No Body Understands Debt - Living in a Free-Lunch World

Interest-Rates / Global Debt Crisis 2015 Mar 31, 2015 - 05:33 PM GMTBy: John_Mauldin

“Everyone is a prisoner of his own experiences. No one can eliminate prejudices – just recognize them.”

“Everyone is a prisoner of his own experiences. No one can eliminate prejudices – just recognize them.”

– Edward R. Murrow, US broadcast journalist & newscaster (1908 – 1965), television broadcast, December 31, 1955

“High debt levels, whether in the public or private sector, have historically placed a drag on growth and raised the risk of financial crises that spark deep economic recessions.”

– The McKinsey Institute, “Debt and (not much) Deleveraging”

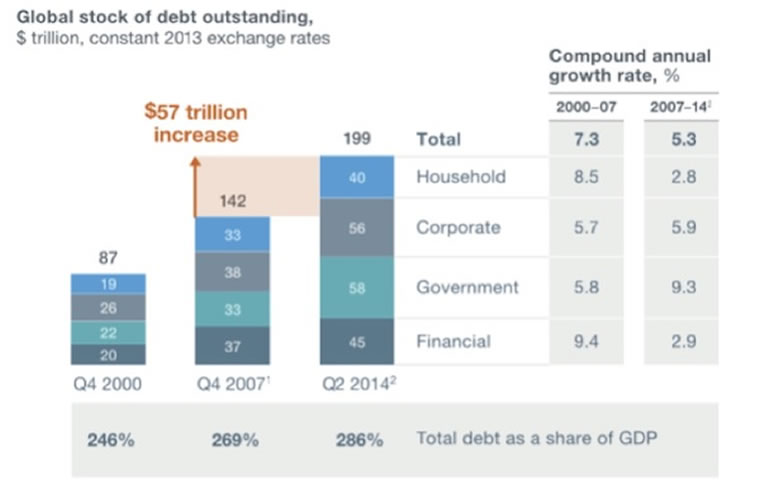

The world has been on a debt binge, increasing total global debt more in the last seven years following the financial crisis than in the remarkable global boom of the previous seven years (2000-2007)! This explosion of debt has occurred in all 22 “advanced” economies, often increasing the debt level by more than 50% of GDP. Consumer debt has increased in all but four countries: the US, the UK, Spain, and Ireland (what these four have in common: housing bubbles). Alarmingly, China’s debt has quadrupled since 2007. The recent report from the McKinsey Institute, cited above, says that six countries have reached levels of unsustainable debt that will require nonconventional methods to reduce it (methods otherwise known as defaulting, monetization; whatever you want to call those measures, they amount to real pain for the debtors, who are in many cases those least able to bear that pain). It’s not just Greece anymore. Quoting from the report:

Seven years after the bursting of a global credit bubble resulted in the worst financial crisis since the Great Depression, debt continues to grow. In fact, rather than reducing indebtedness, or deleveraging, all major economies today have higher levels of borrowing relative to GDP than they did in 2007. Global debt in these years has grown by $57 trillion, raising the ratio of debt to GDP by 17 percentage points (see chart below). That poses new risks to financial stability and may undermine global economic growth.

This report was underscored by a rather alarming, academically oriented paper from the Bank for International Settlements (BIS), “Global dollar credit: links to US monetary policy and leverage.” Long story short, emerging markets have borrowed $9 trillion in dollar-denominated debt, up from $2 trillion a mere 14 years ago. Ambrose Evans-Pritchard did an excellent and thoroughly readable review of the paper a few weeks ago for the Telegraph, summing up its import:

Sitting on the desks of central bank governors and regulators across the world is a scholarly report that spells out the vertiginous scale of global debt in US dollars, and gently hints at the horrors in store as the US Federal Reserve turns off the liquidity spigot….

“It shows how the Fed's zero rates and quantitative easing flooded the emerging world with dollar liquidity in the boom years, overwhelming all defences. This abundance enticed Asian and Latin American companies to borrow like never before in dollars – at real rates near 1pc – storing up a reckoning for the day when the US monetary cycle should turn, as it is now doing with a vengeance.”

Ambrose’s parting takeaway?

