Banks Balance Sheet Destruction and Repair! -Crack Up Boom Part III

Stock-Markets / Credit Crisis 2008 Jun 26, 2008 - 08:56 AM GMTBy: Ty_Andros

Introduction: At no time in my career have I seen greater opportunities for investors who are properly informed. The AVERAGE amount of M3 central bank money and credit creation is simply astonishing. It is clocking in at an average annual rate of 23%. Yes, that's right, 23%. Using the rule of 72, that means those money supplies in one form or another are doubling on average every 3.13 years as money does an imitation of confetti.

Introduction: At no time in my career have I seen greater opportunities for investors who are properly informed. The AVERAGE amount of M3 central bank money and credit creation is simply astonishing. It is clocking in at an average annual rate of 23%. Yes, that's right, 23%. Using the rule of 72, that means those money supplies in one form or another are doubling on average every 3.13 years as money does an imitation of confetti.

In actuality, it is fire hoses of hot money being used to underpin the G7 financial and banking systems. Then it is combined with emerging markets throughout the world with dollar pegs and current account surpluses sterilizing their currencies so they do not ROCKET higher against the dollar. It is a powerful cocktail of stimulus for the emerging world, and an inflationary one for us all.

The HORROR story (see Tedbit archives at www.TraderView.com ) I covered in the beginning of May has materialized in spades. Initially it was the corn market, but that has now spread to soybeans and drought is now surfacing in the Australian wheat crops. As I outlined in that analysis, each year one crop or another gets shortchanged on acreage and must rely on previous year's reserves. Like a game of musical chairs, when the music stops someone is without a seat.

Unfortunately, not only has corn failed to replenish supplies this year but now soybeans are about to be shortchanged due to FLOODING. Almost 5 million acres of corn are GONE, and almost 19 million acres of beans are either not planted or in JEOPARDY. The moves you have seen up to today–and they are up 10 to 20% since that report in early May–are about to be dwarfed. Supplies of corn are basically OUT. Users HAVE NOT secured supplies properly in anticipation of new crop supplies. You will probably see a repeat of the wheat debacle last year (when wheat went from 7 to 20 dollars) as users vie for scarce supplies and hedgers get crushed by lack of available supplies and bank funding issues.

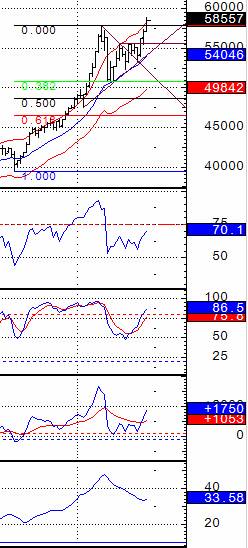

The themes that started us out last move as seen in “Reflections” are now UNSTOPPABLE. The dollar has fully corrected on weekly charts (regardless of Ben's HOT AIR) and regular treasury intervention. The commodity chart outlined there is fully active and signaling a huge move unfolding. Take a look at the updated chart:

Continuous Commodity Index – Weekly

|

|

July |

2008 |

Everything is in place–a PERFECT Fibonacci 38% retracement on the weekly chart, off confirmed new highs the week of March 3 rd . Relative strength has reset to neutral and is heading higher. Slow stochastic's several weeks into the buy signal and MACD just confirming in the last 2 weeks. ADX trend gauge is just turning up from solid area between 30 to 40 area signaling resumption of the trend from HEALTHY levels. The triangle we outlined signals a 102 point move from the breakout area, signaling a potential for an approximate 20% move higher from here. The commodities train has LEFT the station towards its NEW destination. It's off to the races….

The dollar index will probably be the reciprocal of this in the coming months. Helicopter Ben, in a typical head fake, hit the accelerator on short-term liquidity provisions as system repos in the US have TRIPLED since he took on the dollar three weeks ago. As the quarter ends, liquidity is in short supply for the banks as most PRIVATE counter parties have left the short term funding markets in fear of bank insolvency. The central banks must substitute themselves for the former short-term funding sources. Banks in Europe are starved for dollars and EU system repos are frequently over-subscribed by 3 to 1, providing a small support for the dollar as EU banks must then PAY UP to meet short term dollar liquidity requirements.

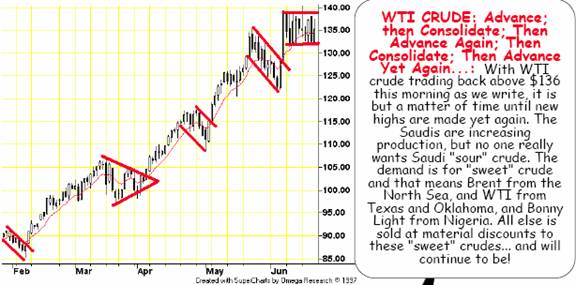

The myth of lower oil prices is also PANNING out. Take a look at this chart from Dennis Gartman at the www.thegartmanletter.com :

This is NOT a picture of a top, once we pop out the top it's another 8 dollar move from the highs.

