Semiconductor Equipment Stocks Sector Update

Companies / Tech Stocks Dec 26, 2014 - 09:07 PM GMTBy: Gary_Tanashian

NFTRH 322 covered the usual range of markets, from US to global stocks to precious metals and commodities to currencies and indicators. It also included an extended economic discussion about the realities of the strong US economy and its dangerous underpinnings.

NFTRH 322 covered the usual range of markets, from US to global stocks to precious metals and commodities to currencies and indicators. It also included an extended economic discussion about the realities of the strong US economy and its dangerous underpinnings.

The economic segment began with this look at the Semiconductor Equipment sector, which was our first indicator on economic strength exactly 2 years ago and will be an initial indicator on economic deceleration when the time is right.

Excerpted from the December 21 edition of Notes From the Rabbit Hole, NFTRH 322:

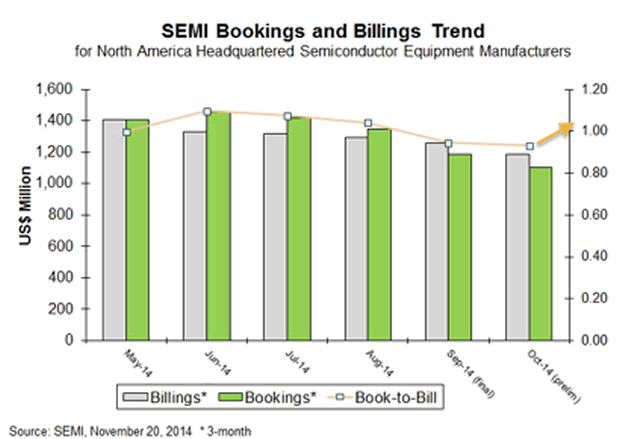

Checking the Semiconductor Book-to-Bill ratio (b2b), this all-important forward looker came in pretty decent for November. Per the data we reviewed in an update last week, the bookings, which is the most important component, was pretty good at $1.22 Billion compared to October’s $1.1 Billion.

The graph from SEMI does not include the November data. I added an arrow showing the current level of the b2b.

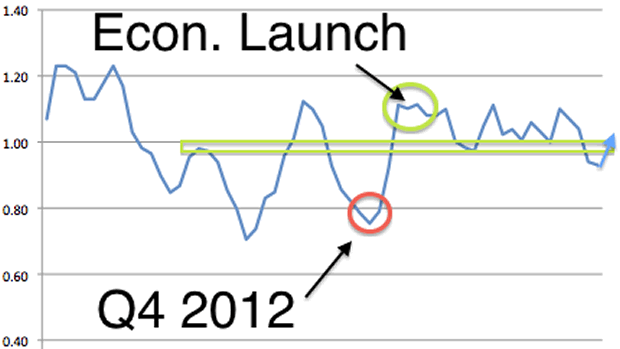

Our original graph is marked up as well to show the longer trend. There is a spike up happening and this may or may not be related to an overall year-end sales spike in some high end capital equipment that happens like clockwork at the end of each year in Machine Tools (ref. sales graph below). I do not have the level of knowledge about the Semiconductor Equipment industry to speak authoritatively about its more structural capital spending cycles. So this is just a possibility to consider.

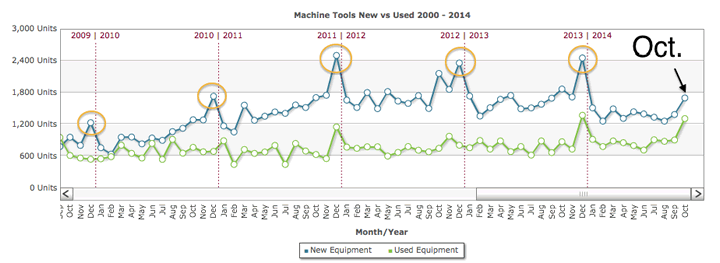

Here is the data once again from EDA Industry Insight that pretty much allows us to set our clocks by the year-end Machine Tool (capital equipment) sales figures, which are due to tax considerations by fence sitting buyers. Machine Tools are so far doing exactly what we expected into year-end.

The bottom line on this exercise is that in order to forecast something negative for the economy (and hence the stock market, insofar as [the market] reflects the economy) we need to start seeing data degenerate in forward-looking items. The year-end period is stable and the back-lookers like ‘Jobs’, GDP, etc. are just fine. We will head into 2015 as always, watching what is happening, not what we project in our minds to be happening.

As we close out 2014, a policy-stoked US economy is still humming along.

From an earlier segment in the report:

We should not discount the significance of the scary test of major support [by the SOX index] in October. That, along with the associated negative hype as Microchip Semi’s weak guidance* was broadcast far and wide, could actually end up being the fuel for a blow off scenario [1].

* As you know, media hype is a source of frustration for your letter writer because he tries to be honest and hype-free in taking on the responsibility of writing about markets and the economy for you. That is why you endure me calling the ‘Fiscal Cliff’ drama from 2012 a Kabuki Dance, calling the Eric Sprott interview (Ebola may lift gold and silver prices!) in the Gold Report a disgrace… Cyprus, Greece, Ukraine… the media (and certain lazy analysis) get a hold of these things and try to use people’s emotions to promote viewpoints.

The latest example was when supposed Semiconductor bellwether Microchip Semi released unpleasant guidance and the market freaked out [and SOX tanked]. We called it hype at the time and what do you know? Now they are out with a brightened outlook…

Global Semiconductor Outlook Brightens, Microchip Sees Sales Rebound

Chief Executive Steve Sanghi said the company has seen an improvement in bookings and billings since October. “We are now even more confident that the small correction that we experienced in the September quarter is behind us,” he said.

You just cannot make this stuff up.

[1] We are not predicting a stock market/Semi sector blow off, but are open to its possibility.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.