Stock Market Accumulation or Distribution

Stock-Markets / Stock Markets 2015 Apr 13, 2015 - 11:14 AM GMTBy: Andre_Gratian

Current Position of the Market

SPX: Long-term trend - Bull Market

SPX: Long-term trend - Bull Market

Intermediate trend - Is the 7-yr cycle sketching an important top?

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. They are important adjuncts to the analysis of daily and weekly charts which ultimately indicate the course of longer market trends.

ACCUMULATION OR DISTRIBUTION?

Market Overview

Since early March, SPX has traded in a broad range of approximately 85 points. The support level, which is between 2040 and 2050 has been tested several times and held each time. The last test was on 4/01, and this generated another short-term uptrend which reached 2102 on Friday.

On a short-term basis, the index probably approached the top of its potential on Friday. This is fairly evident on the charts, as we will see later. Also, several cycle analysts are calling for the bottom of a cycle around 4/17-20. This would make next week a down week, but how much weakness could we expect? One of these analysts, Erik Hadik, had mentioned the possibility of the cycle being powerful enough to take the index below its 2040 support. I discussed this in the last letter. The past week's action has made this less than probable, although a re-test of the bottom of the range is certainly a possibility.

Should prices hold ca. 2060 the current pattern would look like a consolidation in the form of a triangle, which means that after 4/20 we could start another uptrend being able to challenge the 2119 high.

Let's see how next week goes and we'll take it from there.

Indicators Survey

Weekly momentum indicators have also resisted the downtrend and started to turn up.

The daily MACD is neutral with a positive bias. The SRSI has reached the top of its range.

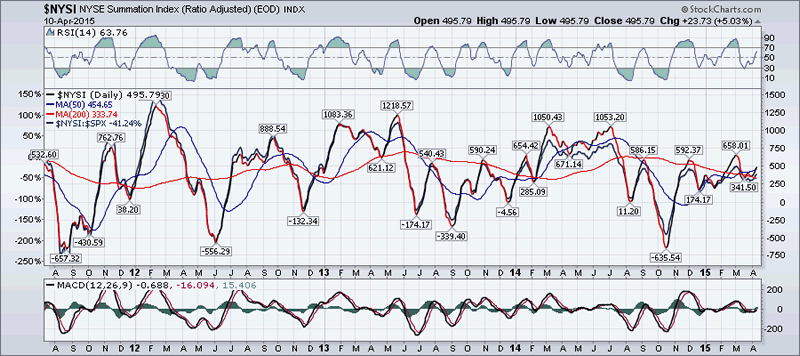

The Summation Index (chart below courtesy of StockChart.com) is also on neutral with little change from last week. Its basic component, the McClellan Oscillator, has decidedly diverged negatively from the SPX strength this past week.

With the index failing to break below the 2040 level, the 3X P&F chart looks as if it is making a consolidation pattern instead of a top, especially after last week's rally.

