Peak Pollution: China Aims For The Top So It Can Go Down

Economics / China Economy Jun 11, 2014 - 03:09 PM GMTBy: OilPrice_Com

City-dwelling Chinese may still be choking on smog, but amid all the haze, China may turning a corner in its fight on pollution. Top Chinese officials have hinted at the fact that China is working hard to achieve "peak" greenhouse gas emissions, which may come sooner than observers expect.

City-dwelling Chinese may still be choking on smog, but amid all the haze, China may turning a corner in its fight on pollution. Top Chinese officials have hinted at the fact that China is working hard to achieve "peak" greenhouse gas emissions, which may come sooner than observers expect.

"Peak pollution" refers to the point at which a developing country's economy reaches a high enough level of production to ensure it will continue to grow even as it begins to work on reducing pollution rates.

Despite off-the-chart air pollution levels in some cities, China has long been the world's leading producer and user of clean energy. It already has the largest wind market in the world and its installed capacity has nearly doubled every year since 2005.

Last year, China accounted for 45 percent of total new wind power installations worldwide. The government has ambitious plans to more than double its wind capacity by the end of the decade. By 2020, it plans to have installed a cumulative 200 gigawatts (GW) of wind, up from the current 92 GW.

While China has dominated the wind industry for several years now, it has been a latecomer to the solar party. Chinese solar companies have been the biggest in terms of manufacturing and exporting cheap solar panels around the world, but domestic demand within China for solar has been slow. That changed in 2013, when China leapt to the front of the pack, installing 12 GW of solar and becoming the world's largest solar market for the first time. This year will likely be even better as the government has set a target of 14 GW of solar.

With the largest wind and solar markets in the world, China is clearly a clean energy powerhouse.

Even so, China's clean energy sector has experienced some serious growing pains. As of 2012, only 61 of the 75 GW of installed wind were actually connected to the grid. The remaining turbines were left idle even as China was claiming to be setting a global example for clean energy. Moreover, China often has to curtail some wind generation on certain days because the electrical grid has not been upgraded in order to handle the intermittency of wind.

And for all of the hype surrounding China's clean energy sector, especially its massive wind market, wind power still only represented 2 percent of China's electricity sector in 2012. Meanwhile, coal-powered plants continue to belch out black smoke, accounting for three-quarters of the country's electricity generation.

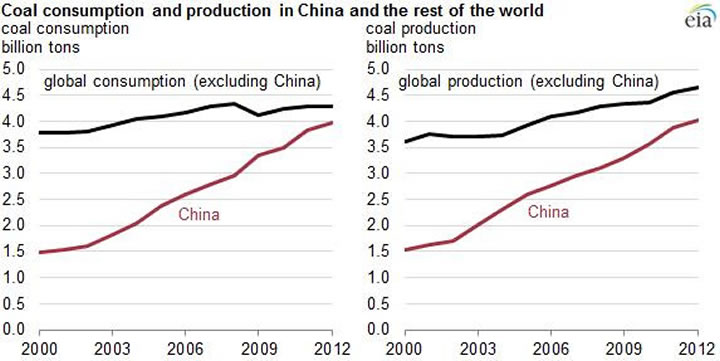

In fact, China is by far the largest producer and consumer of coal. It burns through about as much coal as the rest of the world combined. Over the past 10 years, China alone accounted for 83 percent of the increase in global coal demand, which has more than offset its achievements in wind and solar installation.

But that may be about to change. In the wake of the U.S. Environmental Protection Agency's announcement to regulate carbon dioxide emissions from existing power plants, China has responded in kind. The vice president of China's powerful National Development and Reform Commission, Xie Zhenhua, recently said that China would take additional steps to cut pollution.

China is "working very hard to address climate change," Xie said. "We will try our utmost to peak as early as possible."

The day after the Obama administration released its carbon rules, a senior Chinese official was quoted saying that China may consider a hard cap on carbon emissions in its next five-year plan, which is due in 2016.

If China does ratchet up efforts to clean up its economy, it could indeed reach "peak pollution" much quicker than anticipated. Some experts predict that China's pollution won't top out until the 2030s in a business-as-usual scenario.

This would be an extraordinary development if China articulates a plan to cap its carbon emissions in the near future. For years, global climate talks have been at a standstill because a bloc of developing countries led by China have been resistant to capping emissions, arguing that rich countries have had been polluting for far longer.

China has argued that it deserves more time – which would result in a continual increase in its annual greenhouse gas emissions. If China, influenced by U.S. action, decided to set a ceiling on its emissions rate, it could lead to a significant breakthrough in international negotiations.

Reaching peak pollution would necessarily mean closing coal plants. It would mean a massive increase in nuclear power. It would also mean using much more natural gas. It would require cleaner vehicles and more mass transit. And it would obviously mean a huge buildup of more solar and wind power.

There is still a long way to go, but the days of China's smog-choked cities may be numbered.

Source: http://oilprice.com/Energy/Energy-General/Peak-Pollution-China-Aims-For-The-Top-So-It-Can-Go-Down.html

By Nicholas Cunningham of Oilprice.com

© 2014 Copyright OilPrice.com- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.