Everything You Need to Know About the Stock Market S&P Index Until Christmas

Stock-Markets / Stock Markets 2014 Sep 30, 2014 - 05:55 PM GMTBy: Casey_Research

By Andrey Dashkov

By Andrey Dashkov

When I need to clear my mind, I put on my beat-up Saucony sneakers and drive to nearby Deer Lake Park in Burnaby, British Columbia. After a couple of miles, though, as my body gets into a rhythm, my mind wanders back to the thought that occupy it for hours each day: where will this market go next?

And I’ve thought a lot about what went on this summer. Since June 1:

•S&P 500 is up 2.7%, having set a new record high in September;

•MSCI World index is down 0.5%;

•10-year Treasury yield is down from 2.54% to 2.50%;

•Brent Crude 0il is down 12.8%; and •Gold is down 2.2%.

The Bureau of Economic Analysis reported that the US economy expanded by 4.6% year on year in the second quarter, up sharply from the first quarter’s disappointing 2.1% annual decline. Consensus estimates for annual GDP growth in the third and fourth quarters of this year are about 3%.

The stage seems to be set for the fifth straight year of positive economic growth in the US; however, we’re always cautious about government-supplied information, especially during an election cycle.

At the moment, macro developments seem closely intertwined with stock market performance. Instead of slumping, the market was rather vibrant this summer. The S&P 500 showed resilience, reaching higher highs after a dip in late July and early August that coincided with increased uncertainty surrounding the Ukrainian crisis.

Geopolitics aside, the market was supported by GDP growth, which in turn was underpinned by strong corporate profits and margins. In fact, in the second quarter, the S&P 500 set a new record for profit margins: 9.1%. So much for “sell in May and go away.”

Expanding earnings and margins are great news on the fundamental front. Of the trends we observed this summer, at least two will benefit S&P 500 companies’ profitability. Cheaper oil may keep energy costs down, while consumers are more than willing to swipe their debit and credit cards. In August, consumer confidence jumped to its highest level since October 2007, having increased for four months in a row.

Loose Money Helping Stocks in the Short Term

The Fed has done its part, too. Long-term effects of its prolonged loose monetary policy aside, it’s hard to argue that it hasn’t helped stocks in the short term. With Treasury rates still low, debt options abound, and companies can obtain cheap funding for things like capital expenditures and buying back shares.

In the first quarter, 290 companies from the S&P 500 bought back shares at a cost of $159.3 billion, 59% more than a year ago. Dividends are up as well: in the first quarter, S&P 500 companies spent a record $241.2 billion on dividends and repurchases together, according to Standard & Poor’s.

Second-quarter share repurchases were estimated at $106 billion, according to Financial Post. That’s much lower than first-quarter repurchases (though the official numbers aren’t out yet) and down 10% year on year.

Buyback Frenzy Is a Net Positive for Share Prices

However, the most important takeaway is that the cumulative effect of the recent buyback frenzy was positive for share prices and dividends. With fewer shares, it’s easier for companies to maintain dividend payments. Higher share prices may drive down dividend yields, but companies tend to increase dividends over time, which makes up for that in part. And despite the S&P 500’s significant growth over the past five years, dividend yields have not decreased as much as one would expect.

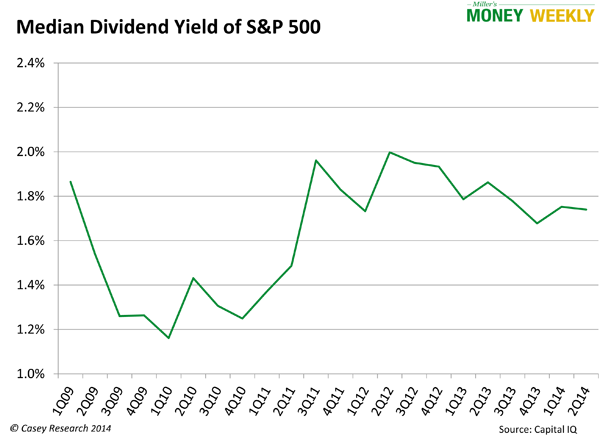

The chart below tracks the S&P 500’s median dividend yield since the first quarter of 2009.

The median dividend yield decreased just slightly over this period: from 1.9% in 1Q09 to 1.7% in 2Q14, and it’s held relatively steady over the past three years.

