The Hyperinflationary Shell Game

Economics / Stagflation May 27, 2008 - 05:14 AM GMTBy: Darryl_R_Schoon

Modern economics is not rocket science. In fact, it's not science at all. It's a game, a confidence game. Once paper passed for money, economics became an elaborate shell game designed to hide the fact paper had been substituted for silver and gold. Debt ratings are an attempt to quantify confidence in paper assets and are an essential part of the game. The shell game is called “Where's The Money?” The answer is simple, it's not there.

Modern economics is not rocket science. In fact, it's not science at all. It's a game, a confidence game. Once paper passed for money, economics became an elaborate shell game designed to hide the fact paper had been substituted for silver and gold. Debt ratings are an attempt to quantify confidence in paper assets and are an essential part of the game. The shell game is called “Where's The Money?” The answer is simple, it's not there.

The question “where did the money go during the Great Depression?” has now been answered to my satisfaction. During the Great Depression, money essentially disappeared and, as a consequence, consumer and business demand collapsed as did prices, beginning a downward coreolis-like spiral that was to suck the global economy into an economic black hole.

My study of the Great Depression began in the 1990s and the subsequent collapse of the dot.com bubble provided a real-time corroboration of assumptions about the connection between loose credit, excessive speculation, and financial bubbles; and, now, in 2008, one of my most troubling questions about the depression has been answered—where did the money go during the Great Depression?

Plunge In US Commercial Property , an article by Daniel Pimlott posted on FT.com (Financial Times) May 21, 2008 provided a critical clue:

Commercial property prices in the US in February saw their sharpest decline since records began nearly 15 years ago as sources of finance for deals has dried up, according to data from Standard & Poor's out yesterday.

The value of commercial buildings fell 1.03 percent between January and February, the largest monthly decline since at least 1993, when the industry was just emerging from a deep slump.

The fall in national property prices comes as banks have retrenched on lending due to credit crisis and the slowing economy, causing the volume of deals to slow sharply. The market for commercial mortgage-backed securities, which until last August was a major route to cheaper borrowing, has largely ground to a halt.

Sales of commercial properties were down 71 per cent in the first quarter compared with a year earlier, according to data from Real Capital Analytics.

The fact that sales of US commercial real estate fell an astounding 71 % from 1 st quarter 2007 to 1 st quarter 2008 is shocking and the implications are quite serious. The cause of the slowdown, however, provided the very clue I was seeking.

Commercial property prices in the US ... saw their sharpest decline…as sources of finance for deals has dried up … as banks have retrenched on lending due to credit crisis…

DURING THE GREAT DEPRESSION MONEY DID NOT DISAPPEAR CREDIT DID

The answer to: Where did the money go in the Great Depression? is found in the metaphor of the shell game. It is now clear that money didn't disappear during the Great Depression, credit disappeared.

The money was never there in the first place. Money had been replaced by credit in the shell game introduced by the Federal Reserve in 1913 when the Federal Reserve began issuing credit-based Federal Reserve notes in place of the savings-based money from the US Treasury.

For details on how the shell game is run, Professor Antal E. Fekete's description of the check kiting scheme between the US Treasury and Federal Reserve provides crucial information for those perhaps wishing themselves to live off the earnings of others.

It is epitomized by an elaborate check-kiting conspiracy between the U.S: Treasury and the Federal Reserve. Treasury bonds, contrary to appearances, are no more redeemable than Federal Reserve notes. It's all very neat: the notes are backed by the bonds, and the bonds are redeemable by the notes. Therefore each is valued in terms of itself, rather than by an independent outside asset. Each is an irredeemable liability of the U.S: government. The whole scheme boils down to a farce. It is check-kiting at the highest level. At maturity the bonds are replaced by another with a more distant maturity date, or they are ostensibly paid in the form of irredeemable currency. The issuer of either type of debt is usurping a privilege without accepting the countervailing duty. They issue obligations without taking any further responsibility for their fate or for the effect they have on the economy. Moreover, a double standard of justice is involved. Check-kiting is a crime under the Criminal Code. That is, provided that it is perpetrated by private individuals. Practiced at the highest level, check-kiting is the corner-stone of the monetary system.

