Stock Market Kondratieff Waves and the Greater Depression 2013- 2020 update

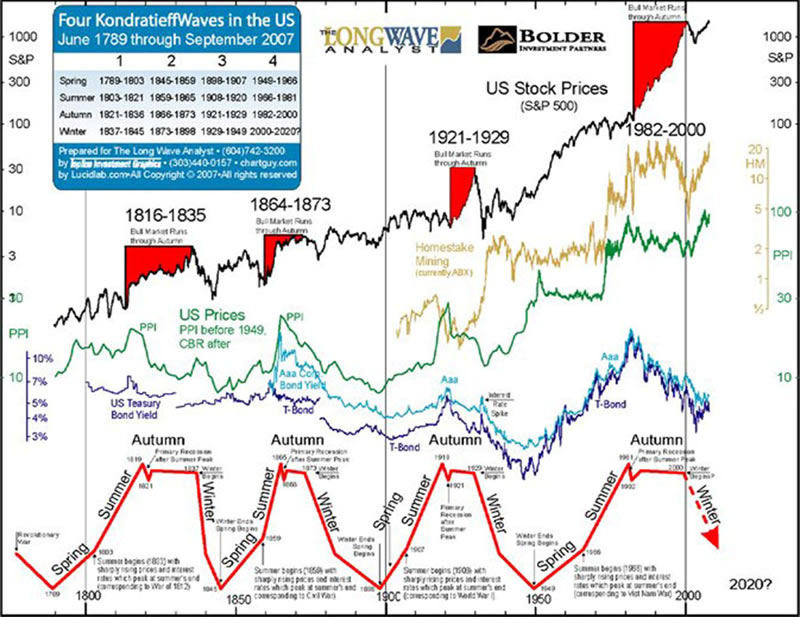

Stock-Markets / Stock Markets 2015 May 01, 2015 - 12:06 PM GMT In February 2012 I wrote an essay on Kondratieff waves (K waves). At that time based on the teaching of Nikolai Kondratieff it appeared that the world economy was in the middle of a Kondratiev winter or “greater recession”. (See chart below).

In February 2012 I wrote an essay on Kondratieff waves (K waves). At that time based on the teaching of Nikolai Kondratieff it appeared that the world economy was in the middle of a Kondratiev winter or “greater recession”. (See chart below).

The K wave is a 60 year cycle ( a year or so) with internal phases that are sometimes characterized as seasons: spring, summer, autumn and winter:

- Spring phase: a new factor of production, good economic times, rising inflation

- Summer: hubristic 'peak' war followed by societal doubts and double digit inflation

- Autumn: the financial fix of inflation leads to a credit boom which creates a false plateau of prosperity that ends in a speculative bubble

- Winter: excess capacity worked off by massive debt repudiation, commodity deflation & economic depression. A 'trough' war breaks psychology of doom.

However, since 2012 the American stock market has not collapsed but moved to new highs. So what is the explanation?

My contention is that we are in a financial “greater-recession” (depression) but it does not “seem” so because it has not yet become a true economic depression. Let me explain.

The worst of the consequences of the “greater-recession” which began in 2000 have been mitigated by the Fed’s and the bank of Japan’s Quantitative Easing policies. For example with regard to the US Fed between 2008 and 2013 reserves held increased to nearly 2.5 trillion dollars.

Reserve Balances Held at the Federal Reserve: St. Louis FED.

When we look to Japan we see from the chart below that the level of assets it holds as a percentage of GDP was a whopping 45% in 2013.

Size of International Central Bank Balance Sheets: St. Louis FED.

This level of central bank intervention worldwide has completely skewed the operation of the free markets. The consequential low interest rates and the availability of easy money to large banks and institutions have resulted in a “corrupted” price formulation for commodities, real estate, stocks and bonds. Thus when we should be experiencing deep price contraction we have market booms across most asset classes.

