Gold Prices Benefit From Economic Sins

Commodities / Gold and Silver 2014 Jul 01, 2014 - 02:54 PM GMTBy: DeviantInvestor

Governments, such as the United States, United Kingdom, Europe, and Japan, spend their paper currencies as if tomorrow will never come. They act as if they believe debts can increase forever, more money will always be available, and debts can be rolled over forever. A recent US vice-president even stated that “deficits don’t matter.” Such economic sins may help the financial elite but they ultimately hurt most people and most economies.

Governments, such as the United States, United Kingdom, Europe, and Japan, spend their paper currencies as if tomorrow will never come. They act as if they believe debts can increase forever, more money will always be available, and debts can be rolled over forever. A recent US vice-president even stated that “deficits don’t matter.” Such economic sins may help the financial elite but they ultimately hurt most people and most economies.

Governments pretend they don’t know there are consequences to actions, bills must be paid, and nothing lasts forever. Government actions are equivalent to an individual announcing, “I can’t be out of money, my credit cards still work.”

A few consequences:

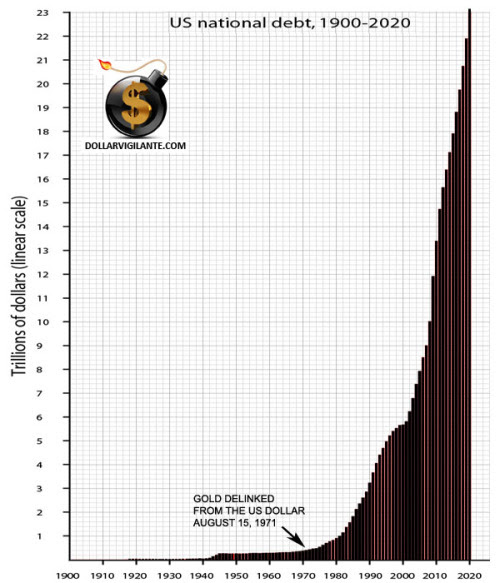

President Nixon closed the “gold window” in 1971 and disconnected the U.S. government, the Federal Reserve and the dollar from the discipline of gold. The result, as measured by official national debt is shown here – a massive increase in debt.

US Official National Debt

The two invasions of Iraq have not, based on recent ISIS conquests, produced the benefits that the US & UK war planners expected. The costs as measured in human life, international prestige, and expenses have been considerable. Additional consequences have been massively increased national debt, a sluggish economy, and accelerating inflation in food and energy prices. Prognosis: higher oil prices, more inflation, weaker dollar and more economic sins.

There are always consequences from the actions of individuals, countries, governments, and central banks. Prognosis: prepare for stormy weather.

Regardless of what politicians profess, there are consequences to their actions – their economic sins – and it is wise to clearly assess the likely outcomes.

Most governments spend much more than their income and borrow the difference – economic sin # 1. The result is a larger money supply and increasing debt. Eventually the central bank begins “printing money” – economic sin # 2. Consumer price inflation accelerates and angry citizens watch as their capital, savings, and pensions are consumed in the fires of government created inflation – economic sin # 3. A diversion, such as another war or invasion, is then needed and economic sin # 4 commences. Prognosis: more spending, more debt, and the cycles of economic sins and economic destruction will continue.

CONCLUSIONS:

- Expect larger government, more government programs, more debt, more spending, and more military adventures.

- Expect more price inflation, declining purchasing power for the dollar, euro, pound, and yen, and wages that will not increase to match the rise in the costs of food, energy, and taxes.

- Expect excuses and diversions.

- Hyperinflation, another economic sin, can be created by central banks and governments. It may seem unlikely in the USA, but it is very real in Argentina and Zimbabwe. It can happen in Europe, Japan, the US, and the UK. The costs to savings, investments, and personal well-being would be incalculable.

- We can’t tax ourselves into prosperity. “Printing money” does not create wealth. We can’t inflate our currencies into wealth for the masses. We can’t devalue our dollars, yen, pounds, and euros and expect to create capital or lasting prosperity. Debts are paid, one way or another.

- More wars and invasions benefit military contractors – but at what cost to everyone else?

- Gold has been a store of value for 5,000 years. It has protected people from inflation, wars, and irresponsible governments during the last several thousand years. Gold has not always and forever been a good investment – the price of gold declined between 1980 and 2000.

- But gold is currently excellent insurance against counter-party risk, consumer price inflation, central bank “money printing” and the consequences of the economic sins committed by irresponsible governments and central banks.

- Gold (and silver) prices have bottomed and will move up substantially for several years.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.