GOTTERDÄMMERUNG The Twilight of Irredeemable Debt , Antal E. Fekete , April 28, 2008

http://www.professorfekete.com/articles%5CAEFGotterdammerung.pdf

THE STUDY OF MODERN ECONOMICS IS SIMILAR

TO THE STUDY OF RELIGION IN A TIME OF IDOLATRY

In the shell game of modern economics, credit replaces money and when credit gives rise to speculative bubbles, the collapse of those bubbles leads to the defaulting of debt which causes credit to disappear and the economy to collapse.

The credit based shell game, however, is nearing its end. The historic credit contraction that began in August 2007 is still in progress. Despite the efforts of central bankers, credit is still disappearing and, just as in the Great Depression, the credit contraction is continuing to spread causing more and more debt to default.

Credit, the fertilizer of human debt, when no longer available effectively spells the end of the legalized shell game masquerading as modern economics; but the kreditmeisters , their global confidence game now damaged by an unexpected lack of confidence on the part of the marks, sic investors, however, will not give up their scam easily.

THE CONUNDRUM OF THE KREDITMEISTERS

Those running the shell game, the central bankers and their codependent brethren, investment bankers, are terrified of losing their day jobs, They have lived well for three hundred years (since the establishment of the Bank of England in 1694) leveraging the productivity of others and we can be assured they will do everything in their considerable power to keep their lifestyle intact..

At this time the central bankers are collectively engaged in financial triage as they attempt to replace the credit that is rapidly being withdrawn in the face of ever increasing amounts of defaulting debt.

Following the same play book they used in the aftermath of the dot.com collapse, the Fed has quickly cut rates from 5.25 % to 2 % but this time they will not ignite a housing bubble as they did the last time. This time, they will do worse. This time, they will burn down the house.

BURNING DOWN THE HOUSE

In the long run, there is no short run

In retrospect it will all be clear, the mistakes, the reasons, the excuses, the results. Now, however, in the beginning of the collapse, events appear more problematic, the outcome still unknown. Nonetheless, even in the fog of unexpected events, certain things can be known and safely predicted; and, one of them is that we are now on the road to hyperinflation.

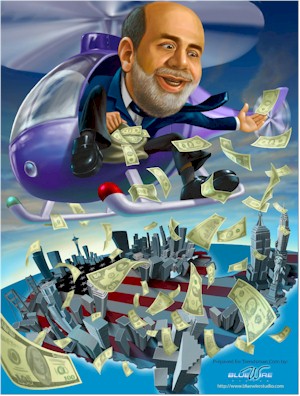

Appointing “Helicopter Ben” Bernanke to head the Federal Reserve now is akin to sending Sammy the Bull, the mafia hit-man, to negotiate with the Palestinians and Israelis; and when the news comes back that Sammy the Bull shot and killed the Palestinians and Israelis at the negotiating table, we should not be surprised—just as we should not be surprised that Ben “the printing press” Bernanke is erring on the side of excess in the current economic crisis by providing even more credit, by shoving even more debt based paper into now a burning house.

WHEN A HOUSE OF PAPER MONEY BURNS

Hyperinflation is to inflation like pneumonia is to a cold. Though similar, the former is much more consequential; and whereas pneumonia can sometimes kill, hyperinflation is a veritable death sentence. Hyperinflation always ends in the total destruction of paper money. In hyperinflation, the value of paper money reverts to its mean—ZERO.

The past is indeed prologue when it comes to humanity, printing presses, and the recurrent desire of governments to turn paper into gold; which through the alchemy of central banking is possible—though only for a limited time.

While central bankers and governments do not intend to cause hyperinflation anymore than drunk drivers intend to crash, they are nonetheless responsible for the decisions that lead to hyperinflation and deflationary depressions.

The United States has experienced high rates of inflation in the past and appears to be running the same type of fiscal policies that engendered hyperinflations in 20 countries over the past century.

Professor Laurance Kotlikoff, Federal Reserve Bank Review St Louis July/Aug 2006

The US is the largest economy in the world and the US dollar is the world's reserve currency. Its central bank, the Federal Reserve, is the most influential, and Ben “the printing press” Bernanke is its chairman. We should not be surprised at what is now going to happen to the US , the US dollar and the world economy.