Chart Analysis

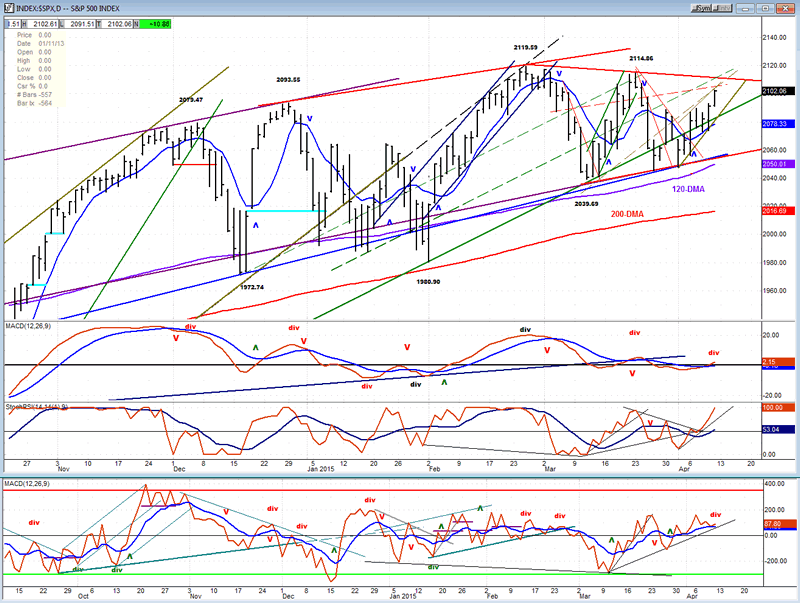

The daily chart of the SPX (courtesy of QCharts.com, as well as others below) shows that the pattern which has been forming since the 2119 high is beginning to look like a triangle. Many factors point to Friday's close being at or near the high of the move from 2048. Besides filling a base projection on the P&F chart, the index has also reached an area where several internal trend lines and parallels form an ideal resistance area which should put an end to the rally. If, indeed, a cycle will be bottoming ca. 4/20, and prices decline to about 2060, it would complete the triangle and allow another uptrend to develop which could easily stretch to a new marginal all-time high in the SPX.

The oscillators also support the view that this is a weak rally which should be coming to an end. Both the MACD and the A/D oscillators are displaying some negative divergence, and the SRSI has reached the top of is range. Everything considered, it's easy to expect a short-term reversal, perhaps as early as Monday.

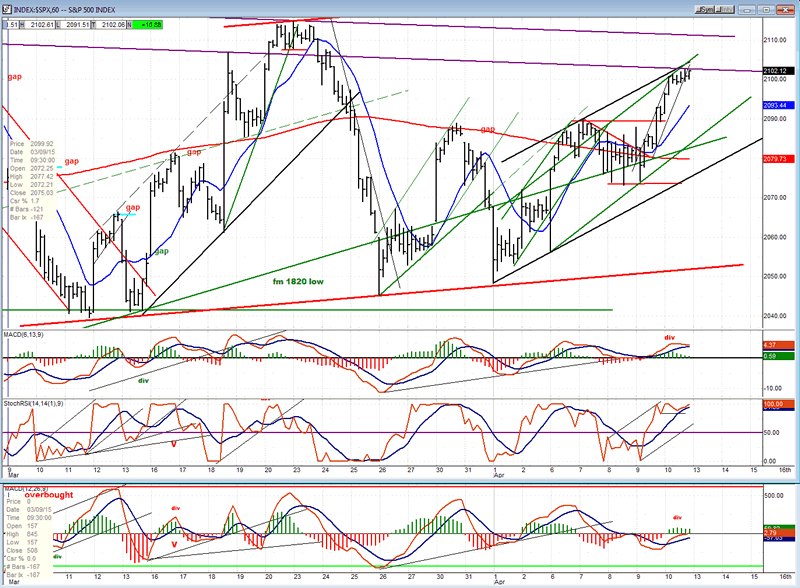

The hourly chart shows that the index has come to the upper junction of two channels which encompass the move from 2048, with another parallel to the top trend line creating some aditional resistance. That resistance was acklowledged by SPX on Friday when it traded five hours in a small lateral range, unable to go higher. With the 2102 level also filling a base count, it will be difficult for the index to make further progress . However, it did close very near its high on Friday, so the short-term top may not be decided until Monday.

The hourly indicators tell exactly the same story as the daily ones: negative divergence in the MACD and A/D oscillator, and an overbought SRSI trading at the top of its range. It will be difficult to avoid a short-term reversal at this level, especially with a cycle bottoming early next week.

How, since divergence is only a warning, one should wait for confirmation that a reversal is taking place by breaking a trend line or surpassing a level.

