Safe Havens Since The Great Financial Crisis

Commodities / Gold and Silver 2014 May 05, 2014 - 09:48 AM GMTBy: GoldSilverWorlds

How have the traditional safe havens performed since the great financial crash of 2008 / 2009? What can we expect from the traditional safe havens going forward? Those are the two questions we try to answer in this article.

How have the traditional safe havens performed since the great financial crash of 2008 / 2009? What can we expect from the traditional safe havens going forward? Those are the two questions we try to answer in this article.

The safe havens we look at in this article are the US Dollar, US Treasuries, gold and the Yen. Obviously, with a never seen amount of debt backing the US dollar and the Yen, some would (rightfully) question their safe haven status. However, the reality is that the market is considering them safe havens, because of a lack of globally accepted alternatives.

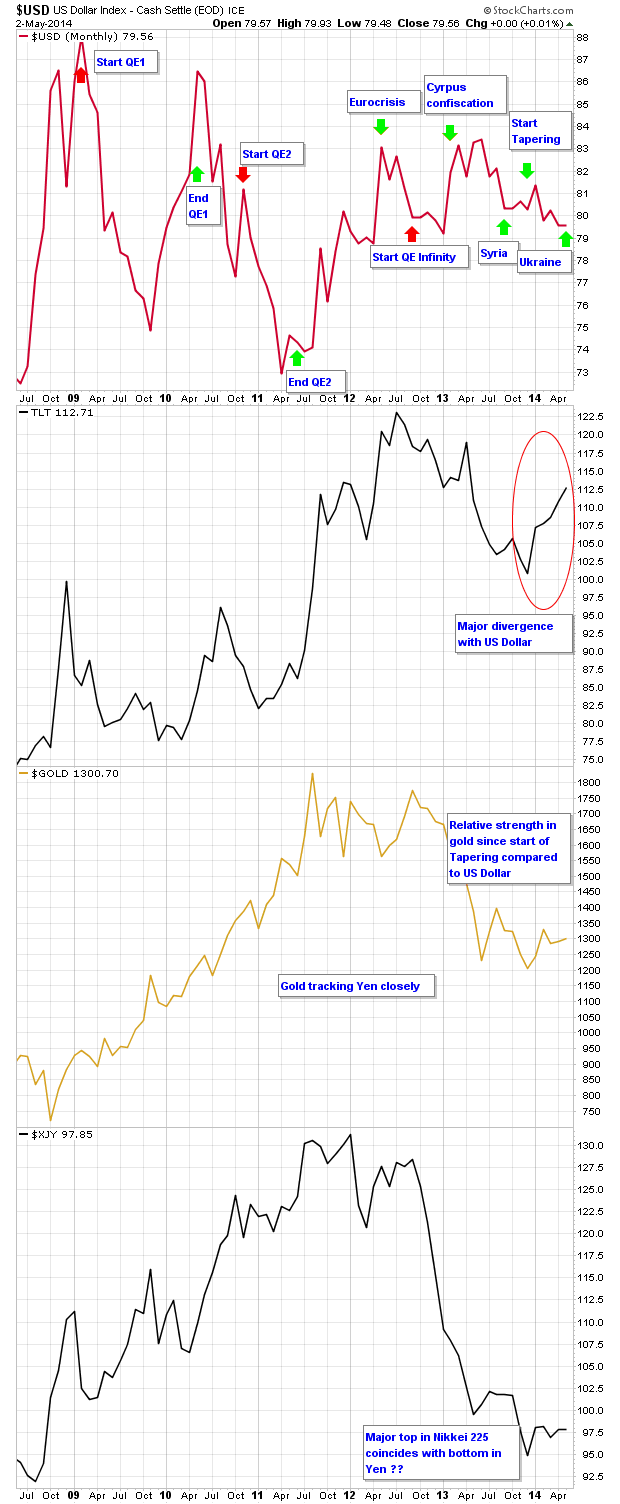

We have prepared a set of four charts to guide us in our thinking, see below. The US Dollar is shown in the first of the four charts. We have marked several key events in the last five years which, combined with the pattern on the chart, tell an interesting story. Our interest in the big picture, not in trading. We look at the monthly charts to smooth short term price movements, which we consider noise in the context of this article.

As the great financial crisis started to unfold in 2008, there was a flight to the US Dollar and Treasuries, as well as the Yen. The depth of the crisis marked the top of the US Dollar. The greenback has not been able to exceed its 2009 heights.