As the Fed is busy bailing out international investment banks with America's money, we should be more concerned with what is going to happen to us; because when the US dollar goes up in smoke, the US economy will go down in flames and the world economy will stumble badly, if not collapse completely.

Hyperinflation will destroy both the US dollar and the US economy and the world will not be unaffected. Professor Kotlikoff's warning about a US hyperinflation was published in 2006; and, now in 2008, US printing presses under Fed chairman Ben Bernanke are running faster than they've ever been run before.

HYPERINFLATION IS LIKE STEPPING OFF A CLIFF.

YOU ONLY EXPERIENCE IT AFTER YOU'VE GONE TOO FAR

Friedrich Kessler, a law professor at Harvard and at Boalt Hall UC Berkeley described the onset of hyperinflation during the Weimar Republic in Germany .

It was horrible. Horrible! Like lightening it struck. No one was prepared. You cannot imagine the rapidity with which the whole thing happened. The shelves in the grocery stores were empty. You could buy nothing with your paper money.

From Fiat Paper Money, The History And Evolution of Our Currency $28.50 by Ralph T. Foster, tfdf@pacbell.net (510) 845-3015 This book, a primer on the end game, is everything you wanted to know about fiat paper money and were too afraid to ask.

At Session III of Professor Fekete's Gold Standard University Live in February, I discussed the possibility of a sequential or simultaneous hyperinflationary deflationary depression, the economic equivalent of having both a severe heart condition and a possibly fatal cancer at the same time. Such is not impossible; in fact, it is increasingly likely.

I highly recommend the thorough and studied analysis of hyperinflation and concurrent possibilities in John Williams' Hyperinflation Special Report , Shadow Government Statistics, Series Issue No. 41, April 8, 2008 , http://www.shadowstats.com/article/292 . John Williams also references and recommends Ralph T. Foster's Fiat Paper Money, The History And Evolution of Our Currency noted above.

The critical question should now be asked: What can we do?

THE PARACHUTE OF GOLD AND SILVER

JUMPING OUT OF UNCLE BEN'S SPUTTERING HELIPCOPTER

The following is from The Nightmare German Inflation , Scientific Market Analysis, 1970, which describes the extreme hyperinflationary conditions during the Weimar Republic in the 1920s:

The following is from The Nightmare German Inflation , Scientific Market Analysis, 1970, which describes the extreme hyperinflationary conditions during the Weimar Republic in the 1920s:

The ones who fared best were the small minority who had the foresight to exchange marks into foreign money or gold very early, before new laws made this difficult and before the mark lost too much value.

The difference between 1920s Germany and today is that there are no longer any currencies convertible to precious metals. In the 1920s, when hyperinflation destroyed the German mark, other currencies were still tied to gold. Today, this is no longer the case. Today, only gold and silver will offer guaranteed monetary refuge during the coming crisis.

A hyperinflation is a monetary phenomena caused by the rapid printing of money not convertible to gold or silver. The inflation of the paper money supply happens gradually, but hyperinflation is itself a sudden-onset phenomena . Suddenly and unexpectedly, inflation becomes hyperinflation and unless you are already prepared, it is already too late.

Today, we are moving closer to the end game, the resolution of past monetary sins when the banker's shell game is exposed for what it is—a monetary abomination, a parasite on the economic body that over time kills the host on which it feeds.

Be aware. Be careful. Be safe.

Have faith.

Note I: I now have a blog, Moving Through The Maelstom with Darryl Robert Schoon . My first blog discusses the underlying reasons for our increasing series of crises. see http://www.posdev.net/pdn/index.php?option=com_myblog&blogger=drs&Itemid=106

Note II: I will be speaking at Professor Antal E. Fekete's Session IV of Gold Standard University Live (GSUL) July 3-6, 2008 in Szombathely , Hungary . If you are interested in monetary matters and gold, the opportunity to hear Professor Fekete should not be missed. A perusal of Professor Fekete's topics may convince you to attend (see http://www.professorfekete.com/gsul.asp ). Professor Fekete, in my opinion, is a giant in a time of small men.

Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.