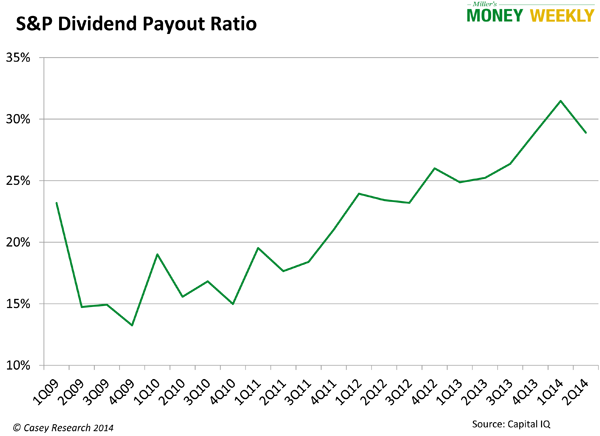

The good news is that S&P companies aren’t stretching their balance sheets too thin to cover these dividend payments—these payments are backed by earnings. The median dividend payout ratio (the ratio of dividends paid to net income), although up from five years ago, still looks solid.

S&P companies can successfully cover their dividends with earnings, so there’s no reason to fear that they’ll have to borrow to keep paying them. However, a lot of investors worry about leverage. On one hand, financial leverage boosts return on equity (ROE), and prudent borrowing can be a positive for investors. On the other hand, large amounts of leverage leads to volatility in earnings, a less stable balance sheet, and risk that affects valuations.

Debt and Cash Both Up

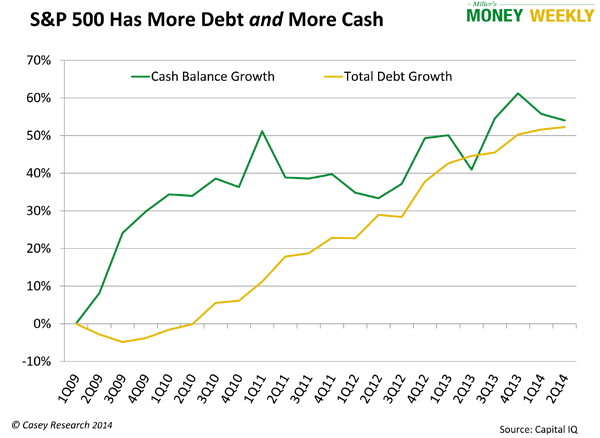

These are legitimate concerns, but our next chart shows that in the past five years, S&P companies have increased debt while also accumulating a lot of cash on their balance sheets.

Debt and cash grew at about the same pace during the last couple of years. There were many reasons for this trend, but two interrelated ones stand out: the abundance of cheap debt that S&P companies took advantage of (why spend your own cash when you can finance on such great terms and pay it back over a long period?); and the desire to keep interest on that debt as low as possible by making credit rating agencies happy and holding a lot of cash in the bank.

If a correction is in the cards for the near term, this cash, increased earnings, and the support coming from share buybacks will provide some cushion for these companies’ valuations.

Why We’re Not “Permabears”

So what’s ahead? I wish I knew. There are a lot of market bears out there who say this rally will come to a halt sooner rather than later, and the S&P will fall off a cliff. I stay away from calling tops and bottoms and wonder how many pundits actually have any skin in the game. Going short the market requires timing; so any “permabear” who puts money where his mouth is may lose a lot if his timing is wrong.

I’m not saying the rising market is somehow “wrong.” There are solid company-level fundamentals and positive macro-level data points here and there that support a significant part of its growth.

Your Plan to Profit

We’re pragmatists at Miller’s Money. Quantitative easing and basement-level interest rates have flooded the market with dollars and eroded yields, but you should use these circumstances to capture some of the benefits they’ve created. No, you can’t earn much on CDs. No, dividend yields might not beat inflation (at least not all of them, and certainly not every estimate of inflation). And yes, the current rally will eventually end, one way or another. We just don’t know when or how. No one does.

What matters is that even in this situation you can protect your financial wellbeing by sticking to our core strategy: diversify geographically and across sectors; and invest in assets that provide robust yield relative to risk and have the potential to rise in price. You can learn more about the Miller’s Money Forever core strategy here—a time-tested plan designed for seniors, savers and like-minded conservative investors.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.