FTSE Stock Market Triple Top - The Golden Age of QE and The Fiat Endgame...

Stock-Markets / Stock Markets 2015 Feb 03, 2015 - 12:46 PM GMTBy: Clive_Maund

As you are doubtless aware we are living in a new paradigm - the age of global QE has arrived. Amongst the major power blocs it started with the US, spread to Japan, which adopted it with a particular gusto, after suffering from deflation for decades, and just has been taken up by Europe in a big way, after waiting for half its young people in many constituent countries to become unemployed due to the ravages of deflation. Smaller countries will have to join in or their currencies will soar and they will become uncompetitive.

As you are doubtless aware we are living in a new paradigm - the age of global QE has arrived. Amongst the major power blocs it started with the US, spread to Japan, which adopted it with a particular gusto, after suffering from deflation for decades, and just has been taken up by Europe in a big way, after waiting for half its young people in many constituent countries to become unemployed due to the ravages of deflation. Smaller countries will have to join in or their currencies will soar and they will become uncompetitive.

It is vital to understand that, having become a universal policy, QE is here to stay - this is a genie that can't be put back into the bottle. The reason is that any attempt to reverse course and rein it in would quickly lead to soaring interest rates because of immense debt levels, a global market crash and a liquidity crisis, in other words a deflationary implosion. Another important to note is that in this "Golden Age of Fiat" where money does not have to be backed by anything and where our masters are accountable to no-one, they can indulge in as much QE as they like.

QE has a number of huge advantages for the ruling elites. First of all it allows them to remain in power indefinitely, because credit crises and the social strife that follows can be avoided by the simple expedient of printing ever more money - the European elites were slow to grasp this point, but judging from the magnitude of their just announced QE, they definitely understand this now. As we know, one of the maxims of the elites is to "privatize profits and socialize losses" - put crudely and simply, when they make money they keep it all to themselves, but when they goof up and lose money, they will push the bill onto the general population, the middle and lower classes - a brazen and glaring example of this being when the "too big to fail" banks and other big institutions in the US got society at large to bail them out at the height of the financial crisis via TARP, the Troubled Asset Relief Program, which of course was not put to a vote.

QE is just another enormous scam, a principal objective of which is to socialize bank and government debt by inflating it onto the masses. They print money (QE), hand as much of it as they please to their crony pals in banks and other powerful elite controlled institutions, and then the increase in money supply reduces the relative magnitude of government debt, since while the debt is nominally the same, there is much more money in existence to service it or pay it off. The public then picks up the tab in the form of inflation as the increased money supply drives up prices.

The reason for the bizarre mismatch where stockmarkets have been continually rising but commodity prices have been falling is due to the fact that the elites are awash with cash to play the markets, while the average poor schmuck on the street is getting poorer and aggregate demand is diminishing as a result, reducing the demand for raw materials. One would think that this must eventually impact stock prices as overall sales fall and profits drop, but in the crazy world in which we now live, we have to factor in the elites with their huge bags of free cash that they have to invest in something, which includes the big banks of course. Their cash mountains resulting from QE could overwhelm old fashioned considerations like corporate profitability and drive stock prices higher regardless. This can be a difficult concept for older investors, who grew up in an age of relative fiscal propriety, to grasp.

A crucial point to understand is that the world is now actually run by and for the benefit of the big banks, who are a "de facto" World Government. Governments and politicians universally do what these banks require of them, or they suddenly find themselves sidelined or usurped - or worse. The banks have encouraged everyone and everything to get into as much debt as possible to maximize profits - they spirit money into existence and then turn round and lend it out at comparatively vast rates of interest. They are using to QE to clamp interest rates at 0 (for them), so that they can maximize the differential with the rates they charge, resulting in, needless to say, huge profits for doing very little, and, as mentioned above they use the zero rates to stop their massive debts from compounding and use the QE to inflate them away at public expense.

The above is not abstract theorizing - it is necessary that we understand what the game really is in order that we have a greater chance of being on the right side of the trade. If we really are in the new age of global QE, then we are living in a very different investment landscape to what would otherwise be the case, with the Masters of the System now able to adjust the faucets to decide how deep recessions will be, and even whether there is a recession or not - and don't forget a recession to them is when the value of their investments falls, not when the guy on the street is broke or unemployed. This is why we have the situation where big Western stockmarkets like the FTSE in the UK or the S&P500 in the US are near to all-time highs, while the average middle class person is struggling.