As every follower of Ludwig Von Mises knows when you manipulate the pricing mechanism of the free market nobody knows the true value of anything anymore and accordingly resources become mis-allocated. Most K wave theorists observe this development with grave concern. They know that there have been nearly 18 K wave cycles in world economic growth since 930 AD and the current manipulation of “natural” prices is only going to make the current Kondratieff winter more catastrophic when it really takes hold. In other words the K winter cycle has been pushed out but it has not been neutralized.

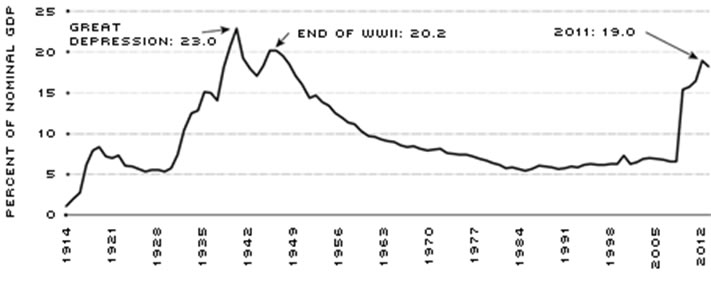

Anyone who does not realize that the USA is actually in a near depression should look at the chart below. The level of central bank “ownership” of the US economy was near 1929 “great depression” levels in 2012 and things have deteriorated since then.

Historical View of Federal Reserve Balance Sheet: St. Louis FED.

How long financial engineering, interest rate swaps, economic statistic modification and stock buy-backs can be used to fudge the economic “greater recession” we are living through is anyone’s guess.

When, due to the potential bankruptcy of the central banks of Japan, the EU, England and the US the current musical chairs of floating currency wars, negative interest rates and quantitative easing stops, my intuition tells me the true nature of our economic vulnerability will become visible for all to see.

It is my contention, as mentioned in the last essay, that the current “recessionary” reality should be accepted for what it is i.e. a depression and dealt with through honest policies rather than through “smoke and mirror” QE delusion. World leaders must accept the reality of Kondratieff’s credit cycle discovery and let the current “natural” international credit contraction take its course.

The essential cause of the current K wave winter is a natural by-product of collapsing growth, high debt, labour obsolescence, falling incomes and contracting employment. The type of enlightened policies needed to deal with the crisis are:

1. Ordered debt liquidation and restructure

2. Promotion of creative development.

3. Limitation of government regulation, taxation and control.

4. Efficient market pricing and asset allocation.

5. Availability of new non debt money to finance real growth, efficiency and productivity.

6. Distribution of purchasing power through fair wages and conditions.

7. Promotion of a new banking system based on sustainable economic growth rather than negative money.

The current policies being endorsed by the likes of the European Union are the antithesis of the above. Instead of debt liquidation we have debt sustained by additional debt. Rather than have wage growth we have zero hour contracts with no minimum wage protection. Instead of the promotion of new industries with cutting edge research and development we have existing conglomerates stifling innovation through pork barrel regulation and repressive government control.

The longer the inevitable K winter is ignored, the more violent will be the eventual political, social and economic collapse. As the famous character Chancy Gardner said in the classic movie “Being There”: “after the winter, economically there will be growth in the spring”. However, we must be courageous enough to allow the current K winter to become fully manifest for this re-growth to occur anytime soon.

Crushing legacy bank debt is the problem. Debt liquidation through deep economic contraction is the solution. As long as this Kondratieff truth is denied the longer will be the delay in the commencement of world reinvention, renewal, rebirth and expansion.

Sources:

St. Louis Fed: “The Rise and Fall of the Fed’s Balance Sheet”.

Lowell Ricketts & Christopher J. Weller, Jan. 2014.

Financial Sense: “Kondratieff Waves and the Greater Depression 2013 -2020”

Christopher M. Quigley February Feb. 24 2012.

K Wave Chart: Courtesy of Longwaveanalysis.ca

By Christopher M. Quigley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2015 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.