American Armageddon: How to Win the Epic Battle for Your Wealth

Stock-Markets / Stagflation May 19, 2008 - 03:14 PM GMT Martin D. Weiss writes: Just when Wall Street was hoping for some relief from surging energy costs, crude oil prices surged more than $3 on Friday ... spiking to nearly $128 a barrel ... shattering all prior records ... and driving prices at the pump perilously close to $4 per gallon.

Martin D. Weiss writes: Just when Wall Street was hoping for some relief from surging energy costs, crude oil prices surged more than $3 on Friday ... spiking to nearly $128 a barrel ... shattering all prior records ... and driving prices at the pump perilously close to $4 per gallon.

Worse, next week, despite the highest gas prices in U.S. history, millions of U.S. drivers will start hitting the road as Memorial Day kicks off the summer driving season. And last week, despite a last-ditch attempt to head off the expected crisis, President Bush failed to persuade the Saudis to pump more oil.

The impact on the dollar and other financial markets will be great; the opportunities for savvy investors, far-reaching. And the timing for our recent online event about this crisis could not have been more appropriate. In this gala issue, I provide the transcript.

American Armageddon:

How to Win the Epic

Battle for Your Wealth

Edited Transcript

Martin Weiss: Ladies and gentlemen, the crisis we have been warning you about is here. But it's far from over ...

- Housing industry experts now predict that this will be the greatest foreclosure crisis of all time, with millions of Americans defaulting on their mortgages.

- The International Monetary Fund now predicts that big banks and brokers will suffer nearly triple the huge losses they've already reported — total losses of close to one trillion dollars .

- U.S. government data now confirms that, with oil prices surging,inflation is about to burst onto the scene with gale force.

- And most worrisome of all, the Federal Reserve is responding to this crisis by pumping paper money into the economy with wild abandon, trashing the value of the U.S. dollar.

But there's a simple reason for the crisis we face today — a single disease that infects almost every aspect of our economic life: Debt in huge, almost unimaginable amounts.

For many years, financial experts have warned us about the consequences of excess debt. They've issued their warnings so many times that their words have fallen on deaf ears, and their voices have seemed to fade into the background.

But throughout all those years, the excess debts kept growing, and as a result, we now have ...

- $49 trillion in interest-bearing debts, according to the U.S. Federal Reserve Board ...

- $50 trillion in federal contingency debts, according to the Government Accountability Office (GAO), and ...

- $164 trillion in derivatives, according to the U.S. Comptroller of the Currency (OCC).

That's a grand total of $263 trillion in debts and obligations, twenty times more than the total size of the entire U.S. economy.

If Washington would only recognize that excess debt is the true cause of this crisis ... if they would deal with the true disease and not its symptoms ... if Americans would be willing to make the needed sacrifices to reduce their debts ... then the future of your money might be very different.

But that's not what's happening now and not what's likely to happen in the foreseeable future — certainly not in this election year. Instead,

- Our fellow citizens are so willing to walk away from their debts, they're abandoning their own homes.

- Wall Street's shakiest corporations have so much political clout, they've persuaded the government to cover their huge losses.

- And our leaders in Washington are so anxious to paper over the debts, they're threatening the one thing that has made America the leader of the world, the one economic force that helped win the Cold War and that attracted trillions of foreign investments to our shores: The U.S. dollar.

You don't have to look very far to see the consequences. You can see it in the surging price of crude oil, gasoline and diesel. You can see it in the surging price of bread, milk and eggs. Plus, it's evident in the sickening slide of the U.S. dollar in foreign exchange markets.

It's in the foreign exchange market — Forex, for short — where the dollar has taken the worst beating. And it's in the Forex market where virtually every other currency in the world goes up when the dollar falls.

This chart is the U.S. Dollar Index compared to a basket of foreign currencies since the beginning of the decade. In just this relatively short stretch of time — a mere quickstep in the march of history — the dollar lost nearly half of its value.

And here's the same dollar index going back to 1971, when the modern foreign exchange market was born.

Look at the range we've drawn in the chart — the dollar's norm for most of the history of the modern currency market.

Now, in recent months, it has broken down below that range. And despite its recent rally, it remains in a veritable forbidden zone in which the world's oil exporters demand higher prices, the rules of the global economy are changing, and your money could be in grave danger.

My Family and I Have Been Trying To Prevent This Disaster for a Long Time

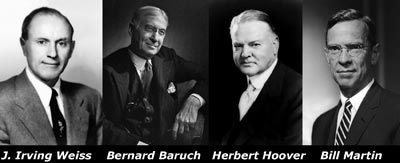

One half century ago, my father, J. Irving Weiss, founded The Sound Dollar Committee. He enlisted the support of presidential adviser Bernard Baruch, former President Herbert Hoover, and Federal Reserve Chairman Bill Martin. They mobilized 11 million U.S. citizens to protest against inflation and protect the dollar. And with Dwight D. Eisenhower on their side, they won that epic battle for the dollar. Ultimately, however, they lost the war.

Today, I am Chairman of The Sound Dollar Committee. But this time, it won't be possible to achieve the same result as we achieved 50 years ago.

The apathy about the falling dollar is too great. Washington's willingness to let the dollar fall is too deeply ingrained. The forces amassed against the dollar — in our government, on Wall Street, on Main Street — are too powerful.

So at this juncture, our efforts are twofold. We are still pursuing the goals of the Sound Dollar Committee to defend the dollar. But we are also pursuing another goal: To help you defend yourself against the dollar's decline and even turn it into a major profit opportunity.

To help you in that goal, let me introduce you to my Associate Editor, Mike Larson.

When Mike first warned investors about the housing and mortgage crisis a few years ago, laying out exactly how it would unfold and why, he was not exactly a popular figure on Wall Street. They vehemently denied the possibility of his forecasts coming true. And when he presented his white paper to the Fed and the FDIC on the housing and mortgage crisis, the authorities generally ignored him as well.