Comprehending that we are in a new age of global QE, where they can print up as much money as they like at any time, changes the way one looks at markets. This gives the elites the power to manipulate markets on a grand, unprecedented scale.

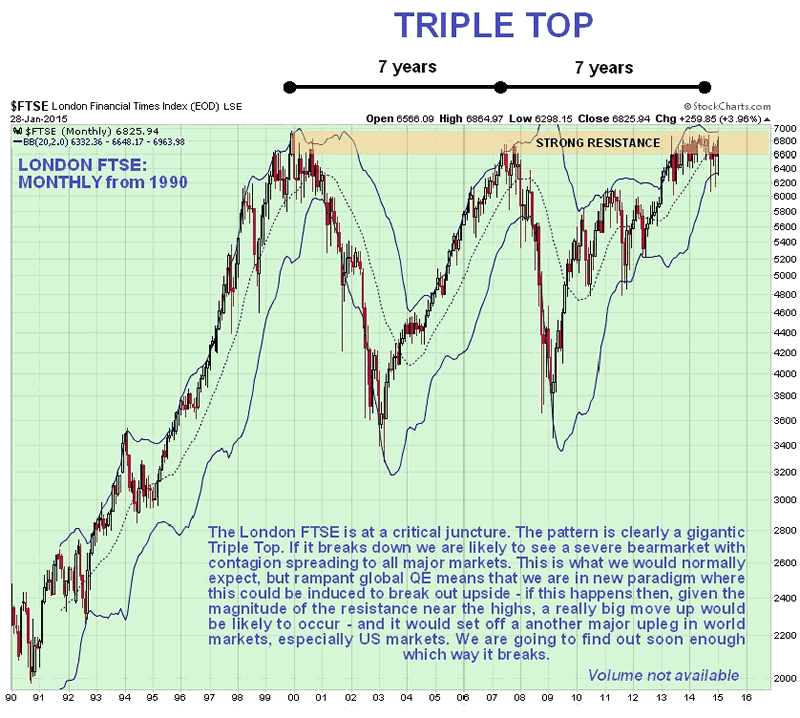

A dramatic example of such gargantuan manipulation may be about to play out in the London stockmarkets. The normal interpretation of the giant pattern forming in the UK FTSE index which we looked at not long ago, using traditional Technical Analysis, is that a huge Triple Top is completing, but the government may be able to avert this outcome by simply doing QE on a sufficient scale to head this off and force an upside breakout. All they have to do is keep pumping money at a sufficient rate and make sure it reaches those whose task it is to keep the market levitated. This is the "new paradigm" that we wrote of near the start - never before have governments had such power to control markets. If they succeed in breaking the FTSE out the top of its gigantic Triple Top, where there is huge resistance, this index will soar. If it starts to descend from this Triple Top, things could get ugly in a hurry.

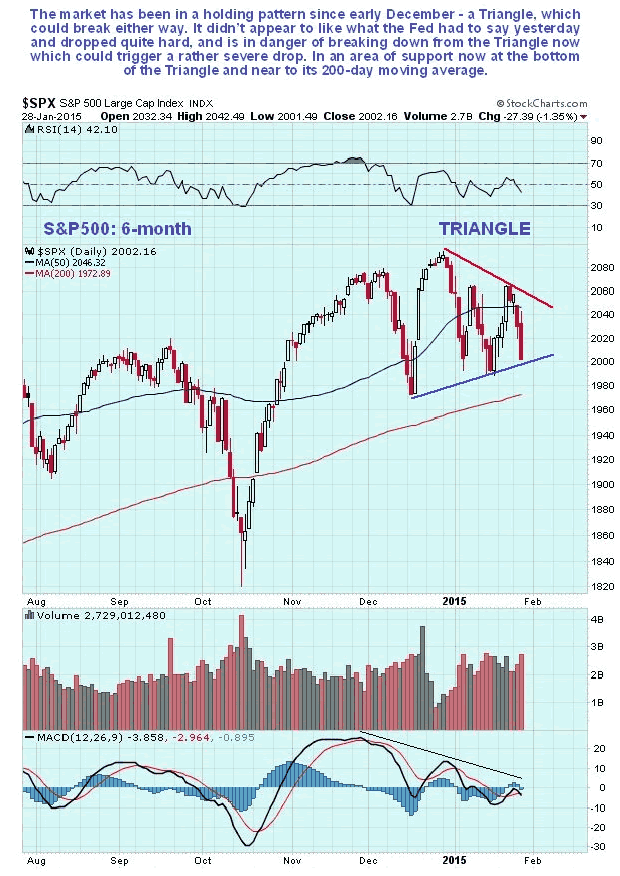

The markets' reaction to the Fed yesterday was negative, as we can see on the 6-month chart for the S&P500 index below...

