Learn How to Apply Fibonacci Retracements to Your Stock Index Trading

InvestorEducation / Learn to Trade Jun 19, 2015 - 11:12 PM GMTBy: EWI

Fibonacci is the mathematical basis of the Wave Principle. You will often find that Elliott waves correct in terms of Fibonacci ratios. The following article explains what you can expect when a market begins a corrective phase.

Fibonacci is the mathematical basis of the Wave Principle. You will often find that Elliott waves correct in terms of Fibonacci ratios. The following article explains what you can expect when a market begins a corrective phase.

If you are interested in learning more about using Fibonacci in your trading, get your free 14-page eBook, How You Can Use Fibonacci to Improve Your Trading.

Retracements -- Corrective Waves

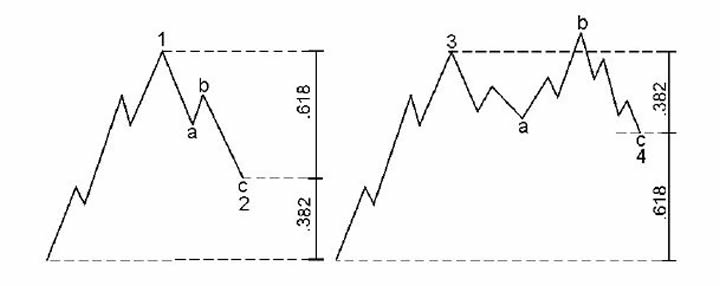

The chart on the left shows a wave 1 followed by corrective wave 2. It is common for second waves to retrace .618 of wave 1 -- thereby making a deep retracement. Another common retracement for wave 2 is .786. You might even see .5, 50%, but .618 is more common. The chart on the right shows the most common retracement for a wave 4. Fourth waves will commonly retrace a smaller percentage or .382 of wave 3. We might also see something like .236.

Examples

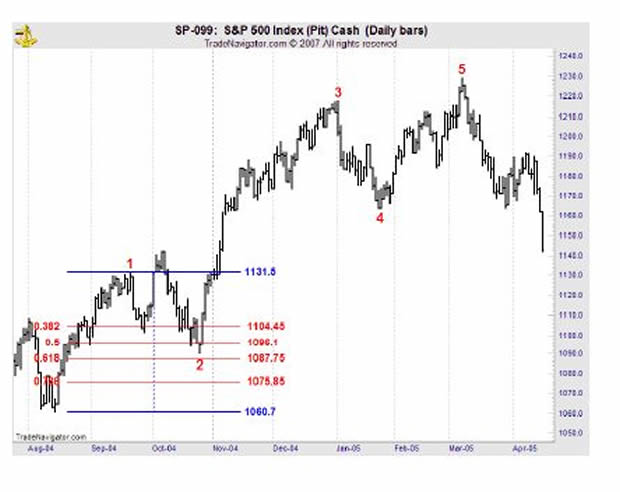

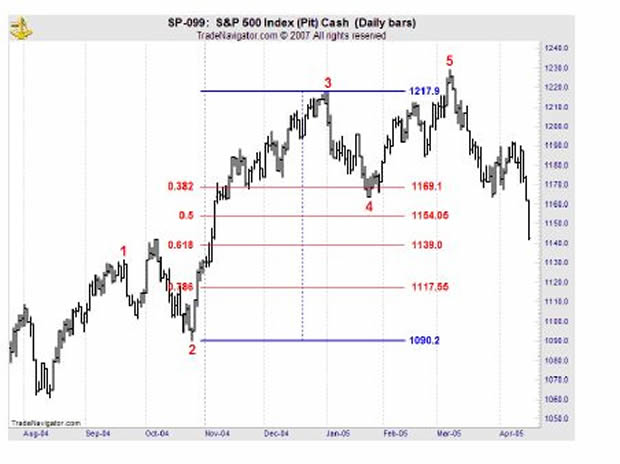

Below you can see an impulsive 5-wave move on the chart of the S&P 500. Wave 2 is an expanded flat. Wave 4 is a zigzag. Let's look at the retracements that waves 2 and 4 make.

Wave 2 made a deep retracement -- close to .618. On the Fibonacci table you can see the .382, .5, .618, and .786 retracements. The .618 retracement comes in at 1087.75 and the S&P low is 1090.19.

Wave 4 made a shallow retracement of wave 3. It went just beyond the .382 retracement at 1169.1, bottoming at 1163.75.

In a nutshell, this is what we mean when we say that Elliott waves often correct in terms of Fibonacci ratios.

How You Can Use Fibonacci to Improve Your TradingIf you'd like to learn more about Fibonacci and how to apply it to your trading strategy, download the entire 14-page free eBook, How You Can Use Fibonacci to Improve Your Trading. EWI Senior Tutorial Instructor Wayne Gorman explains:

See how easy it is to use Fibonacci in your trading. Download your free eBook today » |

This article was syndicated by Elliott Wave International and was originally published under the headline Learn How to Apply Fibonacci Retracements to Your Trading. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.