Marc Faber says Short Central Banks and Buy Gold

Commodities / Gold and Silver 2015 Feb 04, 2015 - 02:37 PM GMTBy: GoldCore

Faber: “Only one way to short central banks and that is to buy gold”.

Faber: “Only one way to short central banks and that is to buy gold”.

Marc Faber warned at the weekend that 2015 may be the year that investors will lose confidence in central banks and that investors will “suddenly realise what a scam that central banking is”.

He is long gold and recently bought more gold and investors should buy gold and short sectors such as biotech and social media.

In an interview with Jack Otter, editor Of Barrons.com, Dr. Faber again reiterated his desire to short central banks. While that is technically impossible, the editor of the excellent Gloom, Doom and Boom newsletter indicated that it can be done by proxy through the buying of gold and silver bullion.

In a Barron’s video interview published by the Wall Street Journal, ‘Dr. Doom’ said,

I think that my bet is that if i could short central banks i would short central banks in 2015 because I think that investors will suddenly realise what a scam central banking is and then they will lose confidence. And there is only one way to short central banks and that is to buy gold.

In January he said at a Societe Generale presentation that he expected to price of gold to go “up substantially – say 30%” in 2015. Dr. Faber has an impressive track record of accurately predicting medium term patterns within the overall long-term trend.

He sees an anaemic economic performance from Europe this year, he thinks the U.S. is slowing and his attitude to emerging markets has cooled. “In some [emerging market] countries they may be growing 1-2%, in others there is a contraction in industrial production. The Chinese economy which is the dominant emerging economy in the world is definitely slowing down.”

Alone among the emerging markets, India is still growing impressively at 5-6%. However, Dr. Faber does not see the enormous gains made in some sectors of the Indian economy – the stock market rallied 35% last year- and those of other emerging markets continuing.

“A lot of markets are not terribly expensive but [they] are not bargains,” he said.

Ultimately he sees the global economy continuing to slow down. “In general, if you look at global exports they are flat, if you look at the global reserve accumulation they are flat. So I think that we will face a disappointing 2015 in terms of economic growth.”

He added that while China is slowing down he expects the stock markets to perform reasonably well due to the distorting influence of central banks.

There is a lot central bank interventions and expectations by investors what the central bank will do next and so investors pile into stocks in the expectation that the Bank of China will essentially ease.

When asked where one should invest their money he indicated that his main strategy currently was to short various sectors rather than shorting companies.

In particular he singled out the biotech industry and with less enthusiasm social media and semiconductor ETFs. He was considering shorting the Australian dollar and indicated that the U.S. dollar was also in his sights while he thinks the euro is oversold in the short-term.

While he sees mainly shorting opportunities, he is long gold, prefers physical gold and opts for storage in Singapore:

Yes I am long gold. I’ve been long gold since the mid 1990’s and I bought recently again more.

Marc Faber Webinar on Storing Gold in Singapore

Essential Guide To Storing Gold In Singapore

DAILY MARKET UPDATE

Today’s AM fix was USD 1,269.25, EUR 1,108.08 and GBP 835.31 per ounce.

Yesterday’s AM fix was USD 1,281, EUR 1,128.93 and GBP 851.84 per ounce.

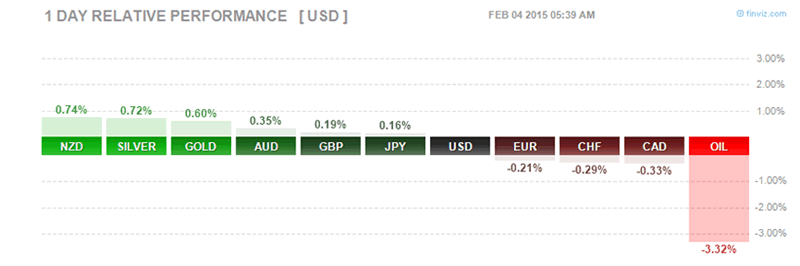

Yesterday, gold lost 1.2% or $13.40, closing at $1,261.20. Silver dropped 0.3% or $0.08, closing at $17.28.

In Asia, bullion in Singapore for immediate delivery moved sideways and this continued in European trading until a sudden spike saw gold suddenly rise in the few minutes before the gold fix. Gold rose from $1,263 per ounce at 1027 (London time) to $1,271.40 per ounce at 1030 London time.

Gold has since retraced some of the gains seen at the fix but is up 0.6 percent this morning, regaining some of the 1.2% price fall yesterday. Risk aversion is back and European equities have fallen after initial gains.

Gold is holding comfortably above its 200-day moving average at $1,252 per ounce. Concerns that the Greek government may not drop calls for a write-off of some of its foreign debt remain which should support gold.

As will geopolitical risk in the Middle East and Ukraine and very robust Chinese demand ahead of the Chinese Lunar New Year on February 19th. Volumes for the Shanghai Gold Exchange’s (SGE) benchmark spot contract climbed to a seven-week high today and premiums remain healthy.

Silver is 1% higher, while the platinum group metals of platinum and palladium were both about 0.6 percent higher.

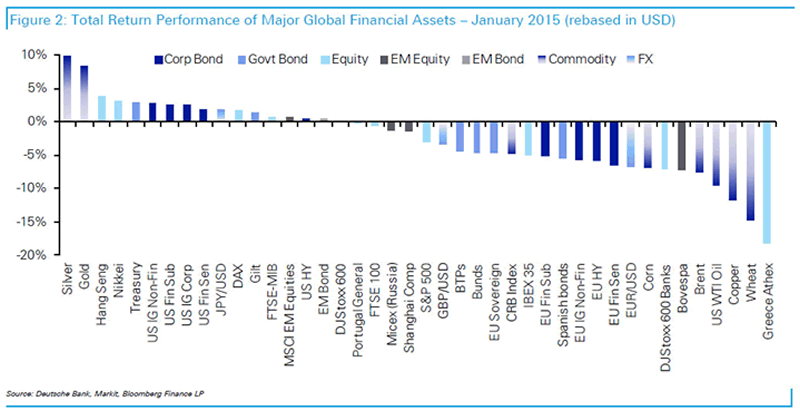

Gold gained 8.4 percent in January, in part as uncertainty over Greece’s membership of the euro zone and ECB QE led to haven demand.

Gold and silver were the top performing assets in January and we expect this outperformance to continue in 2015.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.