Conservatives Bribe Labour Voters by Extending Right to Buy to Housing Association Tenants

ElectionOracle / UK General Election Apr 14, 2015 - 02:10 AM GMTBy: Nadeem_Walayat

The central piece of the Conservative manifesto to be launched today will be the announcement to extend the near 35 year right to buy your council house scheme (over 2 million sold) to 1.3 million housing association tenants so that they too may buy their homes at deep discounts of as much as 70% / £102,700 per property in London and £77k for the rest of the UK. The starting discount for housing association homes after 3 years of tenancy will be 35%, rising by 1% per year, and 50% for flats rising by 2% per year. Though I don't see how this would exactly work because the Conservatives are proposing to sell homes they do not own, so may face stiff resistance from housing associations.

The central piece of the Conservative manifesto to be launched today will be the announcement to extend the near 35 year right to buy your council house scheme (over 2 million sold) to 1.3 million housing association tenants so that they too may buy their homes at deep discounts of as much as 70% / £102,700 per property in London and £77k for the rest of the UK. The starting discount for housing association homes after 3 years of tenancy will be 35%, rising by 1% per year, and 50% for flats rising by 2% per year. Though I don't see how this would exactly work because the Conservatives are proposing to sell homes they do not own, so may face stiff resistance from housing associations.

Additionally the Conservatives will seek to force councils to sell their remaining most valuable properties estimated at 200k at the rate of about 15k per year. Clearly both policies are aimed at attempting to bribe Labour leaning renting voters into becoming owner occupying Conservative voters as £77k to those outside London is a pretty big bribe! That and forcing the sale of the most valuable council houses is aimed at bolstering the vote in Conservative voting constituencies as that is where the most valuable council housing stock will tend to be situated.

This will mark just the latest of a whole stream of continuous house prices boosting voter bribes that all governments engage in as the recent March Coalition budget illustrates with the announcement of the Help to Buy ISA (savings account), that for every £200 saved will have £50 added to by the government i.e. a 25% government house buying deposit subsidy that currently converts into a maximum of £3,000 per prospective home buyer (£12k total deposit) that I am sure will be raised annually, and which for couples implies a £6k subsidy. Which acts to boost DEMAND and this adds further fuel to the UK house prices bull market that illustrates just one additional mechanism by which the government prints money to inject directly into the UK housing market so as to bribe voters.

The cost of today's voters housing market bribe will be at least £5 billion a year, and probably several billions more a year when the extra cost in housing benefit paid out in rent to private landlords has been factored into the equation.

Private Rental Sector Crisis

To date approx 40% of the right to buy council homes have ended up in the hands of private landlords who then rent out these properties to those on benefits or low incomes. So whilst Council house tenants and soon to join them Housing Association tenants are in receipt of 70% discounts (bribes) of upto £102,000! Those in private rental accommodation get NOTHING! In fact the rents in the private sector tend to be substantially higher than for social housing and the properties also on average tend to be in far poorer state of repair.

Therefore at the end of the day the winners will be private landlords as the supply of buy to let sector properties increases. Meanwhile those waiting on the ever expanding housing lists are going to face even less choice as now even housing association properties will soon start to evaporate so that all that will be left will be some 6 million private landlord rental properties.

The big question mark is what bribes will the politicians come up with to appease the 6 million private rental households? Will a future government announce the right to buy your private rental property, especially as it would be a relatively easy votes winning calculation for a left of centre party to make. Something for today's would-be landlords to ponder the consequences of as they mass property empires that they could be forced to liquidate.

UK House Prices 5 Year Forecast

It is now 15 months since excerpted analysis and the concluding 5 year trend forecast from the then forthcoming UK Housing Market ebook was published as excerpted below-

UK House Prices Forecast 2014 to 2018 - Conclusion

This forecast is based on the non seasonally adjusted Halifax House prices index that I have been tracking for over 25 years. The current house prices index for November 2013 is 174,671, with the starting point for the house prices forecast being my interim forecast as of July 2013 and its existing trend forecast into Mid 2014 of 187,000. Therefore this house prices forecast seeks to extend the existing forecast from Mid 2014 into the end of 2018 i.e. for 5 full years forward.

My concluding UK house prices forecast is for the Halifax NSA house prices index to target a trend to an average price of £270,600 by the end of 2018 which represents a 55% price rise on the most recent Halifax house prices data £174,671, that will make the the great bear market of 2008-2009 appear as a mere blip on the charts as the following forecast trend trajectory chart illustrates:

In terms of the current state of the UK housing bull market, the Halifax average house prices (NSA) data for Feb 2015 of £190,113 basically shows that the UK housing bull market paused from August to December 2014 before resuming its bull run in January. House prices are currently showing a deviation of 4% against the forecast trend trajectory. In terms of the long-term trend forecast for a 55% rise in in average UK house prices by the end of 2018, if the current deviation continued to persist then this would result in an 15% reduction in the forecast outcome to approx a 40% rise by the end of 2018.