If the FTSE does break out upside from its Triple Top, then US and other markets should soar too. The US should remain "leader of the pack" for various reasons. The obvious one is that its currency, the dollar, is the global reserve currency. The next is that it is "smelling of roses" right now because it is not doing QE, while other centers of economic power are, although the fact is that the Fed still has a huge tub of money from the last big QE to goose the markets. Still another one is that the US is geographically homogeneous and distant from world trouble spots, unlike Europe which is composed of potentially warring tribes. So while there might be some nasty shakeouts in the US markets over the short to medium-term, as might be occasioned by a disappointing earnings season, there should be plenty of cash sloshing about to drive them back up again. All this is a reason why we are looking at things like airline stocks, which stand to benefit also from the drop in the oil price.

The other side of this manipulation coin is that they also have to power to beat down things they don't like, such as gold and silver, by endless waves of naked shorting - but this will only work until the gap between the physical and paper price becomes untenably large. Given the rampant global QE now underway and the resulting destruction of currencies, and the fact that most of the available physical gold in the world has already been bought up by Asian countries, most notably China, their power to beat down the paper price of gold looks spent, and it is starting to rise again, after the onslaught of the past 3 years.

The end result of relentless global QE would be a hyperinflationary depression, where prices rise strongly because of the endless increase in money but get people get poorer as wages fail to keep pace. When you mention hyperinflation people think of it as prices rising by thousands of percent per year, like in the Weimar Republic in Germany or Zimbabwe at its worst, but it doesn't have to be anywhere near that bad to be hyperinflation - if prices only rise by 60% per year, most citizens would be ruined within 2 years. That could easily happen if this QE gets out of hand.

When we consider the outlook for gold and the impact on the gold price of all this relentless global QE, any fool can see that if you continually increase the money supply, the cost of something finite like gold is going to rise - and possibly rocket, especially as a lot of the physical supply of gold has already been soaked up by more shrewd players like China. This means that the jokers on the Comex with all their naked shorting are going to be way out on a limb, when the price gap between paper and physical gold yawns to untenable and unsustainable levels - it is already big.

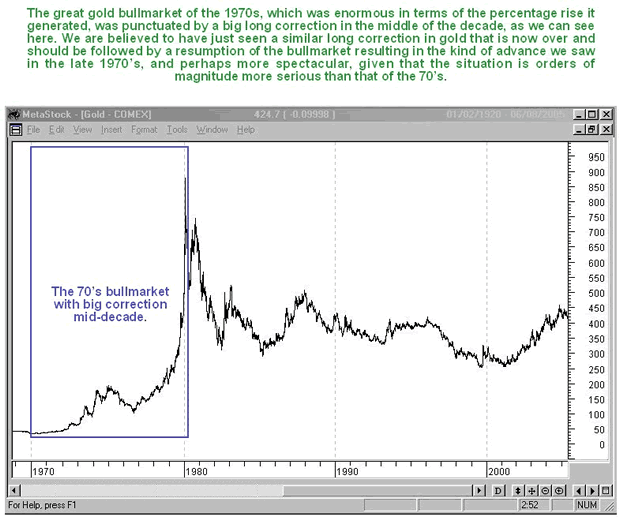

So even though the blizzard of unbacked money created by the ongoing global QE can be expected to drive the prices of many investments like stocks higher and higher, gold (and silver) are not going to be left out for much longer. They are already starting to come to life. Older investors will recall that gold's gigantic bullmarket of the 1970's was punctuated by a big 2-year correction in the middle of it that corresponds to the big 3-year correction that we have just witnessed, before it took off higher again into a massive ramp and a spectacular blowoff top, which is what we should see repeated again, only this time round, given the unprecedented excesses that now exist, it is likely to be orders of magnitude larger.

The biggest danger to the system that could yet - and at any time- cause markets to crash would be a widespread failure of confidence in the banks and the system. So far investors don't seem to care about banks and governments destroying their children's future with their reckless QE programs, but should that change and investors "get cold feet" things could get nasty in a hurry. We are going to need to keep our wits about us.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.