Gold Prices Since 9-11

Commodities / Gold and Silver 2014 Oct 16, 2014 - 05:01 PM GMTBy: DeviantInvestor

The world as we knew it changed after the dot-com crash of 2000 and especially after 9-11.

The world as we knew it changed after the dot-com crash of 2000 and especially after 9-11.

- National debt zoomed much higher

- Stock markets crashed

- The Fed introduced more “stimulus” and helped create a housing bubble

- Government became larger and more intrusive

- Gold, silver, crude, and other commodities rallied

What do the charts show?

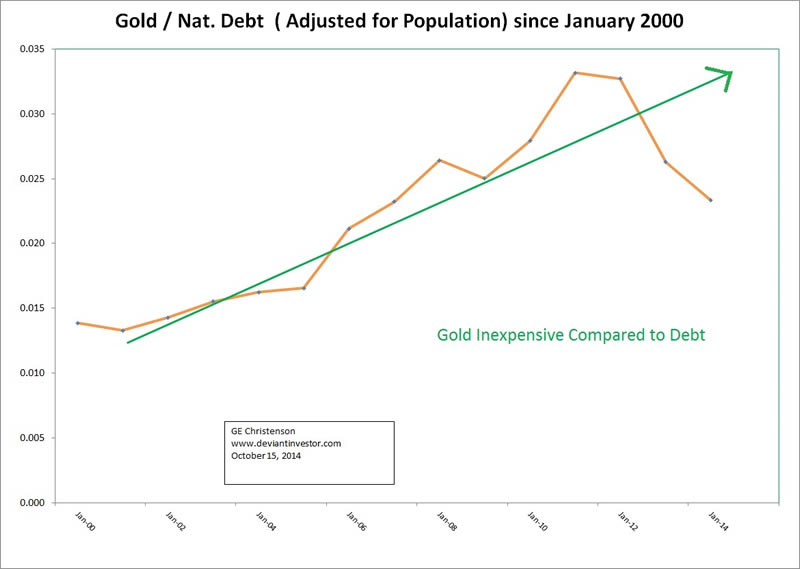

Since 9-11 national debt (official) has increased from $5.773 Trillion to $17.858 Trillion, an increase of $12.08 Trillion. Note the increasing ratio of gold prices to national debt after adjusting for increased population.

Gold to National Debt – population adjusted

We can reasonably assume that National Debt will continue increasing a $Trillion or so per year. I think gold will rise even faster, with notable corrections along the way, for the next several years, as it has since 9-11.

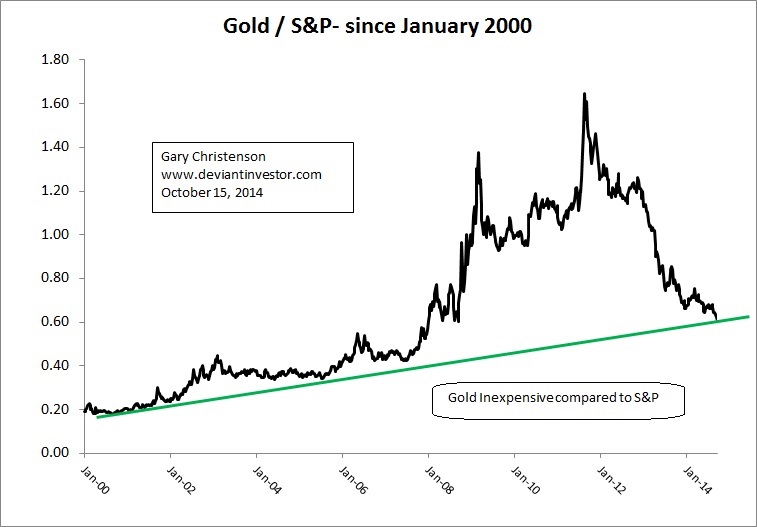

Note the graph of the ratio of gold to the S&P 500 Index. Both are rising together and gold is now inexpensive (again) compared to the S&P 500 Index, like it was on 9-11.

Gold to S&P 500 Ratio

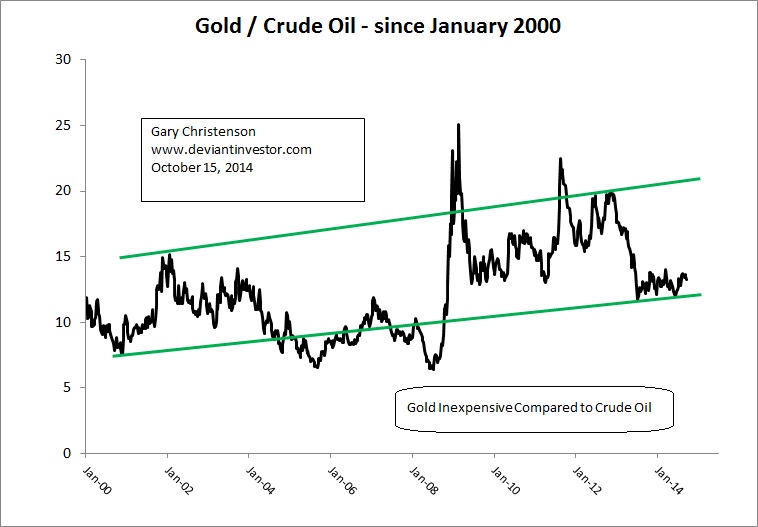

Since 9-11 crude oil prices have gone much higher and crashed lower but on average they have increased with gold prices.

Gold to Crude Oil Ratio

Gold and silver increased dramatically since 9-11, but they corrected after mid-2011. They are now inexpensive, per the graphs, compared to the national debt, the S&P, and crude oil. Note the ratio of gold to silver where peaks in the ratio have been a good indicator of bottoms in the prices for gold and silver.

Gold to Silver Ratio

The gold to silver ratio is near the high end of the trend since 9-11. Silver is inexpensive compared to gold and that occurs at bottoms in gold and silver prices, since silver moves more dramatically, up and down, compared to gold.

In 2000 and 2001 we experienced a stock market crash, bottoms in gold, silver, and crude oil, and preparations for war in the Middle-East and Afghanistan. People were worried about terrorists, security, increasing debt, military build-up, and so much more.

Today we are experiencing a stock market correction that may transform into a crash, bottoms in gold and silver (and maybe crude oil), and preparations for more war in the Middle-East and elsewhere. People are worried about terrorists, security, increasing debt, porous borders, military escalations, Ebola, elections, health care costs, weakening economies, lack of jobs, demise of the middle class, jobs moving offshore, and so much more. Today is similar to the circumstances after 9-11.

Are the markets primed for a repeat of 9-11 conditions, a large rally in gold and silver, an increase in food and energy prices, stock market volatility, and more war?

The charts, as I see them, suggest a rally in gold and silver as well as a correction in the S&P. Of course debt, health care costs, and military activity will increase.

Are you prepared? Have you converted some of your digital dollars, euros, pounds, and yen to physical gold and silver safely stored outside the banking system in a secure vault?

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.