How to Find Junk Bonds That Don’t Stink

Interest-Rates / Corporate Bonds May 06, 2014 - 04:43 PM GMTBy: Casey_Research

By Andrey Dashkov, Research Analyst

By Andrey Dashkov, Research Analyst

Riddle me this: Why would anyone ever buy junk bonds or a junk bond fund? Before we get to the answer, I would like to point something out that seems to be a given, but that astonishingly few investors think about: bonds are debt instruments, so investing in bonds means investing in debt, governmental or corporate.

Note that credit ratings from agencies like Standard & Poor’s, Moody’s, and Fitch do not reveal the whole picture about the risk these bonds represent. Bond ratings only deal with one risk: default. They are supposed to help investors discern investment-grade bonds from the lower-rated junk bonds. AAA-rated bonds, on average, have a historical default rate of zero; B-rated bonds, on the other hand, have a default rate of 4.3%.

With so many negatives, why buy these debt instruments? The reason that junk bonds are so popular with investors is that if there are enough interest-rate differentials to offset the default risk, junk bonds can be a better deal than their triple-A peers and make for a diversified bond portfolio.

Diversification is a complex subject. With bonds in particular, to really understand diversification, one must look behind the curtain.

There are two rules of thumb when it comes to bonds:

- When interest rates rise, bond prices fall. This is true for fixed-rate debt, and it works most of the time.

- Investment-grade bonds are good while speculative-grade bonds are just that and have a much higher risk of default.

The Guggenheim Battle

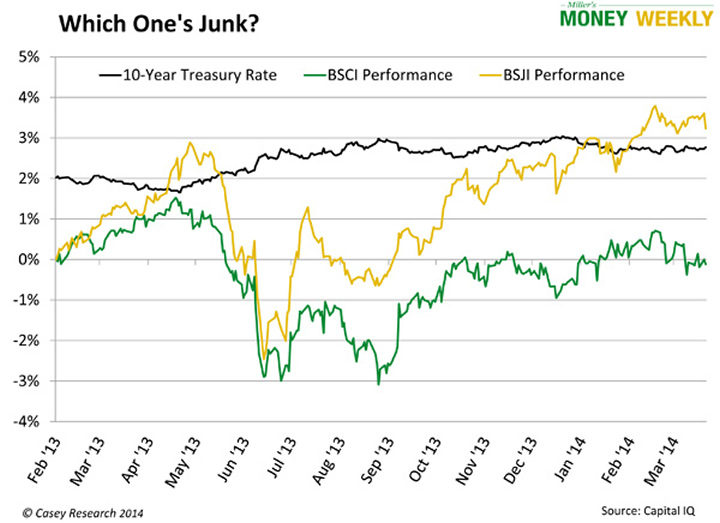

Let me illustrate my point with two Guggenheim funds: Guggenheim BulletShares® 2018 Corporate Bond ETF (BSCI) and Guggenheim BulletShares® 2018 High Yield Corporate Bond ETF (BSJI). Both are target-maturity funds expiring in 2018.

BSCI runs the full gamut of investment-grade ratings (from AAA down to BB-) and currently pays 2.2% yield to maturity. On the surface, it is well diversified and should be safer because of the investment-grade ratings.

The BSJI portfolio is diversified among lower-rated bonds and pays 4.9% yield to maturity. The junk bonds historically have a higher rate of default. In a default, normally bondholders don’t lose all their money, because they’re higher up on the creditor ladder; however, on average they lose about half.

Safety‘s in the Duration

Average effective duration is a measure of the sensitivity of the price of a fixed-income investment to a change in interest rates. For the BSCI portfolio, it’s 3.9; for BSJI it’s only 3.2. You need to understand that duration is a historical calculation and an estimate. As the TV commercials say, “Individual results may vary.”

Using duration history as a guide, for every 1% rise in interest rates, the market price of BSCI should drop 3.9%, while BSJI would drop just 3.2%—a difference of 18%.

When Treasury rates rise and the spread between them and corporate debt narrows, many investors flock to government bonds on the (shaky) premise that they are safer. As a result, the demand for corporate bond funds like BSCI drops and their prices dwindle. This is why BSCI has shown higher interest-rate sensitivity.

High-yield funds, on the other hand, attract a different class of investors: the more adventurous types who are willing to take a greater risk for the extra yield. Ironically, however, the extra risk isn’t necessarily there.

For the past year, highly rated corporate bonds have experienced much wilder swings than the high-yield sector. At least part of that is due to investors not jumping ship—since there are no “high-yield Treasuries,” there’s no ship for high-yield investors to jump on.

Not that they would want to. We won’t go into the whole inflation protection debate here, but when push comes to shove and Treasuries finally show their junky nature, viewer discretion will be advised.

For Correlation, Pick the Weak Ones

BSCI and BSJI are both bond funds, but their correlation to 10-year Treasuries paints a much different story. The correlation (a statistical measure of how two securities move in relation to each other) between the 10-year Treasury rate and BSCI is -0.6. That means when interest rates rose, BSCI’s price dropped in 60% of all cases. One would have to take a loss and sell the fund in the market or hold it at an interest rate much lower than current market.

The one-year correlation between 10-year Treasuries and BSJI is 0.08—in other words, when interest rates rose, BSJI rose only 8% of the time.

Within a portfolio, it’s best to hold assets that are correlated as weakly as possible. If some of your investments become too interest-rate sensitive, one-year correlation data suggests that a junk bond fund like BSJI will diffuse the risk better than a fund that has a lot of investment-rated debt in it. I know it’s counterintuitive, but that’s how it has worked during the past year. Remember, the correlation coefficient would differ from what I calculated if you looked at another time period.

Baby Boomers on the Hunt for Yield

Yield is the primary reason many baby boomers and retirees own bonds, and they generally plan to hold them to maturity. If that’s you, and if you don’t have to sell the bonds before maturity—and have the stomach to endure day-to-day price swings—you should be fine.

Here’s the bottom line. Currently BSJI has a yield to maturity of 4.9%, while BSCI has a yield to maturity of 2.2%. So which looks safer? That depends on what risk you are trying to avoid.

BSCI, as I said before, is diversified among higher-rated corporate bonds and has a lower probability of default. Because of that low risk, it is currently paying 2.2% yield to maturity.

Should the interest rates on Treasury bonds rise, you would face two choices: hold the bonds until maturity and lose money via inflation… or sell them in the aftermarket and lose money too.

Why would an investor buy a so-called “safe” bond fund that doesn’t keep up with inflation?

With the Guggenheim High Yield Fund paying 4.9%, should interest rates rise, you would take a smaller loss if you needed to sell before maturity. If you held on until maturity—even with the possibility of higher default—your yield would be more than double that of the “safe” bond fund.

The Key Takeaways

What the rating agencies tell you is spotty at best. Sometimes a bond or bond fund that looks great on the surface will underperform its counterpart that conventional wisdom would deem too risky. When it comes to bond portfolios, duration and correlation will tell you much more about risk than letter combinations created by institutions whose criteria for safety may be substantially different from yours.

If you’re new to the bond market, learn everything you need to know about how to evaluate bonds… which types of bonds can fit nicely into your portfolio… and how to understand your risk/reward options… with the free Miller special report, Bond Basics. Click here to get it now.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.