Forget 'Haircut', Instead Syriza Plans Beheading of Greek Bank Depositors, Theft of Deposits

Politics / Eurozone Debt Crisis Jul 05, 2015 - 12:55 PM GMTBy: Nadeem_Walayat

Greeks voting YES or NO won't make any difference to what I see as a near certainty of the Greek banks NOT reopening Tuesday, and it is not just because the banks won't have the euro bank notes in their vaults, it's because they are ALL insolvent and have been so for the past 5 years where the only thing that had prevented a collapse of the Greek banking system was generous and I mean GENEROUS support from the Euro-zone's ECB central bank that has literally financed every withdrawal from the Greek banks for the past 5 years, right up until Syriza announced its baldrick-esk cunning plan for a Referendum. That's over Euro 120 billion Euro-zone tax payers funds paid into the Greek banks to finance ALL withdrawals that amounts to 50% of the original total Greek bank deposits.

Greeks voting YES or NO won't make any difference to what I see as a near certainty of the Greek banks NOT reopening Tuesday, and it is not just because the banks won't have the euro bank notes in their vaults, it's because they are ALL insolvent and have been so for the past 5 years where the only thing that had prevented a collapse of the Greek banking system was generous and I mean GENEROUS support from the Euro-zone's ECB central bank that has literally financed every withdrawal from the Greek banks for the past 5 years, right up until Syriza announced its baldrick-esk cunning plan for a Referendum. That's over Euro 120 billion Euro-zone tax payers funds paid into the Greek banks to finance ALL withdrawals that amounts to 50% of the original total Greek bank deposits.

Therefore the only thing that the Greek central bank can do come Tuesday is to extend the bank holiday indefinitely as it works out how much of the Greek bank deposits it needs to steal in a 'bail in' or a 'haircut' as the bankster's prefer to call what actually amounts to a beheading, outright theft which is perfectly in line with the marxist ideology of Syriza.

How Much WIll be Stolen?

Well, Cyprus's theft of bank deposits of March 2013 is a good starting point as I covered at the time -

25 Mar 2013 - Cyprus Shows Your Savings Will be Stolen! UK Theft is by Means of High Inflation

The Damage Has Been Done Expect a Bank Run

The emerging details early Monday morning in the face of a literally eye popping deadline are that of at least 40% of deposits over Euro 100k will be stolen in the two largest cypriot banks, one of them Laiki (2nd largest) will definitely be wound down, many mainstream commentators have jumped onto the fact that the depositors will receive shares in the banks which might be fine if the shares were given AFTER the banks were restructured i.e. bad assets being written down, but they are not instead the depositors are likely to be handed what amounts to worthless toilet paper in exchange for their hard cash.

The damage has been done, as the one thing that the banking system relies on has been destroyed and that thing is confidence. No depositor in Cyprus has any confidence in any cypriot bank and will try to transfer out of the Cyprus tax haven at the earliest possibility so there will be a bank run on cypriot banks the unfolding of which will be inline with the capital controls have been put in place.

The damage has been done to the Cypriot economy as its biggest industry the finance sector has been destroyed to result in huge job losses.

The damage has been done as all businesses have been impacted severely due to both many businesses having had their bank deposits stolen and for Cyprus having become a cash economy, where credit is scarce and not trusted by suppliers, so expect many non finance related business to go bust over the coming months.

The damage has been done to the reputation of Cyprus, where it is now seen as a high risk destination for tourists and investors for the reason of perceived instability, just as Greece's tourist industry has suffered.

Therefore as a MINUMUM one can expect a similar theft of 50% of bank deposits over Euro 100,000. However, I think that the theft of Greek bank deposits will be a lot worse for ordinary Greeks, given the Greek economies economic collapse and unless the ECB opens the flood gates and starts pouring billions of euros per day into Greek banking system, then Greek banks could steal 50% of virtually all deposits starting from as little a balances of over Euro 5,000! Especially as Greece can only afford to refund Euro 3 billion of an estimated E120 billion of deposits. This highlights another point that Bank Deposit Guarantees tend to be worthless propaganda, for when banking systems collapse then the bank guarantees TEND NOT BE FULLFILLED!

The bottom line is that the Greek bank depositors only have themselves to blame for they have had ample warnings to get their funds out of Greek banks, especially in the light of what happened in Cyprus of over 2 years ago!

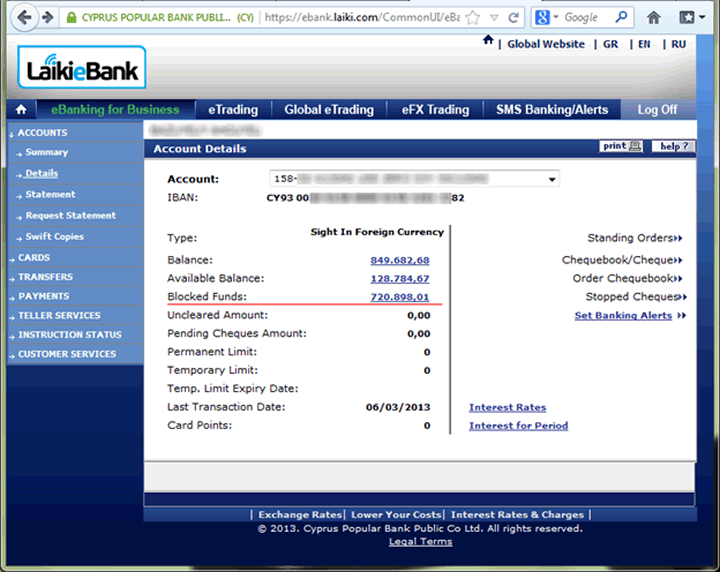

Cyprus's banking system exploding in spectacular style resulting in the overt theft of a growing percentage of deposits that could reach as high as 85% as the following real life example illustrates to what an 85% theft of this customers bank balance at Laiki Bank actually looks like -

Source - So, What's It Like To Have a Business in Cyprus Right Now?

Writes the account owner:

"Most circulating assets on our business Current Account are blocked. Over 700k of expropriated money will be used to repay country's debt. Probably we will get back about 20% of this amount in 6-7 years.

I'm not Russian oligarch, but just European medium size IT business. Thousands of other companies around Cyprus have the same situation.

The business is definitely ruined, all Cypriot workers to be fired. We are moving to small Caribbean country where authorities have more respect to people's assets."

Think it can't happen elsewhere? Think again! It CAN and WILL,which is why it is important to diversify OUT of bank deposits and into asset classes such as stocks and housing that are LEVERAGED to money and debt printing INFLATION as I have covered liberally over the years and in several ebook's that can be downloaded for FREE.

Ensure you are subscribed to my always free newsletter for ongoing in-depth analysis and detailed trend forecasts that include the following planned newsletters -

- Why Thousands of Muslims Are Going to Live, Fight and Die in Syria / Iraq

- US Dollar Trend Forecast Update 2015

- Gold Price Forecast Second Half 2015

Also subscribe to our Youtube channel for notification of special video projects such as -

Also subscribe to our Youtube channel for notification of special video projects such as -

- The Illusion of Democracy and Freedom

- Did God Create the Universe?

By Nadeem Walayat

Copyright © 2005-2015 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.