China May be Preparing for War to Rally the Country in Case of Recession

Politics / China US Conflict Jul 17, 2015 - 06:23 PM GMT As the living standards improved in China for hundreds of millions of people. Instead of a grateful nation, the Chinese Communist Party got more demanding people. The more the Chinese people get, the more the Party is asked to deliver.

As the living standards improved in China for hundreds of millions of people. Instead of a grateful nation, the Chinese Communist Party got more demanding people. The more the Chinese people get, the more the Party is asked to deliver.

There is an unwritten agreement in China: the people will tolerate the Communist Party as long as there is strong economic growth. But what happens if the economy stalls, or worse still, contracts? War could be the answer.

It has been done thousands of times throughout history. When things get tough, war gets going. Argentina did it in the Falklands. Iraq did it with Kuwait. Putin has used and abused this tactic, first in Chechnya, then Georgia and now in the Ukraine. Each time he did it, his popularity went through the roof. The less democratic and the more nationalistic a country his, the better this tactic works.

War is the most horrible and stupid of Human endeavours. It places people below the level of animals. Yet, it is surprisingly easy to manipulate people into going into war. The violence we can´t stand for ourselves, suddenly becomes glamorous when it is performed by our soldiers against foreigners. And by “our soldiers” and “foreigners”, I mean soldiers of any country and foreigners of any nationality.

The case for war

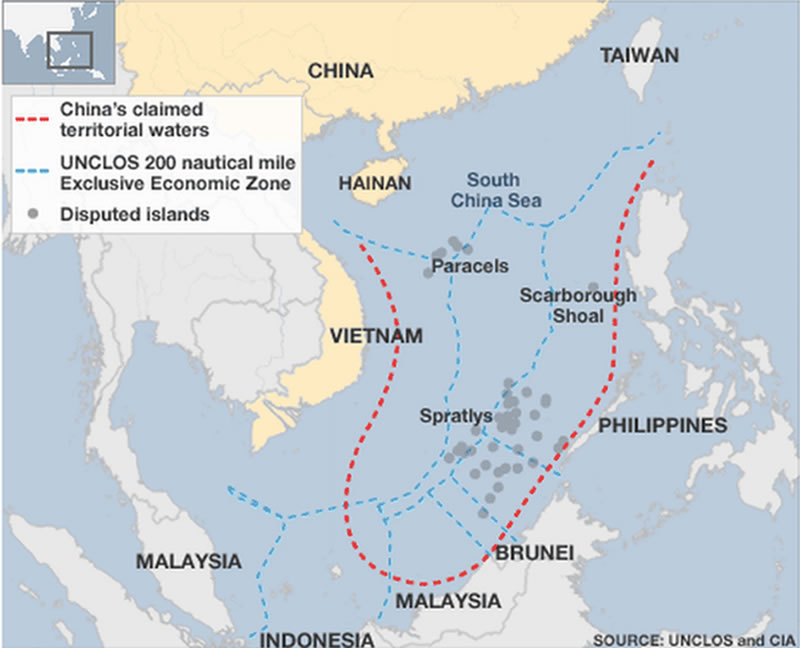

China has been ramping up its ridiculous claims in the South China Sea. Let´s save many words by using a simple map to understand this situation:

In one word: ridiculous. Yet, China means it.

The Chinese military power is overwhelming when compared to that of the other surrounding nations. And by “surrounding nations”, we mean countries thousands of kilometres away. Again, ridiculous comes to mind...

China is getting more and more engaged in this South China Sea claim. The process started through diplomatic channels, by issuing declarations on the subject. Then came less than diplomatic declarations. And now the message is being carried out by military planes and warships. The Chinese are even building islands made of garbage to establish outposts to back their claim. Ridiculous or not, this shows how serious the situation is.

Chinese leaders know that their economy will not grow forever, or at least not at the pace everyone got used to. Periods of slow growth or even recession will eventually come. And when that happens, there will be hundreds of millions of Chinese people blaming the government. The Chinese Communist Party leaders are of course not planning to go away any time soon. To keep their positions, they basically have 2 options:

1. Use violence against their own within the context of a political crackdown.

2. Use violence against others, in a war to rally the people around their glorious leaders showing the world the new power of China.

When the time comes, which option do you think Beijing will choose?

The empty promises of Washington

The United States has again and again promised to protect its allies in the region. Good luck with that. One more empty promise. Look at how well the “American protection” worked in Georgia and the Ukraine. It´s a classic example of “from withdraw to withdraw until the final victory”.

There is no way the United States will go into war with China. Militarily speaking, fighting a war half a world away against a military superpower fighting “at home”, would obviously be a defeat waiting to happen. The US couldn´t win the Korea war, lost in Vietnam and would surely not be able to defeat China directly. Also, would it want to? A war against China would simply not be approved by the majority of Americans or Washington politicians.

And then there are the bonds. You just don´t start a war with a country holding 2 trillion dollars of your debt.

Conclusion

The United States can´t and won´t fight China militarily. If and when the Chinese use force to take de facto control of the South China Sea, the US will do the same thing it just did with Russia: nothing. Beijing knows this. This is why war - or at least a period of more or less violent confrontations at sea - is guaranteed to happen. Beijing is just waiting for the right moment to attack. We believe that moment will come when the Chinese economy gets into trouble. That´s the Atlantic Perspective.

The Atlantic Perspective is an opinion blog, aimed at explaining and providing solutions to some of the world´s most relevant issues.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.