Central Banks Will Be Printing Money Like There's No Tomorrow

Economics / Money Supply Jun 23, 2008 - 01:10 PM GMTBy: Captain_Hook

That's what master planners will be doing in continuing efforts to offset a collapsing credit cycle. And we are just a few short weeks away from when this should begin in earnest. Why not right now? Why will this likely take until July to begin in earnest? Well, for one thing master planners (heavy on the sarcasm) have it their minds they need to talk the dollar ($) up right now, at least until things start falling apart again. This is official Fed policy at present, and orthodox hedge fund managers are supporting it, along with selling commodities and precious metals. And the other thing is the stock market. As mention many times this year, hedge funds are locked into a sell commodities / precious metals and buy the $ / stocks trade for the present quarter that will be pushed aggressively right until the end of June.

That's what master planners will be doing in continuing efforts to offset a collapsing credit cycle. And we are just a few short weeks away from when this should begin in earnest. Why not right now? Why will this likely take until July to begin in earnest? Well, for one thing master planners (heavy on the sarcasm) have it their minds they need to talk the dollar ($) up right now, at least until things start falling apart again. This is official Fed policy at present, and orthodox hedge fund managers are supporting it, along with selling commodities and precious metals. And the other thing is the stock market. As mention many times this year, hedge funds are locked into a sell commodities / precious metals and buy the $ / stocks trade for the present quarter that will be pushed aggressively right until the end of June.

The following is an excerpt from commentary that originally appeared at Treasure Chests for the benefit of subscribers on Friday, June 6th, 2008.

So although its days are numbered, which will be discussed in further detail below, in the meantime the stock market should continue to defy gravity, albeit volatility is picking up in signaling bigger things are anticipated as the summer matures. A second close over 20 in the CBOE Volatility Index (VIX) this week would be a signal the corner has turned in this regard, with the only question being one of velocity. As discussed the other day , the velocity of the downturn in stocks is being defined by speculators, as usual, where right now historic low open interest put / call ratios in the S&P 500 (SPX) are being offset by put buying against tech indices (NDX, QQQQ, MNX). This is why tech indices were strong yesterday, while the SPX was down.

Moving past this consideration however, a study of open interest configurations is suggestive volatility should pick up in July, and become more profound in August, where again, as discussed Wednesday, when open interest contracts, the true nature of the trend will unfold. And like last year, where a seasonal slowdown in speculation caused the price weakness into August, stocks should come under pressure once again, especially considering margin debt has now established a contraction trend, as seen below. It must be added here that a collapsing short interest ratio , which measures a corresponding contraction in short selling on the stock exchange, is already falling hard, meaning technically stocks are set to plunge from this perspective as well. (See Figure 1)

Figure 1

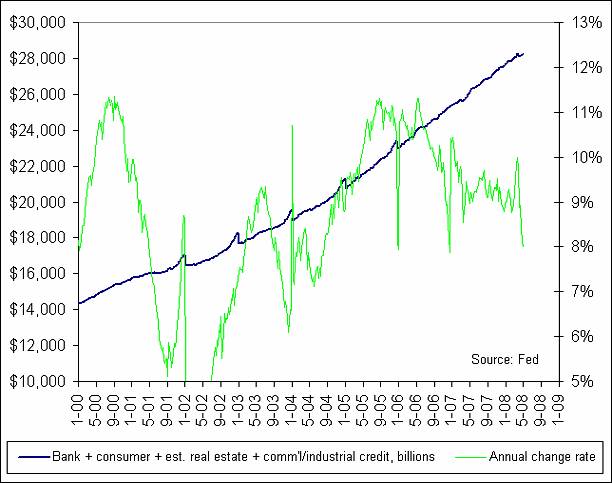

And it doesn't stop there in terms of the bad news either, where although most prefer to imagine things could not get worse, they will. As alluded to above, a collapsing stock market, although important and long overdue in terms of fundamentals (think contracting earnings), is only one element of the credit crunch. Housing will continue to fall, and home equity loans will contract as a result. And then there is credit card debt, car loans, and commercial credit that will suffer as a result of the collapsing consumer. It's all tied together you know, not compartmentalized as the bubbleheads on CNBC would like you to believe. Bottom line is, the rate of growth in consumer credit is contracting, but it hasn't gone negative yet, not with all those people buying their necessities on credit cards. (See Figure 2)

Figure 2

One does need wonder what would be the result in the economy if this were to happen however (which it surely will), or god forbid, if the consumer were actually to begin saving money. This is why master planners smash the gold price down every chance they get, because they don't want you doing something sensible, like saving your money. You see, when you buy gold you are saving your wealth, which is a big ‘no no' as far as the banks are concerned. They need money velocities to be elevated in order to keep bank profits growing, which is all these characters are ever worried about. This is why they take such great efforts to suppress its pricing, and why the levels of gold derivatives have exploded, according to the Bank of International Settlements. It's taking increasing effort to keep gold contained however, as reflected in the growth rate (40% annualized) of derivatives required to keep prices contained.