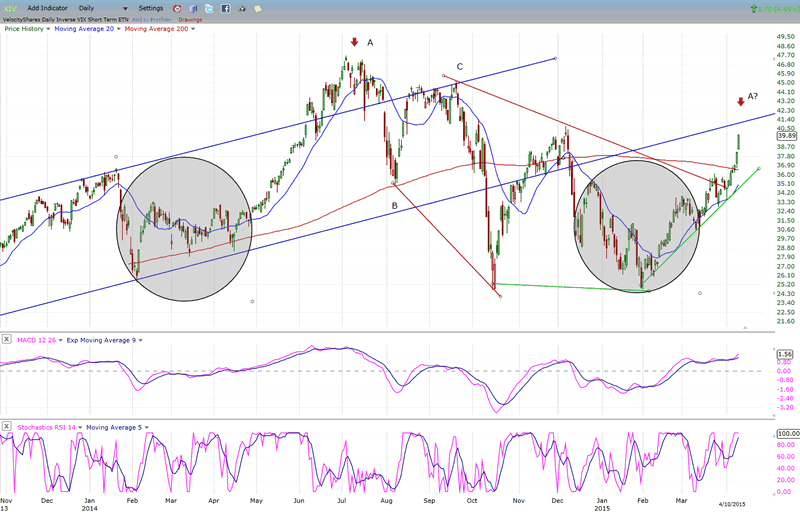

XIV (Inverse Volatility Index) - Leads and confirms market reversals.

The VIX's lack of volatility lately has made it difficult to draw some predictive conclusions about the state of the market. We can get a much better reading from its inverse, the XIV, which has had a powerful recovery from an oversold condition.

A fractal pattern seems to be emerging which is reproducing what took place just before the October decline. A base is formed (circle) followed by a sharp rally (A), a pull-back (B) and another rally to a lower high (C) before a sharp sell-off. At (A) and (B) XIV and SPX are in sync. At (C) XIV shows relative weakness to SPX, making a lower high while SPX makes a new high. This is followed by a significant decline!

I don't know how exactly this pattern will be followed ( if at all), but it's worth keeping track in case something similar -- with the same implication -- takes place over the next few weeks.

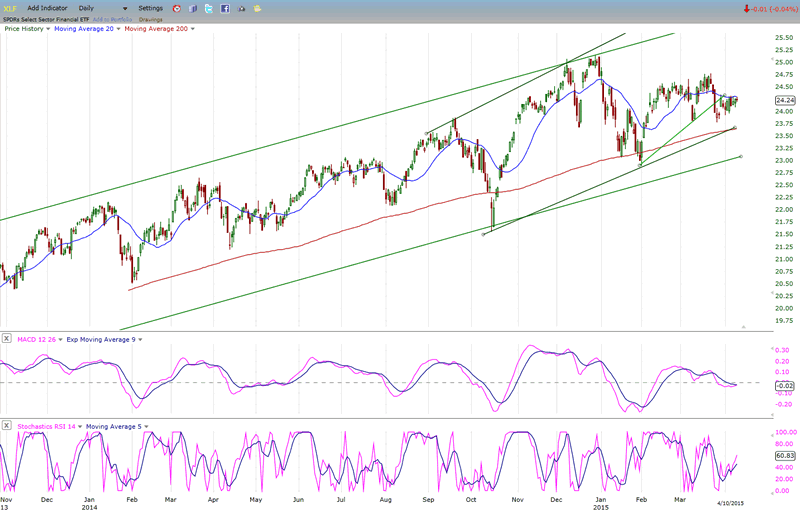

XLF (Financial ETF) normally leads the market at important tops.

XLF retains its relative weakness to SPX, showing little activity this past week. The divergence in XLF can appear long before the top is made in SPX. In 2007, XLF started to show divergence around July and SPX made its high in October.

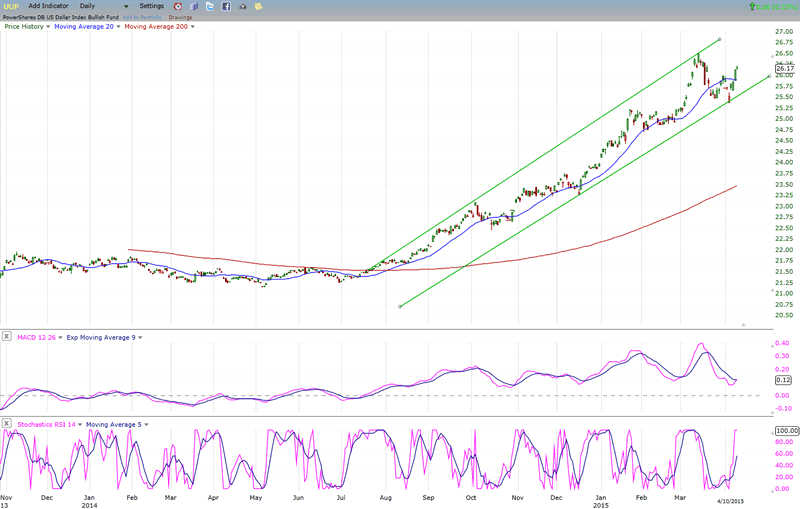

UUP (dollar ETF)

I suggested earlier that since the dollar had a higher P&F target, UUP was only undergoing a minor consolidation in an uptrend. This appears to be the case and this index looks as if it is in the process of resuming its uptrend.

