The Fed Will Likely Remove 'Patient' from its Statement, But Not from its Actions

Interest-Rates / US Federal Reserve Bank Mar 17, 2015 - 02:06 PM GMTBy: Ashraf_Laidi

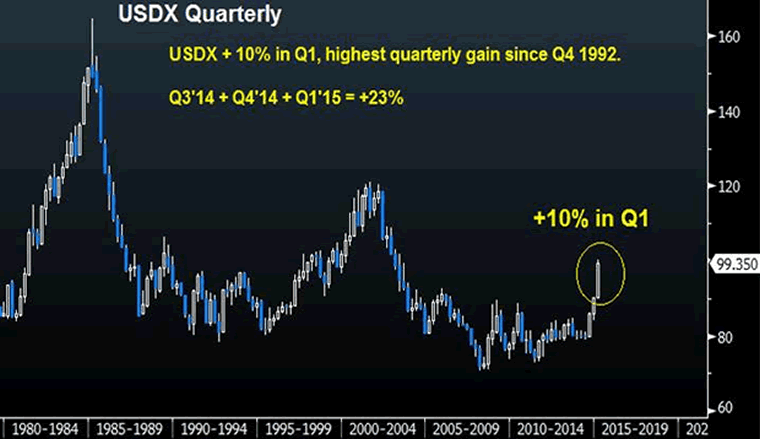

Although oil prices rallied more than 20% following the January Fed decision, their swift decline to fresh six-year lows raises questions about whether the Fed will underestimate threat of deflation as it did with GDP growth over the last three years. A June rate hike would be a policy mistake, especially as the US dollar index is heading for its biggest quarterly gain since Q4 1992. Adding Q3 & Q4, the USD index is up 23%. And yields remain muted as bond traders do not buy into a summer rate hike.

Although oil prices rallied more than 20% following the January Fed decision, their swift decline to fresh six-year lows raises questions about whether the Fed will underestimate threat of deflation as it did with GDP growth over the last three years. A June rate hike would be a policy mistake, especially as the US dollar index is heading for its biggest quarterly gain since Q4 1992. Adding Q3 & Q4, the USD index is up 23%. And yields remain muted as bond traders do not buy into a summer rate hike.

All eyes will be on Wednesday's Federal Reserve decision (due 14:00 ET, 18:00 GMT) and the post-announcement press conference from Fed chair Yellen (due in the ensuing 30 minutes), where capital, equity and currency markets will bear witness to further twists and turns in the syntax of the English language in order to signal a discreet step towards raising interest rates. The recent onslaught of US data disappointment from housing, retail sales and six-year lows in consumer and producer inflation will likely force the Fed to shift guidance for higher interest rates towards data dependence and away from any specific date.

The last FOMC decision from January 28 was more upbeat than many had anticipated, pushing the USD higher across the board, while dragging stocks violently lower. On Wednesday, the market reaction will depend on the Fed statement; Fed projections - known as dot forecasts; and the post-announcement press conference from vice Fed chair Yellen.

FOMC statement on labour markets, price stability & international developments

The first item for scrutiny will be the "patient" phrase in the 3rd paragraph of the January statement, referring to normalizing monetary policy i.e. raising interest rates. Owing to persistent improvements in the US labour markets (unemployment rate and jobs creation), the Fed statement is widely expected (by markets not us) to remove the "patient" phrase, paving the way for a rise in fed funds rate as early as June.

The statement will likely maintain upbeat assessment on job gains and overall growth, but may alter the wording on inflation after it described the effects of falling energy prices as "transitory". Another dovish counter to dropping "patient" would be the reiterating and/or a more detailed highlighting of "international developments" as factors determining the timing of the rate hike. These developments also include the repercussions of excessive USD strength.

Role of dot forecast

The Fed's economic projections set in its "dot" forecast will likely issue an upgrade of median 2016 GDP and a downgrade in both median unemployment and inflation forecasts. The inflation downgrade would likely take the form of lowering median core PCE in dot forecast. We expect the majority of the dots for the Fed Funds rate to signal a rate hike between Q4 2015 and Q1 2016.

Yellen's post-meeting conference

Any rally in the US dollar and yields resulting from the policy statement could be erased if Yellen uses the post-meeting press conference to expound on the FOMC's likely downgrade of inflation and on the impact of the strong US dollar (such as disinflationary pressures from China and Europe). Any departure of consideration from Fed's official view that the falling oil prices are transitory could hit the dollar hard.

Yellen will seek to calm bond markets by indicating that the aim of removing "patient" guidance is to allow the FOMC to further test markets' reaction to a June rate hike. Yellen should reiterate her statement from last month's Congressional testimony that "...a modification of the forward guidance should not be read as indicating that the Committee will necessarily increase the target range in a couple of meetings."

From calendar to data

The Fed has no choice but to return to the "data drawing board" as it replaces the "patient" phrase with a more "data dependent' guidance because the inflation is likely to stall further as oil prices hit new six-year lows.

Although oil prices rallied more than 20% following the January Fed decision, their swift decline to fresh six-year lows raises questions about whether the Fed will underestimate threat of deflation as it did with GDP growth over the last three years. A June rate hike would be a policy mistake.

For the currency experts at the Fed

And finally, here is something for currency experts at the Federal Reserve to ponder: The Bank of England revealed last week via governor Carney and previously hawkish Monetary Policy Committee member Weale that the effect of the 15% appreciation in the pound between summer 2013 and summer 2014 could exacerbate disinflationary prices in the UK and may even trigger a deflationary shock. In the case of the US dollar, it rose twice as much as the pound over the last seven months - and still rising. So why can't the Fed step up its worry over deflationary pressures resulting from its soaring currency?

It is irresponsibly ignorant to assume the Fed will not care about USD strength. Combining the fallout from oil prices below $40, and emerging markets, including China, suffering from repaying expensive USD debt, the deflationary spiral looms especially large. Signalling a rate hike for June is one thing, getting there will not happen.

Best

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.