It's hard to believe anyone has a shortage of dollars, but the G7 money center and investment banks do. Balance sheet black holes that were created during their foray into hedge funds in disguise. They have lent long and borrowed in the short-term money markets. Now those sources of funding are GONE, requiring the G7 central banks to step in and provide the necessary funds to prevent insolvent financial and banking institutions from demise. The reason the Crack up Boom is accelerating into our futures is the tremendous amount of money that will have to manufactured out of THIN AIR to recapitalize the G7 banking systems and prevent CATASTROPHIC NOMINAL losses in so many asset classes. Let's take a look:

Balance Sheet Destruction and Rescue

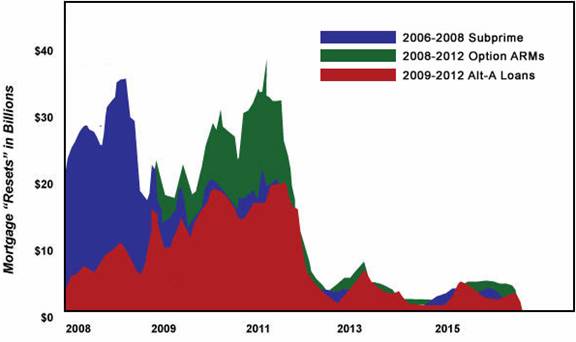

The G7 financial regulators and central banks are engaged in the mother of all reflations to underpin the solvency of their financial systems. We are going to look at what lies directly ahead and look at the condition of their balance sheets and what's going to be required over the next several years to preserve them. Sub-prime was just the first round of the credit crisis. Enormous new black holes of liquidity lie directly ahead and we are going to detail them now. First, let's just look at the mortgage industry with a chart from a recent daily reckoning ( www.dailyreckoning.com ):

As you can see, this part of the collapse is still in its beginnings as option arms (also known as EXPLODING arms, as when they do reset they explode higher in payment requirements) and Alt A loans are due to reset. These categories are still borrowers of dubious borrowing qualifications, and have NO INCENTIVE to stay in their homes when negative equity SWAMPS the future prospects of their purchases. Housing prices are declining at a year over year rate of 24% in the US and are now declining throughout the real estate markets in Europe as well.

Most of these loans were combined with numerous other types of lending such as credit card receivables, home equity loans and car loans, and securitized into CLO's, CDO's, MBS's, etc (collateralized loan, debt obligations and mortgage-backed securities) and sold to investors with investment and money center banks holding some of the more highly rated tranches. These backs believed their own BS about the quality of the underlying paper mortgages. They were fully aware of the poor lending requirements which were used to make these loans as they securitized them. But once they had the Moody's, S&P or Fitch ratings, they believed they could hold them long-term and borrow short-term and make the spread.

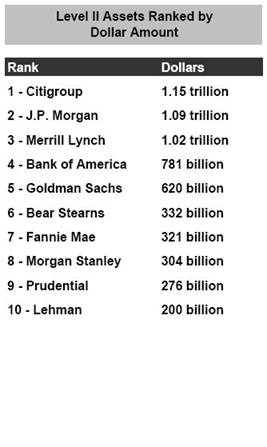

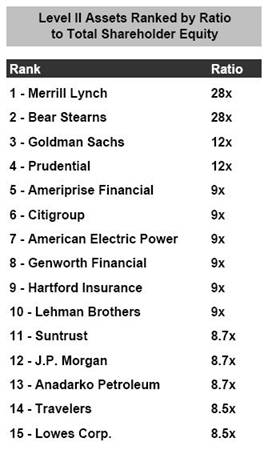

As these over the counter securities lose investor interest, they become less and less valuable as bidders disappear. Thus they move from liquid level one investment to illiquid level two and three and as they do so bank balance sheets become more and more ILLIQUID as a result. As they fall from level one to level three, regulators require more and more capital set aside to cover losses. Let's take a look at level 2 and 3 assets, and look how the crisis is now spreading to the insurance sectors:

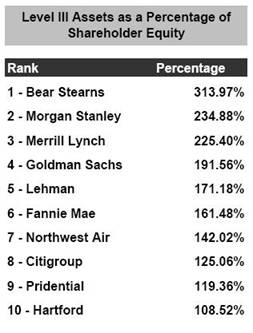

Now let's look at level III assets as a percent of shareholder equity:

