, 2014 - 10:44 AM GMTBy: Jas_Jain

There has been lot of commentary about the transition at the head of the Federal Reserve. During the past four months, Janet Yellen has appeared for confirmation hearing, testimony to the Congress, and a Q&A session following her first meeting as the Chairperson of the Fed.

There has been lot of commentary about the transition at the head of the Federal Reserve. During the past four months, Janet Yellen has appeared for confirmation hearing, testimony to the Congress, and a Q&A session following her first meeting as the Chairperson of the Fed.

Yellen, Bernanke and Greenspan on the Current Stock Market Valuation (Bubble or Not)

During her confirmation hearing, Yellen was asked about stock market being in bubble territory and her answer was that the market was fairly valued and was not a bubble. In a Q&A session following the meeting of American Economic Association in Philadelphia in January 2014, two weeks before his last FOMC meeting as the Chairman, Ben Bernanke was also asked about the stock market bubble and he said that the stock market valuation was within a historical norm. In early March, Greenspan appeared on CNBC and he was also asked about stock market being a bubble and he also said that the market was not over valued and was fairly valued.

Have any of the three most recent Chairpersons of the Federal Reserve looked at any of the data that assess market valuation in the historical context? Highly unlikely, because the best methods of market valuation clearly indicate that the stock market is grossly over-valued, historically, with valuation levels above 90 percentile. I will mention two of the best methods of market valuation, one of which, the Shiller Cyclically Adjusted P/E ratio (CAPE), was the basis of Greenspan's "irrational exuberance," comment in 1996 when CAPE reached the level above 25 that it has been during the past 4 months.

Greenspan and the Stock Market Bubbles

From the transcripts of a 1994 FOMC meeting we learn that back then Greenspan did believe in stock market bubbles and he commented that by raising the rates in 1994 the Fed might have burst the bubble in the stock market, towards the end of 1993, when the CAPE was just above 21, fueled by low Fed Funds rates. The stock market spent 1994 in a correction. After the "irrational exuberance" comment in late 1996, Greenspan stopped commenting on the market bubble and in 1999 even try to justify the valuation. He was correctly called the bubblemeister back then and he remains one today. After 1996, Greenspan learned that Wall Street doesn't look kindly at any Fed Chairperson who would confirm that there could probably be a bubble in the two most important asset markets, the stock market and the housing market. Since then asset bubbles have become a preferred mechanism of keep the economy growing and Federal Reserve has chosen to look the other way and allow the bubble to continue.

Congressional Testimonies of Fed Chairs and Questions About Bubbles

In March 2007, Bernanke was asked about the housing market being a bubble and not only he denied that there was any nationwide bubble he said that housing price rise would slowdown to 3-5% a year. Few short months later the historical housing bubble burst with a vengeance. I don't remember Congresspersons asking the Fed Chair a question about a bubble, in the stock market or the housing market, unless there was a real bubble. The same applies when there is lot of talk about a bubble on Bloomberg and CNBC. Both these indicators have confirmed that there must be a bubble in the stock market.

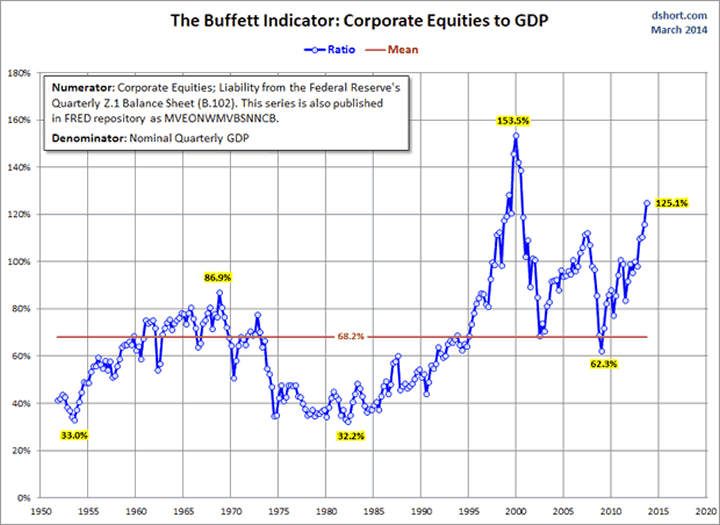

The "Buffet Indicator," i.e., the Stock Market to GDP Ratio

Another very good indicator of a bubble in the stock market is the stock market capitalization to the GDP ratio that some have labeled the "Buffet Indicator," because Buffet had mentioned that long-term there is a relationship between the GDP and its growth rate and the stock market and its growth rate. Below is the latest graph of this ratio. Both, this indicator and Shiller's CAPE, clearly indicate that the stock market over the past 3 months has been above 90th percentile and if we were to exclude the supper bubble period of 1998-2000, we are at 98th percentile.

To call this level of historical over-valuation, "historical norm," or "fairly valued," is a deliberate lie, intended to mislead the Congress and the public and constitutes fraud. They could have given a non-committal answer as to "we don't know," or even a more honest answer that Fed Chairs have a horrible record at identifying bubbles and that the Fed policy might have even contributed to them with artificially low rates.

Periodic Fraud by Wall Street and Economists, Including the Fed Chairs

As I had concluded earlier with the supporting evidence that Economists and Wall Street commit "periodic," or cyclical fraud, very predictably. At cyclical peaks they flat out lie about impending recessions. Their horrible record during 2007 speaks volumes. The same would prove to be the case in near future.

Lying about bubbles has become a required qualification for the job for the Federal Reserve Chairperson since 1997, after Greenspan uttered the famous phrase irrational exuberance. Had Greenspan continued to talk about the stock market bubble he would have lost his job by no reappointment after his 4-year term at that time. The Fed chairs, like most politicians, must serve their real masters -- Wall Street, large corporations and the super rich. The periodic fraud by Wall Street and the Fed has been largely responsible for the income and wealth inequality in America. Many other countries have followed the example set by the US.

By Jas Jain , Ph.D.

the Prophet of Doom and Gloom

Copyright © 2014 Jas Jain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.