Gold and Mining Stocks Refuse to Decline Despite Soaring US Dollar

Stock-Markets / Gold and Silver Stocks 2015 Jan 05, 2015 - 06:15 PM GMTBy: P_Radomski_CFA

Briefly: In our opinion no speculative short positions in gold, silver and mining stocks are currently justified from the risk/reward perspective.

Briefly: In our opinion no speculative short positions in gold, silver and mining stocks are currently justified from the risk/reward perspective.

The USD Index soared much higher on Friday, well above the previous high. With the USD Index being so high, it seems odd that gold managed to close higher and the same went for mining stocks, which even outperformed the yellow metal. Is the rally in gold around the corner?

Actually, it could be the case. We have been aiming to profit on the next decline in the precious metals market after a confirmation of the market’s weakness, most likely after a correction and continuation of a rally in the USD Index. However, the USD Index is already very high – well above the 90 level and relatively close to the resistance at 92.33. Since gold is not declining, it could be waiting for a bigger sign of weakness in the USD Index in order to start at least a short-term rally. This means that we might see an opportunity to go long very soon.

Let’s see why, starting with the USD Index chart (charts courtesy of http://stockcharts.com).

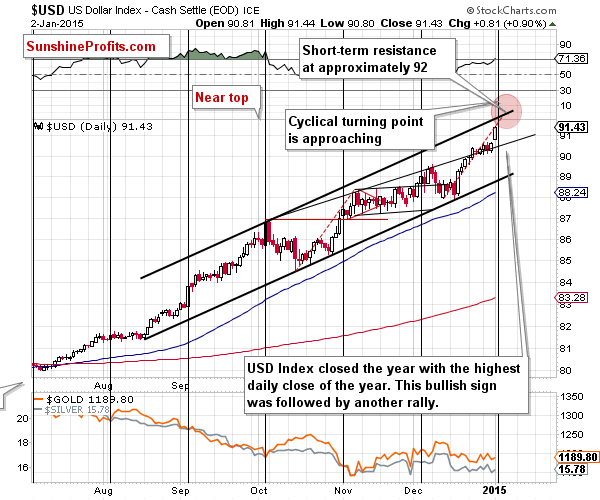

The USD Index moved much higher and is now approaching its medium-term rising resistance line. The cyclical turning point is also just around the corner, which means that we will likely see a turnaround shortly.

The resistance is just above the 92 level and the above chart is not the only one that tells us that this is the case.

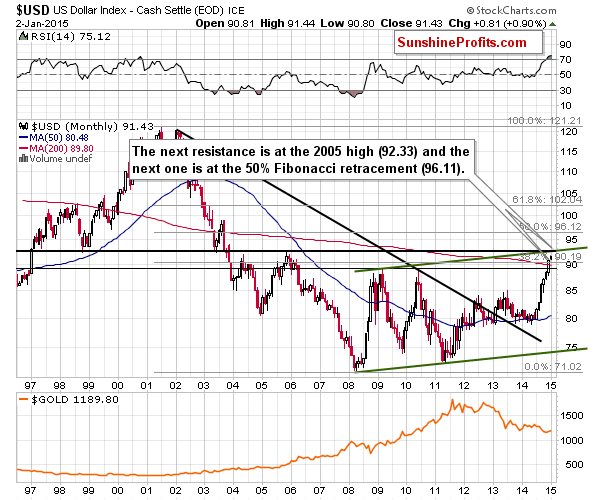

The 2005 high (92.33) is the next major horizontal resistance and this level is more or less where the rising green resistance line is. There are two very important reasons for which we could see a corrective downswing or a decline after the USD Index reaches this level.

Naturally, the USD Index could rally even higher, to the 96.11 level, but even if this is going to be the case, a corrective downswing after a move to 92.33 (or close to this level) is likely.

All in all, a short-term decline seems to be likely for the USD Index, but not necessarily right away. The USD Index will probably need to first rally once again by approximately as much as it rallied last week.

Our previous comments for the long-term gold chart remain up-to-date:

The events of the last three weeks didn’t change much as gold ended the previous week below $1,200 and – more importantly - well below the declining resistance line. The medium-term trend remains down.

Please note that the long-term turning point will come into play in a few months – it may be the case that this is when the final bottom will form.

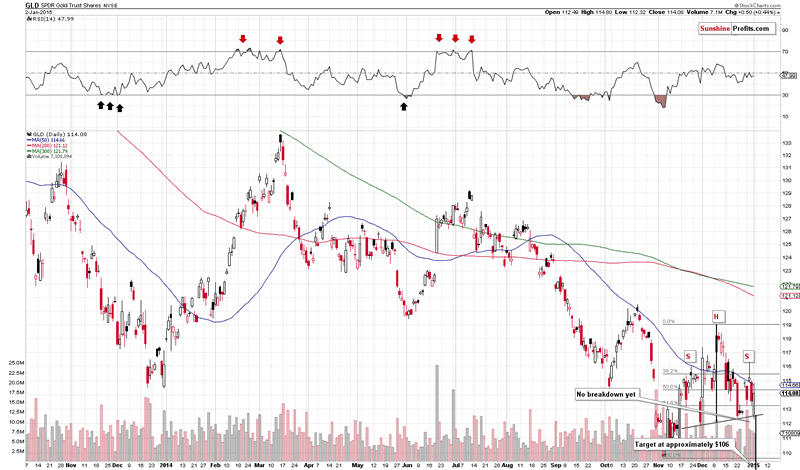

However, another visible thing is that gold didn’t move below the previous lows while the USD Index was rallying. It seems likely that gold needs to move higher once again before it’s ready to move much lower.

As far as the short term is concerned, we see that the head-and-shoulders was completed but immediately invalidated and at this time there are no bearish implications. The target based on this formation is at about $106 for the GLD ETF, which corresponds to about $1,100 in spot gold. This target will become very probable only once we see a confirmed breakdown below the neck level of the head-and-shoulders pattern.

For now, we can say that gold has been showing strength lately by refusing to decline in spite of the U.S. dollar’s rally.

The situation in the GDX ETF is rather tense because of 2 things. The first thing is the fact that the 50-moving average was broken only insignificantly. As we wrote previously, that’s the average that has been stopping local rallies since late November. We now see a 5th attempt to move above it. The implications are bearish.

The other important thing is that mining stocks moved higher by over 3% on Friday, which is significant as gold rallied only a little and the USD rallied strongly. This is bullish. The only reason that it’s not very bullish is that the volume that accompanied Friday’s rally was relatively low – it was not a huge-volume rally that would confirm the strength of the move.

Since all the recent attempts failed and history tends to repeat itself, we are quite likely to see another local top relatively soon.

Please note that even if miners rallied from here – say to the $20 level or so – it would not really change the bearish outlook for the medium term.

Summing up, if gold and mining stocks continue to show strength relative to the USD Index and the latter moves to the 92.33 level or very close to it, we will strongly consider (after examining other factors) opening speculative long positions in the precious metals sector. We are not at this point just yet. If, however, we see a confirmed breakdown below the head and shoulders formation in the GLD ETF, we will probably open a short position in the precious metals sector. Either way, we will be monitoring the market for additional signs and confirmations and report to you – our subscribers - accordingly.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep our subscribers updated should our views on the market change. We will continue to send them our Gold & Silver Trading Alerts on each trading day and we will send additional ones whenever appropriate. If you'd like to receive them, please subscribe today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.