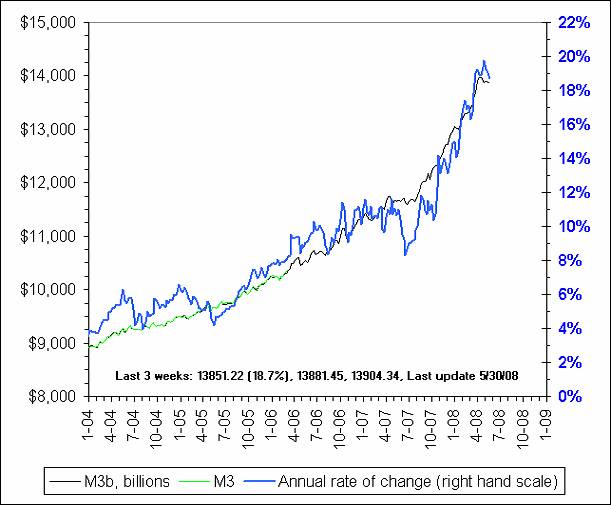

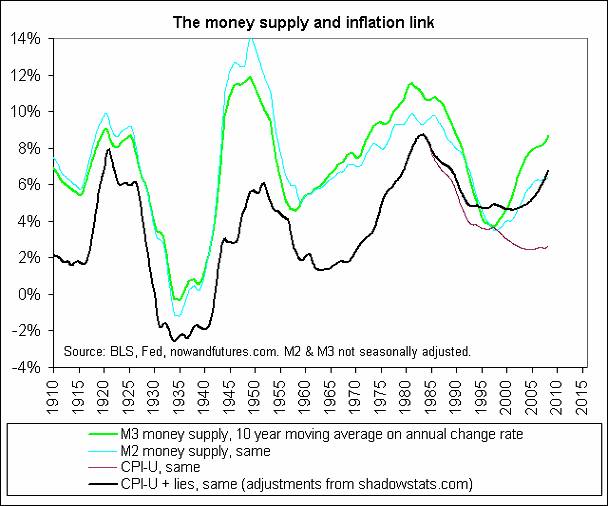

The implication here is one of these days, with the increasing amounts of fiat currency necessary to counter a collapsing consumer, a combination of physical buying in gold, along with demand for paper pricing mechanisms, will outstrip all constraints, and the biggest short squeeze in the history of any market will ensue. So make no mistake about it, having a portion of your wealth anchored in precious metals is an absolute financial necessity these days, as this will send gold and silver prices far higher than most can presently contemplate, and in rapid fashion. In the meantime, master planners keep a lid on the situation by monetizing everything that goes wrong, which is evident in the growth of M3 shown below. In the end however, and in classic ironic form, all this liquidity floating around will lead to the demise of the present system of exchange and commerce. (See Figure 3)

Figure 3

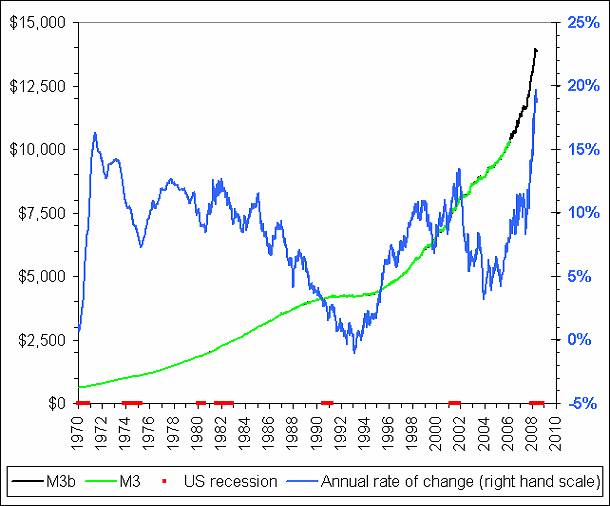

Further to this, one cannot help but be take back with the degree of detail, depth, and insight found in John William's recent study on how hyperinflation is unfolding before our very eyes today. As you should know, hyperinflation is an unsustainable monetary / economic condition, and according to John, we are on the cusp of a hyperinflationary depression that will likely end in monetary deflation, barter, and the need for revolutionary reform. As you may know, gold would play a key role in such a reformulation, along the lines of what Antal Fekete describes in his latest . Of course you will not need wait until the present monetary system melts down to witness the virtues associated with owning gold, not with US monetization (phantom money supply) growth rates at the highest levels in recoded history. Here, even the Austrian's will soon need to admit money supply growth rates are accelerating, as evidenced in True Money Supply (TMS) , commodities, and gold. (See Figure 4)