But now, Mike's views are getting widespread attention, and his analysis is in great demand — by CNBC, Fox, the Wall Street Journal , the Washington Post and many others. Mike, congratulations!

Mike Larson: Thank you!

Martin Weiss: But let me ask you this: Could your popularity be a contrarian sign — that the housing market has reached bottom?

Mike: In some areas, the worst "for sale" inventories are behind us. In other areas, they still lie ahead. For the country as a whole, however, the most painful phase is still ahead — price declines.

Price declines are the only thing helping to bring down inventories, and it's exactly what the market needs to see — over the long term — to restore its health by attracting new buyers. But it can be devastating for existing homeowners. More than 8 million are now estimated to be "upside down." As a result, the foreclosure rate in this country has more than doubled in the past couple of years — to an all-time high.

Martin: What's the force that will drive home prices down?

Mike: The falling dollar and inflation. To understand why, think about what automatically comes with inflation: Falling bond prices and rising bond yields. Then think about the impact rising bond yields will have on mortgage rates!

Martin: Everyone assumes that mortgage rates are going down, or at least will stay where they are. Virtually no one on Wall Street is talking about higher mortgage rates.

Mike: They're pushing their own agenda. They don't want to connect the dots for folks. But the fact is that when inflation rises and bond prices fall, mortgage rates must rise.

Unfortunately, the Fed's easy money policy is creating huge problems. Look at oil prices! Look at food prices! Falling bond prices are the market's way of saying: "We're not going to take this any more!" They see the inflation. And the inflation is going to drive up mortgage rates.

Martin: And the Fed does not control mortgage rates.

Mike: It can influence mortgage rates. But it can never control mortgage rates.

Martin: Where does this take us?

Mike: To even more downward pressure on home prices and home sales, plus another potentially big wave of losses by lenders and investors.

Martin: For most people, rising mortgage rates are a bit hard to believe. Could you explain your argument as to why you see bond prices falling and mortgage rates going up?

Mike: It's the falling dollar and the rising inflation. I have two young daughters, and when my wife comes home from the grocery store, all I hear about is the rising cost of a gallon of milk, a carton of eggs or a box of diapers. Inflation is everywhere. Look at import prices — rising at the fastest rate in history. Look at producer prices — what wholesalers are paying.

Martin: So inflation drives mortgage rates up. What does the Fed do? Does it counter that by injecting more money into the economy?

Mike: That may help slow down the rise in mortgage rates. But with higher inflation, no matter what the Fed does, mortgage rates must go up. They just may not go up as much as they should.

Right now, when you consider inflation, short-term money isn't cheap. It's free. In fact, the money isn't just free, the Fed has rigged things so that it's actually paying folks to borrow money. And that generates even more inflation.

We have all these cheap, free or even better-than-free dollars sloshing around. Cheap money rushing into commodities. Cheap money rushing overseas to stronger currencies. And cheap money perpetuating the vicious cycle of the falling dollar and rising inflation.

Martin: So the next question is: When does the vicious cycle end?

Mike: Only when and if you get the reverse scenario — when and if money has a real cost — when interest rates go up higher than inflation. But that's not about to happen any time soon.

Martin: I'm anxious to get to solutions for the investor. But before we do, I have one more question for you that we've been getting from subscribers to our Safe Money Report . The question is:

"You warned about home prices going down, and you were right. That's a form of deflation. At the same time, you warned about consumer prices going up, and you were right about that, too. That's inflation. But can we have deflation over here in the housing market and, at the same time, inflation everywhere else?"

Mike: The answer is "Yes" — and the proof is that we already have deflation in the housing market and we already have inflation everywhere else!

Martin: Maybe I should rephrase the question: How long can we continue to have deflation here and inflation there?

Mike: Look. The housing market is a special situation. Think of it not so much as an inflation-deflation indicator, but as a bubble that's bursting.

After the dot-com stocks crashed and burned, the Fed cut interest rates like crazy. That helped create a new bubble in a fresh asset class — housing.

Looking back, did tech stocks re-inflate? Did the Nasdaq turn around and ramp right back up to 5,000? No, the index is still almost 3,000 points off its high! The bottom line: You can't re-inflate a bubble that has popped no matter how hard you try. All the Fed can do is try to ease the pain. But the more the Fed pumps in, the more inflation you'll get.

Martin: Now, let's talk about solutions. In our Safe Money Report , we provide a full model portfolio with recommendations. Mike, can we reveal some of the investments that are typical of the Safe Money Report for this kind of environment?

Mike: For this event, let's talk strictly about ETFs, which anyone can buy any time. First, for protection against the dollar, one of our favorites is an ETF that owns strictly Australian dollar deposits. The symbol on that is FXA.

Second, for further protection against the falling value of your money and for a stake in the commodity boom, another ETF you can look at is the streetTRACKS Gold Trust, symbol GLD.

Martin: And we have also recommend ETFs that give you a stake in the strongest foreign stock markets.

Mike: Yes, ETFs and stocks in the Brazilian and Chinese markets, for example. But when they were near a peak, we recommended taking some huge profits, and I'm glad we did. Looking ahead, though, when we see a new opportunity to jump back into those — or something similar — we'll send out a flash alert to Safe Money subscribers via email.

Martin: Thank you, Mike. I'm delighted that you're finally getting the Wall Street and Washington attention you deserve. And I want to thank you for a superb job with the Safe Money portfolio!

[Editor's note: For more information on our Safe Money Report — plus a complete package of free reports — Currency Riches 2008, Natural Resource Riches 2008, and Global ETF Riches 2008 — click here .]

Good luck and God bless!

Martin

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.