Gold Bugs’ Hearts Are Beating Faster

Commodities / Gold and Silver 2014 Jun 23, 2014 - 12:14 PM GMTBy: John_Rubino

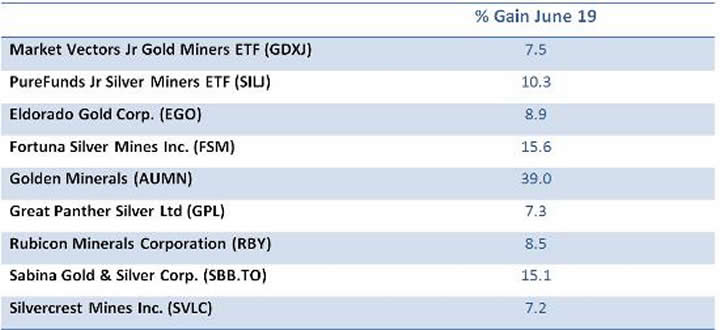

Last Thursday was the kind of day that precious metals investors have been waiting (and waiting and waiting) for. Gold and silver popped 3.5% and 4.8% respectively and the junior miners, which have been universally unloved lately, took off. Some more-or-less random examples:

Last Thursday was the kind of day that precious metals investors have been waiting (and waiting and waiting) for. Gold and silver popped 3.5% and 4.8% respectively and the junior miners, which have been universally unloved lately, took off. Some more-or-less random examples:

One day does not of course make a bull market, but it does give a sense of what the bull market will be like when it comes. And long-suffering gold bugs like the feeling. Some snippets from articles that appeared in response:

From Jim Sinclair:

Dear CIGAs, Here are the 30 reasons, 23 new and 7 set in cement, of why the Bear phase in the bull market for gold ends this summer without any new lows.

1. The New definition of warfare is economic. Sanctions against Russia and the implications for the Petrodollar.

2. FACTA and the universal long arm of the US government via any transaction internationally that passes even momentarily through the dollar as a contract settlement mechanism. The negative implications for the dollar’s future as a contract settlement mechanism internationally.

3. EU split over sanctions due to Russian energy demand and Russian business interests.

4. Middle East Western Hegemony and Arab Spring is defunct.

Chart of gold below. As I write an hour before the close, gold is up $41. Referring to the chart you can see this puts gold above its 50-day and 200-day moving averages. This should start squeezing the gold shorts. The bear market in gold is over, and gold again is in a bull market.

When you talk about who is left to sell these things, and how they (the mining stocks) have all been bombed-out and the shares are now being held by strong hands, flip that question around for a second: What happens if some real buyers come into these markets, some real buyers who want to own these shares? And they decide, ‘I want to own a big chunk of gold mining stocks.’ Where are they going to buy that stock? They are not going to buy that stock down here because it’s not for sale down here. As we’ve said, the people holding these shares now, for the most part, are die-hards.

For anyone (managing billions of dollars) who wants to establish a position here in something that they think is a three-year to five-year investment, if they do want to get ahead of a turn in the inflation around the world, they are not going to get a meaningful position in these things — not down here. It’s going to cost them a lot more money to do that. So we could see some very interesting moves in the next few weeks.

If inflation expectations are picking up, there are very few things better equipped to protect you from that than gold mining shares. And you’ve got the advantage that they are now so bombed-out that even if you are wrong, even if you get your timing wrong, your downside here (is minimal).

So not only is the rally in gold that we are seeing way overdue, but there are a lot of shorts in this market that will create a real scramble. We have already broken above the 200-day moving average. My sense is that between $1,330 and $1,360 there is a little bit of resistance. But after that there are some big vacuums higher in terms of the price and it wouldn’t surprise to see $100 to $200 up-days for gold. This leg of the bull market has just begun and the mining stocks seem to be the best bet. You get a multiplier of 2 to 1. We saw that unfortunately on the downside. Now we are going to see it on the upside.

It was like this on pretty much every sound-money website and a lot of the mainstream media over the weekend. Suddenly, the world looks like a much more dangerous, uncertain place and precious metals are back on the radar screen of worried people awash in paper stock, bond and real estate profits. The math was always theoretical but compelling: Let even 1% of the (fictitious) financial wealth that has accrued during the credit bubble be redirected to tiny, thin markets like gold and silver, and double-digit percentage gains will start to seem normal, while junior miners will behave like late-90s dot-coms.

Is this the start of that? Who knows. But it is coming eventually. And when it does, it will be spectacular.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.