These ratios have ballooned as a direct reflection of the deterioration of their balance sheets. They are sinking ever more deeply into insolvency as their assets VAPORIZE in value and become increasingly impaired and unmarketable. The more these assets sink the more they try to hedge their exposure to further losses. So the holders of these toxic securities have turned to the unregulated over the counter insurance market known as the credit default swaps (CDS) for protection from losses. It has grown by over 15 trillion dollars since the first of the year and now is over $60 trillion in size. What's even worse is that these companies above are buying these CDS from EACH OTHER and from hedge funds trying to trade in and out of them whose ability to perform their counterparty responsibility is unknown. Let's look at the definition of the credit default swaps from Jim Sinclair's www.jsmineset.com :

Keep in mind that over the counter derivatives generally have the following characteristics:

• Without regulation.

• Without listing on public exchanges.

• Without standards.

• Therefore not in the least bit transparent.

• Therefore without an open market of the bid/ask type.

• Dealt in by private treaty negotiations.

• Without a clearinghouse.

• Unfunded without financial guarantee of any kind.

• Functioning as contracts of specific performance.

• Financial character or ability to perform is totally dependent on the balance sheet of the loser in the arrangement.

• Evaluated by computer assumptions made by geek, non market experienced mathematicians who assume religiously that all markets return to their normal relationships regardless of disruptions.

• Now in the credit and default category alone considered by accepted authorities as totaling more than USD$20 trillion in notional value.

• Notional value becomes real value when the agreement is forced to find a real market for ending the obligation which is how one says sell it.

As you can readily see, they HAVE NO definition, no clearing house and probably no value. Buying one of these CD's would be like buying tissue-paper-thin insurance from groups of investors or institutions that no one knows if they can PAY OFF in the event that pay off is required. If you bought this insurance from someone who is bankrupt, do you think they would pay off? NO WAY . They are basically bankrupt banks, insurance companies insuring bankrupt banks and insurance companies. Mix in pension funds and hedge funds and we have a real explosive brew. OUCH!

I want you to keep in mind that these TRILLIONS and TRILLIONS of dollars, UK pounds, and euros of loans are STILL out there in the GLOBAL economy and were created in the fractional banking systems of the G7. The banks have only, at the most (let's be generous), 15 dollars of reserves for every 100 dollars of lending. If those loans decline 15% in value, combined with the leverage detailed here, they are GONE unless the central banks and respective governments step in and rescue them–WHICH THEY WILL.

It's as simple as John Dizard of the Financial Times so aptly put it in an article entitled

“Pragmatism replaces principle at central banks”:

“The central bankers' streams are two mutually exclusive policies: the containment of inflation and the avoidance of systemic risk to the financial system. The official pretence, now hard to maintain, is that, thanks to clever management, there is no contradiction between the two; that careful balancing of priorities can ensure stable currencies and the continued support of a highly leveraged financial system.

Not.

Just as capital is being withdrawn from speculative trades, there are more possibilities emerging for speculation all the time, thanks to the internal contradictions of central banking. The time for principled stands by Federal Reserve governors against official support for over-leveraging came and went years ago, starting in 1998. It's really too late for that now. Time was bought, for politicians, policy people and the investment world. Now it will be paid for.

The question is whether it will be paid for with devalued currency or with cans of preserved food and AK-47 ammunition. The answer is devalued currency. No, Lehman - or the next name - will not be allowed to collapse. To avoid that, though, policy will need to remain accommodative, as they say.”

Thank you, John.

These are the DEFINITION of Mal Investments, investments which CANNOT survive unless REAL interest rates are NEGATIVE. -- which they will be until this Crack Up Boom runs its course. John is so correct, but now they will have to do what they have always done. They will PRINT THE MONEY as tuna and AK 47's are in short supply in the G7 on the scale that is required while money can be created easily with a KEYSTROKE!

In conclusion: The next round of debasement and confiscation of wealth by FIAT money and credit creation has BEGUN. It is set to run at least another 2 years. Transfer of the wealth and purchasing power from your savings accounts and bonds to the financial sectors is set to accelerate. There is no shortage of LIQUIDITY and currencies as there are trillions and trillions of them sitting in bank accounts around the globe. There is only a shortage of them where they are needed the most: in the G7 financial and banking systems BALANCE SHEETS. Private sector lenders have increasingly withdrawn to the PERCEIVED safety of government bonds and cash, where their purchasing power is most at risk from debasement from printing money out of THIN AIR.