[T]he message from a string of Fed governors over recent days is that rate rises cannot be put off much longer, the Atlanta Fed's own Dennis Lockhart among them. ‘All meetings from June onwards should be on the table,’ he said. [This is from a regional president whose own research suggests GDP growth in the first quarter of 1%! – JM]

The most recent Fed minutes cited worries that the flood of capital coming into the US on the back of the stronger dollar is holding down long-term borrowing rates in the US and effectively loosening monetary policy. This makes Fed tightening even more urgent, in their view, implying a ‘higher path’ for coming rate rises.

Nobody should count on a Fed reprieve this time. The world must take its punishment.

Ouch! Please sir, may I have another? Punishment indeed. Ask the Greeks. Or the Spanish. Or… perhaps there is punishment coming soon to a country near you!

I began a series on debt a few weeks ago, and we return to that topic today. I believe the fundamental imbalances we are seeing in the world (highlighted in the two papers mentioned above) are the result of the massive increases in global debt and misunderstandings about the use and consequences of debt. Too much of the wrong kind of debt is going to be the central cause of the next investment crisis. As I highlighted in my February 24 letter, the right type of debt can be beneficial. However, as the McKinsey Report emphasizes,

High debt levels, whether in the public or private sector, have historically placed a drag on growth and raised the risk of financial crises that spark deep economic recessions.

Read that again. This isn’t the Mises Institute. This is #$%%*# McKinsey. As establishment as it gets. And they are clearly echoed by the BIS, the central banker’s central bank. Unless this time is different, they are saying, the high levels of debt are the reason for slowed growth in the developed world, a point we have highlighted for years in our research. There is a point at which too much debt simply sucks the life out of an economy.

A useful starting point for today’s letter is Paul Krugman’s lament that “Nobody understands debt.” But to borrow a phrase from Bill Clinton, it really depends on what your definition of “debt” is.

Paul Krugman has actually written two New York Times columns entitled “Nobody Understands Debt.” The first, and more nuanced, one was published on January 1, 2012; and the second one appeared last month (on February 9). It is a constant theme for him. If you want a short take on what at an uber-Keynesian believes on debt, these columns are a good place to start. (Paul [may I call him Paul?] is as good a representative of the neo-Keynesian species – Homo neo-keynesianis – as there is, an interesting subset of the human genus.) In our musings on debt, we are going to look at these two essays in the effort to understand the differences between those who want more government spending and increases in debt and those who favor what is now disparagingly referred to as austerity.

I choose Krugman not because of any need to disparage him (he does write some rather good essays) but because he writes remarkably clearly for an economist, he has an extensive body of public work to choose from, and he says many things about debt that I think everyone can agree with. The differences between his positions and mine can, however, be pronounced; and I have spent some time trying to discern why reasonably intelligent people can have such significant disagreements. My goal here is to be respectful and gentlemanly while trying to expose the foundations (there is a pun here, soon to be revealed) of our disagreement.

To do this, we are now going to step out of the economic realm and move a little farther afield. Some readers may wonder at the journey I am am about to take you on, but this diversion will be helpful in explaining Paul’s and my different approaches to debt. We’ll return to our central theme by and by. Stick with me.

One of the things I learned in my religious studies (yes, I did attend – and graduate from – seminary as penance for what must have been multiple heinous sins in my past lives) is that disagreements are often driven not by the “logic path” of an individual’s thoughts but instead by their core presuppositions. Presuppositions are often more akin to tenets of faith and insight than they are to actual, provable observations or facts. They are things assumed to be true beforehand, ideas taken for granted. Sometimes our presuppositions are rooted in prejudice, but more often than not they just arise from normal human behavior. Often, presuppositions are formed because of beliefs stemming from other areas of our lives or imposed by society. Your basic presuppositions, what “everyone” knows to be true, can lead to absurd conclusions. If you believe, as people did in Galileo’s day believed, that the Bible teaches the earth is flat and that the Bible is the authoritative source for understanding physical geography along with everything else, then it is logical to believe you can sail off the end of the Earth.

We are, as the great journalist Edward R. Murrow said, “prisoners of our own experiences.”

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.