When Mr. Bernanke opened the easy money gate and flooded the banking system with a tsunami of liquidity (aka QE1), the value of the dollar logically fell down. In the year 2009, the dollar lost 15% of its value. When the end of the first stimulus package came in sight, the value of the dollar reversed its course. The end of QE1 is marked in green on the chart, implying it is dollar positive (pardon us, we know that central bankers do not consider a strengthening currency as positive, but let’s stick to simple human being logic).

The second round of QE resulted in a smaller loss in the value of the dollar. Again, the end of QE2 made the greenback go up in value.

In 2012, the world was fearing a breakup of the Euro area. The Euro crisis resulted in a flight to safety, i.e. the US dollar (indicated with a green arrow on the chart).

However, as of that point in time, we see several “irregularities” in the dollar index. First, when “QE Infinity” started, contrary to the previous rounds of monetary injections, the dollar went higher till the summer of 2013. A plausible explanation for this would be the start of a strong bull market in US equities. Second, the crisis in Syria was not really able to send the Dollar higher. The fact that the Syria crisis was short lived could serve as an explanation.

However, since the first round of tapering in December 2013, the Dollar has been losing ground. Admittedly, we are not able to find any serious argument as an explanation. The US Fed has tapered already half of their monthly bond purchases; the Dollar has gone down since then. On top of that, the situation in Ukraine is not really supporting the greenback. The only rationale for this trend, in our view, is inherent weakness.

Interestingly, the chart reveals how “dollar positive” events (marked with green arrows) since the summer of last year have not resulted in strength in the dollar.

From a chart perspective, the dollar has arrived at a critical support point. It is testing a key support area for the third time since 2012. Is the dollar weakening because US equities have topped? Or is the world losing trust in its reserve currency?

An insight to answer that question was provided by Alex Merk recently. He stated that the euro is strengthening against the dollar. A currency index is made up of several exchange rates, each one with a specific weigth. As is the case for the Dollar index, its most important component is the Euro which accounts for some 55%. So, increasing trust in the Euro could be the driver, at least partly, of recent dollar weakness.

Euro strength could explain the major divergence between the US Dollar and US Treasuries. As the chart above shows, 2014 is a year, so far, which marks weakness in the greenback and strength in Treasuries.

What about the other two safe havens: gold and the Japanese Yen? Interestingly, both have had a similar pattern since 2009. After an initial drop in the gold price during the financial crisis, the yellow metal went steeply higher until September 2011. Since then, the price has declined till December 2013. The Yen has a similar pattern, although it lost much more of its value over the course of 2013.

Mind that the Yen index has a composition of 4 other currencies, with an equal weight of 25%: Euro, US Dollar, Australian Dollar, New Zealand Dollar. Recent strength in the Euro and weakness in the Dollar could, for now, explain why gold and the Yen have held up.

Where do we go from here?

The first conclusion is that US Treasuries and gold are the only assets who are significantly higher than where they were at the top of the financial crisis.

Second, looking at the evolution of safe havens since the great financial crisis is, it seems there is no real safe haven among currencies (mainly US Dollar and Yen). If the recent past is a prologue of future events, than investors should really be prepared to embrace change. What is considered a safe haven in 2012 is the biggest loser among currencies in 2013.

Going forward, given the correlation between gold and the Yen, there is a high probability that the Nikkei 225 is topping, leading to strength in the Yen index. Admittedly, in distorted markets, this type of simple correlations could be worthless. But, nonetheless, one should not exclude a top in equities and a bottom in Yen, taking gold higher in such an environment.

In general, given the current financial and monetary context, it is not realistic to expect another 12 year bull market in any asset, even not in gold or silver. With the distortion created by central planners it is unlikely that a long term rise in any asset is able to hold. The global currency war will undoubtedly result in cracks in the monetary system and in several currencies in particular. Do not exclude the landscape to change with a political decision; in a matter of seconds the world could look different.

In the same respect, the probability of a monetary event shocking the landscape of currencies is very high. In case gold is remonetized with the aim to alleviate the world’s debt burden, a sudden spike in the price of gold could realistically be expected. However, it remains anyone’s guess when and how that will happen.

For individuals and investors, it seems a safe bet to be prepared in the “no safe haven era” with physical gold in its possession, outside the banking system. That is the ultimate safety on counterparty risk which cannot be provided by any other safe haven.

Source - http://goldsilverworlds.com/money-currency/safe-havens-since-the-great-financial-crisis/

© 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.