Bernanke's Open Mouth Operations Attempt at Halting Inflationary Dollar Slide

Economics / Inflation Jun 13, 2008 - 11:34 AM GMTBy: Joseph_Brusuelas

Over the past fortnight Fed Chairman Ben Bernanke has engaged in “open mouth operations” to shape market expectations regarding future monetary policy out of the US Federal Reserve. Mr. Bernanke rhetorically intervened in the global currency markets to prop up a beleaguered dollar, explicitly expressed unease over the current course of inflation and signaled that the Fed would not tolerate a breakout of inflation expectations. Not bad, for a Fed Chairman fighting multiple crisis on multiple fronts.

Over the past fortnight Fed Chairman Ben Bernanke has engaged in “open mouth operations” to shape market expectations regarding future monetary policy out of the US Federal Reserve. Mr. Bernanke rhetorically intervened in the global currency markets to prop up a beleaguered dollar, explicitly expressed unease over the current course of inflation and signaled that the Fed would not tolerate a breakout of inflation expectations. Not bad, for a Fed Chairman fighting multiple crisis on multiple fronts.

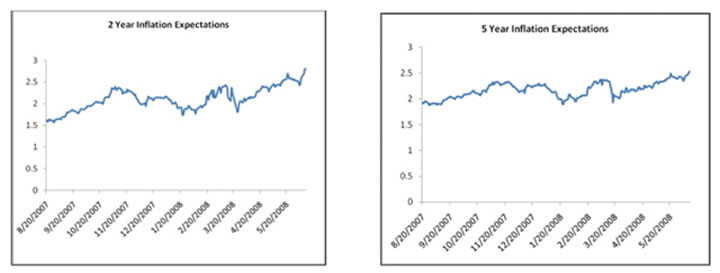

The concerns over inflation expectations expressed by Mr. Bernanke and the more intense hawkishness expressed by Dallas Fed President Richard Fisher and Richmond Fed President Jeffrey Lacker are well founded. Public expectations over short-term inflation have soared. According to the University of Michigan the public expects that over the next year inflation will increase 5.5% and the Conference Board's twelve-month gauge suggest a 7.7% rise in the year ahead. Even market sentiment, which has lagged public sentiment, has changed.

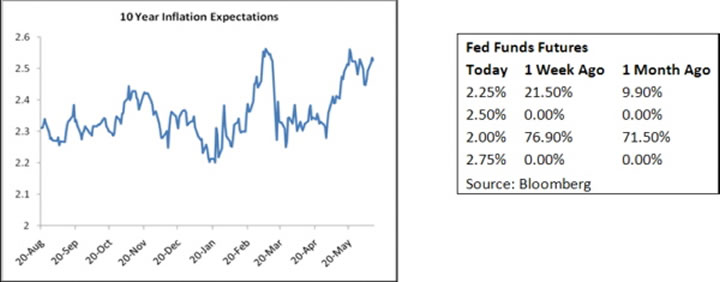

The market, caught off guard by the rapid change in expectations and surprised by the speed and sustained switch in rhetoric out of the Fed, changed its expectations of rate hikes in confused haste. Using federal funds futures rates as a metric for measuring changing market sentiment traders now expect that the Fed will hike rates by 50bps before the end of the year with a 37.1% probability of 75bps in hikes by the end of the year.

Under normal circumstances, I would welcome a return of the hawkish instincts that underlie the foundation of Mr. Bernanke's hallmark academic work on inflation targeting. Such a hawkish turn would compliment my own theoretical orientation and normative preferences regarding appropriate monetary policy and the necessity of a single focus on price stability.

Such a potential move by the central bank is in line with the systematic case I have been making over the past several months regarding the future impact on inflation expectations caused by the rise in energy and commodity prices. The entire efficacy of contemporary Fed policy is hinged on a stable set of expectations and the slow and steady upward movement in those expectations over the past few months has stimulated the gravest crises faced by the Fed in many years.

While, a case can be made that there is little threat to macroeconomic stability from inflation until wage demands begin to work their way through the system, I do not concur. By the time that unit labor costs begin to rise and a newly minted Congress bestows upon labor newfound power, it will be to late. The pain that would be necessary to inflict on the public to combat a such a breakout of wage-push inflation is way beyond what our current political system and the likely leftward composition of the next Congress will be willing to stomach.

That being said, once one takes a step back and looks at the recent statements of Mr. Bernanke in the proper context, these are good reasons to be more than a bit skeptical of the recent hawkishness out of the Fed chair. Let me elaborate. Given the continued stress in financial markets, an economy moving sideways and a consumer that remains under duress we are highly suspect of the recent claims by the Fed chair that rate hikes are imminent. Moreover a simple observation of the movement in markets is quite instructive of the real problem the Fed currently faces.

