Is the Gold Price Manipulated?

Commodities / Gold and Silver 2015 Jul 29, 2015 - 10:44 AM GMTBy: Clif_Droke

One of the most commonly held beliefs among gold investors is that the market for gold is heavily manipulated. It has become an article of faith among gold advocates that the price is subject to direct control by government, central banks and other parties who have a vested interest in depressing the gold price. In this commentary we'll explore this belief and try to arrive at a firm conclusion as to its veracity.

One of the most commonly held beliefs among gold investors is that the market for gold is heavily manipulated. It has become an article of faith among gold advocates that the price is subject to direct control by government, central banks and other parties who have a vested interest in depressing the gold price. In this commentary we'll explore this belief and try to arrive at a firm conclusion as to its veracity.

Nearly four years after the gold bear market began it has become increasingly common to hear gold writers mention the gold conspiracy theory in their commentaries. I can't recall as many references to gold manipulation since the late 1990s, when the gold price was nearing the end of its 21-year bear market. At that time it was quite normal to see discussions of gold market manipulation as gold investors were becoming frustrated by gold's seeming inability to rally. Meanwhile the stock market was zooming to all-time highs, which made gold bugs feel even more frustrated for missing out on the equities bull market.

At the time, the rationale behind the alleged gold price manipulation was the prevailing belief that the U.S. government favored a stronger dollar. The strong dollar policy of then Treasury Secretary Robert Rubin catered to this belief. It was thought by conspiracy theorists that the U.S. sought to collapse of the vulnerable nations by weakening foreign currencies in order to facilitate a fully integrated global economy. This theory was given some credence by the near collapse of commodities in the summer of 1998 along with currency crises in Russia, Argentina and several Pacific Rim nations. As it turned out, the scare was short lived and gold and other commodities soon thereafter established a long-term bottom.

The market for gold is immensely huge and virtually impossible for any one entity to control its price swings. Beyond the very immediate term, any attempt at raising or depressing gold prices would almost certainly meet with failure. Even a coterie of interests devoted to pushing gold prices lower would meet with certain failure due to the enormous size and complexity of the market. As one well known market analyst of the previous century commented, "...the market itself is bigger than all the 'pools' and 'insiders' put together....the great market movements are beyond the manipulation of the combined financial interests of the world."

One commonly shared belief among gold bugs who subscribe to the manipulation theory is belief in a global conspiracy. Probably the most famous example of this is the Illuminati concept. Illuminati theorists believe in a highly organized group of elite individuals within government, industry and finance who share the common goal of undermining the sovereignty of nations and establishing a one-world government.

This group, moreover, is allegedly unified by centuries of blood ties and political connections. In his book, "Exploding the Doomsday Money Myths," Sherman S. Smith observed: "The idea of such total unity and perfect loyalty among relatives and different families and nations is unfathomable. From what we know about history and the infighting that can occur within even a single family unit, the possibility of such a large group successfully devising and implementing a planned strategy for more than two hundred years is miniscule."

While there's no denying that conspiracies and monopolies do exist, there's also no denying that for every attempt at controlling an industry or a commodity there is a counterbalance. Within any group of would-be monopolists there are those who can never agree on a common plan for gaining control; common experience teaches this (as anyone familiar with corporate politics knows). Further, there are always other parties who would also like to gain total control in opposition to other conspiracy groups. In other words, there is no one overriding "Illuminati" monopoly group, but multiple groups of would-be controllers competing amongst themselves. "If this weren't true," wrote Smith, "the entire world would already be controlled by the Mafia or other such underworld organization."

There are several questions which should be asked by those who subscribe to the gold manipulation theory. To begin with, why would manipulators actively seek to push prices lower when there is less to be gained by a lower gold price than a higher one? The manipulation crowd is presumably in favor of multinational businesses which comprise the global economy. It's well known that higher commodity prices reflect a healthy outlook for big business due to the increased demand for raw materials and industrial inputs. Gold being the strongest barometer for commodities demand, a falling gold price is more apt to reflect deflation, which is the bane and scourge of big business. If anything, manipulators would have more interest in raising gold prices, not crashing them.

Secondly, what interest could gold manipulators have in lowering gold prices when it automatically presumes a stronger dollar? A stronger currency does no favors to the U.S. economy over the longer term. It results in lower export prices for U.S. manufacturers and strains profit margins. As the Wall Street Journal reported on April 24, the strong dollar has been "wreaking havoc" on the profit margins of American multinationals. A stronger dollar forces multinationals to raise prices in order to offset currency issues, yet as WSJ pointed out, this only tends to depress profits due to lower sales.

In fact if a gold conspiracy did exist, the only conceivable reason for knocking down prices would be for the sole purpose of allowing the manipulators to buy the gold back at bargain levels. This in turn would allow them to profit from the inevitable bull market which always eventually follows a long-term bear market. To this end, I can't recall gold bugs discussing manipulation during the glory years between 2002 and 2011 when the gold price was rocketing to all-time highs. Indeed, it would seem that cries of "manipulation!" are selectively applied to only those times when gold's prospects have dwindled.

Finally, if the conspiracy theorists truly believe that the gold price is subject to manipulation then why do they advocate owning gold? This is probably the biggest inconsistency of their hypothesis. Why even touch gold if its price is subject entirely to the whims of an elite group of power brokers? Could it be that the ringleaders of the conspiracy theorists haven't bothered to smooth out this dissonance because so many of them have a vested interest in promoting gold coins?

I've noticed over the years that many conspiracy theorists advocate owning gold; some of them even sell it as retailers, regardless of whether its price is rising or falling. In fact, some of the most aggressive marketing efforts of gold bullion coins occur when the gold price is showing its greatest weakness. It comes across as contradictory that the very people who declaim loudest against gold manipulation are also those who advise owning it even when its investment prospects are dim. Could it be that there is just as much a conspiracy among gold coin retailers as there allegedly is among the alleged gold market manipulators?

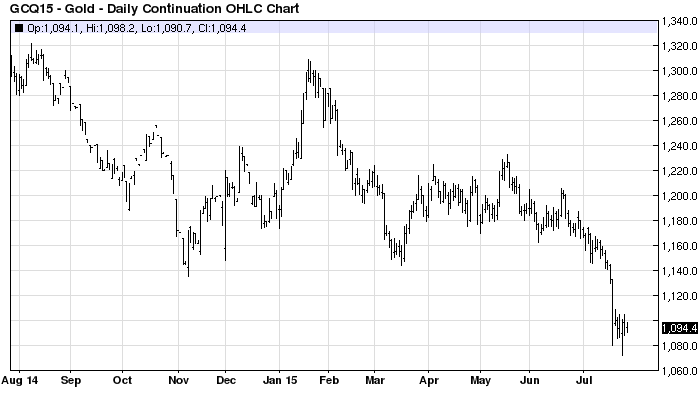

Gold's greatest attribute is that of a fear barometer. When investors are concerned about the longer-term economic outlook they invariably turn to gold as a safe haven. This was true in the 1970s when investors worried over the impact of runaway inflation; it was also evident in the previous decade when they had many concerns about war, terrorism and the global economy. When investors are less fearful, however, gold loses its luster as safe havens are ignored in favor of riskier assets. This, and not some well organized gold conspiracy, is why gold's price has been declining since 2011.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's also a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies for Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.