Figure 4

What's more, it's important to understand that in terms of the ‘credit crisis', and the levels of monetization / money supply growth that will be required bail out a ballooning contagion as process unfolds, these growth rates will need to accelerate further. The result here, as alluded to above with respect to comments associated with TMS, is that traditional money supply measures, such as M2, should see accelerating expansion as well, and that all of this will lead into higher prices. This is of course the same point John Williams is making, and can be visualized in the chart overlay displayed below, where it's apparent M3, M2, and the Consumer Price Index (CPI) are all poised to make growth rate gains in long-term averages moving forward. (See Figure 5)

Figure 5

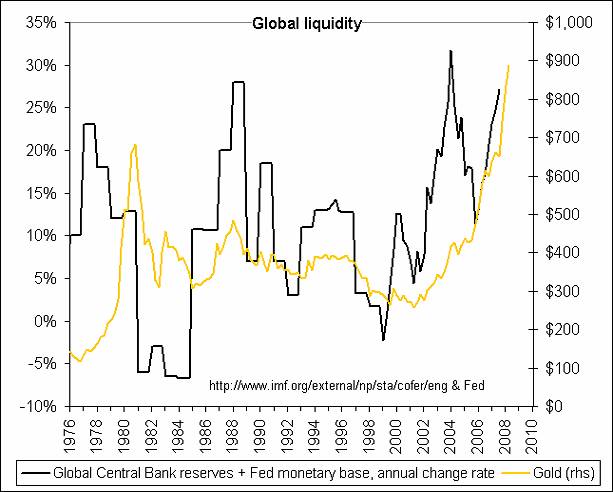

And this will all lead to increased liquidity on a global scale (see Figure 6 below), where emerging market producers of manufactured goods and commodities will be forced to expand their own money supplies to adjust to accelerating inflation coming out of increasingly bankrupt Western economies. In turn, and as alluded to above, this will continue to fuel further gains in commodities, which as you know from recent work on the subject is our view moving forward. Commodity prices will continue to move higher, and this will further underpin precious metals prices, where at some point, like crude oil at present, things will get ‘out of control'. (See Figure 6)

Figure 6

This is when gold and silver prices will start to make 3 to 5-percent daily gains – maybe more. You see, the banks will be forced to ‘buy in', even if the gold they have sold is formally leased out, and supposedly the responsibility of hair-brained mining executives. Of course more recent accelerating derivatives growth (short sales) cannot be attributed to new mine production because with the exception of China , gold production is contracting in most other areas of the world, and so is hedging. No – these forward sales are naked shorts put on by the banking community that will need to be covered one day. And as mentioned above, this should sponsor the biggest short covering rally seen in any major market ever witnessed, assuming current market are not shut down. This would naturally be difficult to do with physical gold and silver, which again, is why we harp on the virtues of physical metals religiously.

Unfortunately we cannot carry on past this point, as the remainder of this analysis is reserved for our subscribers. Of course if the above is the kind of analysis you are looking for this is easily remedied by visiting our newly improved web site to discover more about how our service can help you in not only this regard, but also in achieving your financial goals. For your information, our newly reconstructed site includes such improvements as automated subscriptions, improvements to trend identifying / professionally annotated charts , to the more detailed quote pages exclusively designed for independent investors who like to stay on top of things. Here, in addition to improving our advisory service, our aim is to also provide a resource center, one where you have access to well presented ‘key' information concerning the markets we cover.

On top of this, and in relation to identifying value based opportunities in the energy, base metals, and precious metals sectors, all of which should benefit handsomely as increasing numbers of investors recognize their present investments are not keeping pace with actual inflation, we are currently covering 69 stocks (and growing) within our portfolios . This is yet another good reason to drop by and check us out.

As a side-note, some of you might be interested to know you can now subscribe to our service directly through Visa and Mastercard by clicking here .

And if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line . We very much enjoy hearing from you on these matters.

Good investing in 2008 all.

By Captain Hook

http://www.treasurechestsinfo.com/

Treasure Chests is a market timing service specializing in value-based position trading in the precious metals and equity markets with an orientation geared to identifying intermediate-term swing trading opportunities. Specific opportunities are identified utilizing a combination of fundamental, technical, and inter-market analysis. This style of investing has proven very successful for wealthy and sophisticated investors, as it reduces risk and enhances returns when the methodology is applied effectively. Those interested in discovering more about how the strategies described above can enhance your wealth should visit our web site at Treasure Chests

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, as we are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence.

Copyright © 2008 treasurechests.info Inc. All rights reserved.

Unless otherwise indicated, all materials on these pages are copyrighted by treasurechests.info Inc. No part of these pages, either text or image may be used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

Captain Hook Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.