Perhaps, other than the clear change in the federal funds futures market, the most startling shift has occurred is in fixed income space, where curve steepening trades have been rapidly unwound. The spread between 2yr and 10yr yields has closed quite quickly. This has put an unexpected bout of pressure on financial firms, who rely on the ability to borrow short and lend long and thought that they had reached a short-term point of stability. Why have financials continued to tank? In addition to the lingering uncertainty over the condition of their books, it is due to the newfound hawkishness on the part of Mr. Bernanke. Why is this so problematic? Unless, Mr. Bernanke is willing to undo much of the patchwork that his innovative and unorthodox approach to shoring up the financial system over the past several months has accomplished, we do not see him urging his colleagues to move quite quickly on rates,

Second, we are approaching what will be a very close and contentious Presidential election in the United States. After doing a bit of research, I was able to observe that with the exception of Paul Volker's rate increase ahead of the Reagan-Carter match in 1980 and Alan Greenspan's hike before the 1992 election between Clinton and Bush the elder, Fed chairman have been quite careful to steer clear of Presidential elections. It would be nice to believe that the central bank independence has been thoroughly absorbed by our monetary officials and that price stability would outweigh political considerations. But it does strike me as quite difficult to believe that Mr. Bernanke would hike rates, not once, but twice according to current market expectations, in advance of the election. This would surely facilitate the election of a candidate that would summarily reject Bernanke's reappointment early in the first term the new President.

The net effect of all of the sound and fury that the market has experienced over the past few days, will in all probability, be to set up a confrontation down the road between the market and the Fed. My own ex-ante GDP forecast strongly suggests that after two consecutive quarters of sub 2.0% growth through the middle of 2008, that output will fall back towards zero to conclude the year. I think that the Fed is counting on both output and resource utilization (unemployment) easing later this year to provide cover for their continued dovish policy.

In fact, Fed Vice-Chair Donald Kohn, who since the crisis began last August, has been something of a useful barometer for those of use who attempt to derive what the Fed will do next. Mr. Kohn in his most recent statement made the case that the proper policy path for the Fed may be to tolerate higher inflation and higher unemployment in fact of a commodity shock of the sort that we are facing today. This fact that it was made at a Boston Fed conference discussing the trade off between unemployment and inflation, better known as the “Phillips Curve,” is no accident.

What all of this tells this economist is that the Fed is going to continue to tolerate inflation, attempt to manage inflation expectations and quite simply buy time for the financial system to repair itself. If the Fed truly wanted to get serious about inflation and signal the start of a rate hiking cycle, it would begin to reduce the growth of the money base, set a date for the end of the “temporary auction facility” and raise rates at the next meeting. But it will not.

Unfortunately, the unintended consequence of this very delicate balancing act is that a potent dénouement is forming over the horizon in which the market will move to demand that the Fed move to increase rates, well before it is ready to do so. With the very credible signals out of the European Central Bank that rates hikes are just around the corner, with each passing day, the Fed finds itself slowly but surely painted into policy path that upon further review is not of its choosing. The inability or unwillingness to act on the part of the Fed will have a deleterious impact on the dollar and with it a reduction in the living standard of individual Americans.

By Joseph Brusuelas

Chief Economist, VP Global Strategy of the Merk Hard Currency Fund

Bridging academic rigor and communications, Joe Brusuelas provides the Merk team with significant experience in advanced research and analysis of macro-economic factors, as well as in identifying how economic trends impact investors. As Chief Economist and Global Strategist, he is responsible for heading Merk research and analysis and communicating the Merk Perspective to the markets.

Mr. Brusuelas holds an M.A and a B.A. in Political Science from San Diego State and is a PhD candidate at the University of Southern California, Los Angeles.

Before joining Merk, Mr. Brusuelas was the chief US Economist at IDEAglobal in New York. Before that he spent 8 years in academia as a researcher and lecturer covering themes spanning macro- and microeconomics, money, banking and financial markets. In addition, he has worked at Citibank/Salomon Smith Barney, First Fidelity Bank and Great Western Investment Management.

© 2008 Merk Investments® LLC

The Merk Hard Currency Fund is managed by Merk Investments, an investment advisory firm that invests with discipline and long-term focus while adapting to changing environments. Axel Merk, president of Merk Investments, makes all investment decisions for the Merk Hard Currency Fund. Mr. Merk founded Merk Investments AG in Switzerland in 1994; in 2001, he relocated the business to the US where all investment advisory activities are conducted by Merk Investments LLC, a SEC-registered investment adviser.

Merk Investments has since pursued a macro-economic approach to investing, with substantial gold and hard currency exposure.

Merk Investments is making the Merk Hard Currency Fund available to retail investors to allow them to diversify their portfolios and, through the fund, invest in a basket of hard currencies.

Joseph Brusuelas Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Nazmul H. Palash

09 Jun 10, 12:01 |

comments

It's an interesting and informative article for the students of Buiness especially for Banking Students!!!!!! |