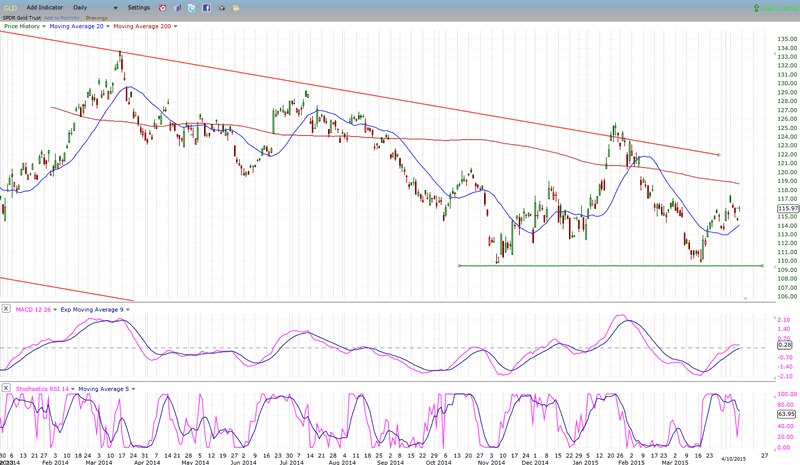

GLD (Gold trust)

With a 25-wk cycle low due in early May, GLD is - and should be - running out of upside momentum and getting ready to turn down into that time frame. However, there is apparently an even larger cycle due in late June/early July which could take prices even lower. Under these circumstances, the P&F target of 100 seems like a reasonable expectation

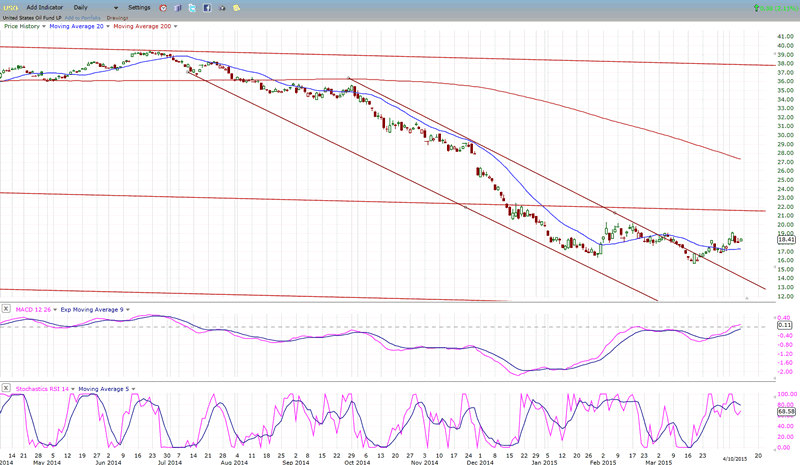

USO (US Oil Fund)

Both GLD and USO tend to be affected by the dollar's strength. If the greenback is resuming its uptrend with a higher target in mind, it would make sense for GLD and USO to move to their lower targets at the same time. For USO, it's about 13.

Summary

On Friday 4/3, the market was closed because of Good Friday. However Globex remained open for 45 minutes so that traders could react to the jobs report. And react they did, with a 19-point drop in the SPX futures. This caused a widespread expectation that SPX cash would follow through at the opening of last Monday, and possibly crash below the 2040 support level. That did not happen! Although there was some initial weakness at the opening, SPX immediately reversed and started a rally which continued until Friday when it finally seemed to be running out of steam.

That tells us that the market is not yet quite ready for a large correction and more distribution will have to occur before this happens. I had stated in an earlier article that the rounding top could make additional marginal highs before turning down and that seems to be the path that the index is following.

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.