Implications for Election 2015

The following graph further illustrates the fall in momentum during the second half of 2014 and that this years surge to back above 10% has already evaporated as momentum has now slowed to +6.6%, so it appears the Coalition government will miss setting a new UK average house prices record high just prior to election day, probably due to ongoing weakness in house prices in the South East.

Therefore can expect a continuing slowdown in house price inflation during the summer months. In fact the momentum trend is likely to be very similar to Labours 2010 house prices mini-election boom that I had started to warn to expect from mid 2009. Though at this point I am not expecting a similar post election collapse to -5% as that was as a consequence of Labour going for broke on a near £160 billion annual deficit debt printing binge.

Whilst the most recent polls are now marginally putting Labour ahead of the Conservatives. However my long standing analysis of seats vs house prices trend trajectory painted a picture for a likely probable Conservative outright general election victory.

16 Dec 2013 - UK General Election Forecast 2015, Who Will Win, Coalition, Conservative or Labour?

The following graph attempts to fine tune the outcome of the next general election by utilising the more conservative current house prices momentum of 8.5% which has many implications for strategies that political parties may be entertaining to skew the election results in their favour.

The the key implications of the above graph are -

- The window for an outright labour election victory has ended as of July 2013.

- As of writing an election today would result in a Coalition government with a majority of about 40 seats.

- The window of opportunity for a Coalition government ends by mid 2014 after which there is an increasing probability for a Conservative outright majority.

- A May 2015 general election at an average house price inflation rate of 8.5% would result in a Conservative overall majority of about 30 seats. Therefore this is my minimum expectation as I expect UK house prices to start to average 10% per annum from the beginning of 2014.

The updated election seats trend graph illustrates that the Conservatives are trending towards achieving a single digit outright majority election win which NO ONE, and I mean no serious commentator / analyst either has or is currently advocating, so it would come is a big shock to pollsters on election day!

UK General Election Forecast 2015

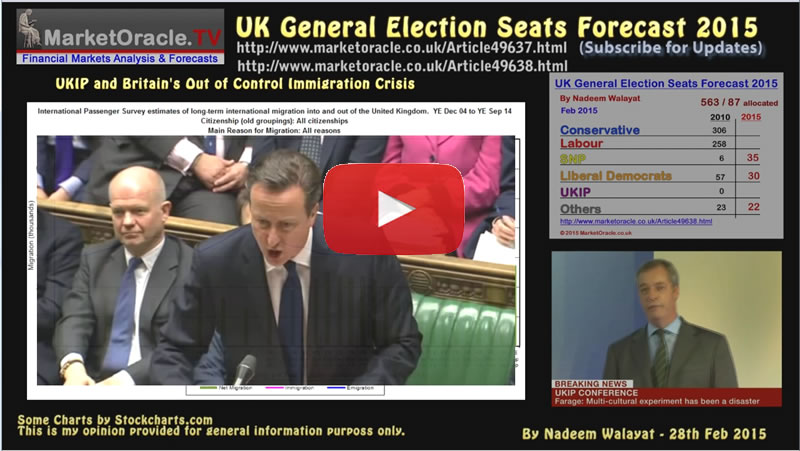

In terms of what I actually see as the most probable outcome for the general election, I refer to my in-depth analysis of 28th Feb:

- 28 Feb 2015 - UK General Election 2015 Seats Forecast - Who Will Win?

- 28 Feb 2015 - UK General Election 2015 - Forecasting Seats for SNP, LIb-Dems, UKIP and Others

UK General Election May 2015 Forecast Conclusion

My forecast conclusion is for the Conservatives to win 296 seats at the May 7th general election, Labour 2nd on 262 seats, with the full seats per political party breakdown as follows:

Therefore the most probable outcome is for a continuation of the ConDem Coalition government on 326 seats (296+30) where any shortfall would likely find support from the DUP's 8 seats.

The alternative is for a truly messy Lab-Lib SNP supported chaotic government on 327 seats (262+30+35) which in my opinion would be a truly disastrous outcome for Britain, nearly as bad as if Scotland had voted for independence last September.

Another possibility is that should the Conservatives do better than forecast i.e. secure over 300 seats but still fail to win an overall majority, then they may chose to go it alone with the plan to work towards winning a May 2016 general election.

The bottom line is that the opinion polls do not reflect how people will actually vote on May 7th when they are faced with a stark choice of steady as she goes ConDem government or take a huge gamble on Ed Milliband's Labour party. So in my opinion several millions of voters will chose to play it safe with ConDem which thus is the most probable outcome.

Also available a youtube video version of my forecast:

Ensure you are subscribed to my always free newsletter for my next in-depth analysis on the UK housing market delivered straight to your email in box.

Source and Comments: http://www.marketoracle.co.uk/Article50242.html

By Nadeem Walayat

Copyright © 2005-2015 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.