Gold and commodities are set to resume their long term trends. The removal of subsidies in China will not reduce demand for oil and energy supplies. Rationing was already in place as producers withheld supplies as it was unprofitable to provide them, had energy supply's been available they would have been consumed even at higher prices. Now that profitability has been restored, look for China to gobble up the new supplies available to them finally hit the street. They are not broke as the G7 is. They are sitting on 5 trillion dollars of savings in the public and private sectors and that DOES NOT include the euros, pounds and yen they hold. Who cares if growth slides from 11 to 8 percent? The G7 no longer makes its own products or supplies its own energy so their customers will only BUY LESS, they won't disappear.

VOLATILITY IS OPPORTUNITY and it is set in concrete to explode higher. ALL Markets are set to MOVE all over the place so position yourself to CAPTURE it and thrive. Keep saying to yourself: paper investments are poison (bonds and cash), paper investments are poison….

Income is collapsing in the G7 as the wolf wave signaled (see 2008 outlook at www.TraderView.com ) as inflation consumes purchasing power. Wealth destruction is at hand courtesy of your public servants, central banks and main stream banking and financial houses. Inflation is occurring in all of the staples of life, the food and fuel you use and consume. As peoples incomes are increasingly eaten up by runaway inflation it robs them of the ability to repay their outstanding borrowing, so a wage spiral is going to be required to allow them to CONTINUE to pay their predatory lenders in the banking system. As bidders disappear inflated asset values will continue their collapse, leaving many with obligations much greater than assets.

The 300 billion dollar mortgage bailout of lenders and reckless borrowers is set to begin, and it is only a fraction of what is to come. Fannie, Freddie and the FHA (Federal Housing Authority) are in deep water as the new legislation enshrines higher lending authority for conforming mortgages (over $600,000) combined with basically ZERO requirements (zero to 5% for deposits). It is the recipe which got us here in the first place. Let's see: borrow money with no money down for a home that is falling in value at a 10 to 20% rate. It is the policy of insolvency. (Next weeks Crack up Boom series will cover the Policies of insolvency, don't miss it!)

Write-downs in the financial sectors are about to accelerate again, and bottom pickers and capital are now scarce as previous forays into the sectors have lost 30 to 50%. So the governments and central banks now have to set up. They will, as I said, tuna is in short supply.

The unfolding politics of America HAVE NOT been priced into the market; OBAMA combined with a Democratic congress is a recipe for an inflationary recession. I believe the warnings of a debacle into the fall could be quite accurate. The ghosts of Stalin and Lenin are walking the halls of Washington as we speak. Misery spread widely is about to accelerate as these collectivists destroy wealth creation in the United States . Economic illiteracy and the source of rising middle classes is a mystery to those in power in the G7. The only good thing is it will provide astute investors large opportunities are markets move to price in the unfolding NEW realities.

Interest rates have completely been mispriced due to Bernanke's and Paulson's HOT AIR. Raising rates is a recipe for even more mayhem, and they have enough already. Those assets detailed above cannot withstand HIGHER interest rates. It's damned if you do and damned if you don't raise interest rates. THERE WILL BE NO INTEREST RATE HIKES AT LEAST TILL NEXT YEAR IN THE UNITED STATES. In order to rescue reckless borrowers who do not have a problem NOW, but will next year or the year after inflation has to rage. The public will drown in red ink if wages are not allowed to spiral higher. So they will, and unemployment is set to spike higher and higher as predicted in this commentary over two months ago.

I received this anecdote from a regular reader Bob G. It outlines the definition of real money versus paper. It is a powerful:

In 1962, the year before I got my driver's license, one could buy a gallon of gasoline for one (silver-containing) quarter or one could buy four gallons for one dollar, whether it was a Silver Certificate or a Silver Dollar, both of which were readily available and legal tender.

One could buy a 1962 Ferrari 250GT for 12,500 dollars. Or, if you were too young to drive and had 12,500 dollars, you could get 12,500 silver dollars and put them in a closet.

Fast forward to 2008.

A silver dollar, ignoring numismatic value, could be sold and the proceeds could be used to buy four gallons of gasoline.

12,500 silver dollars could be sold for more than $200,000. Last I looked, there were still some low-end Ferraris available for that amount of money.

Hard to believe that a Ferrari went for less than a typical 2008 Chevy. But then again, a Rolls went for all of $20,000.

Thank you Bob,

Think of it as a one dollar coin from 1962 containing one ounce of silver still buys four gallons of gas. What do you think the paper dollar from 1962 buys today? It isn't pretty: ¼ of a gallon….Paper is poison……

Please remember that beginning the first week in June subscribers will receive Tedbits two to three days before it is posted on the web. Subscribers will also start getting guest essays from leading economic pundits, and a blog looms soon. So, if you want it early and the added features SUBSCRIBE NOW, it's FREE!

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.