Three Critical and Disturbing Facts About the Debt Market

Interest-Rates / US Bonds Sep 13, 2015 - 02:21 PM GMTBy: Investment_U

Andrew Snyder writes: The next five days are going to be some of the most important days for investors in recent history. What happens next will set the stage for big profits or a sustained downturn.

Andrew Snyder writes: The next five days are going to be some of the most important days for investors in recent history. What happens next will set the stage for big profits or a sustained downturn.

We are worried about what the Fed has done to the interest rate game. As Yellen and her troops prepare to raise rates for the first time in over half a decade, the distortions they created in the market have become flat-out dangerous.

We’ve often referred to interest rates as the “hormones of the economy.” Like the powerful chemicals flowing through our bodies, interest rates control the mood, growth and stability of the economy.

The bond market, then, is the arteries those hormones travel through.

That’s what has us worried. Everywhere we look, that market - especially the Treasury market - is distorted and manipulated. We blame Uncle Sam’s massive manipulation.

We’ve put our thumb on three critical and highly disturbing facts.

First, there’s evidence that Treasury auctions have been rigged in the favor of big banks - depressing prices and keeping interest rates higher than the market would have naturally allowed. It’s not all that different from the collusion we saw in the 2012 Libor-fixing scandal.

But the effects could be much more far-reaching.

That’s because liquidity is becoming a concern within the Treasury market. Regulators are getting increasingly worried about the sort of volatility we’ve seen recently in the stock market creeping into this critical bond market. If the big banks in charge of making the market are more concerned with lining their pockets with arbitrage profits, they won’t be doing the sort of fair-market buying and selling that keeps the Treasury market functioning properly.

If volatility in the Treasury market rises, the arteries that control the flow of the economy’s hormones will be effectually clogged.

We’ll be in trouble. Think economic heart attack.

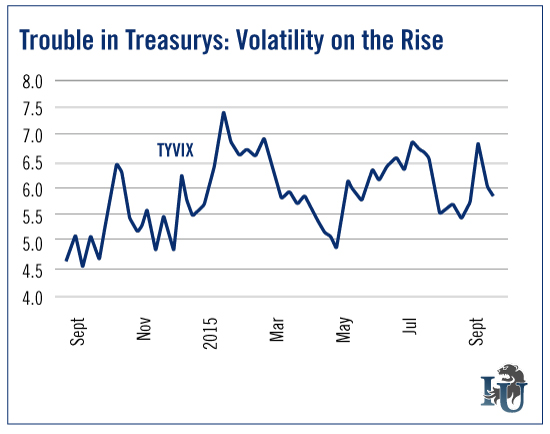

Knowing volatility was on the rise, the Chicago Board Options Exchange gave us an easy way to keep an eye on the situation. Late last year, it created the 10-year U.S. Treasury Note Volatility Index (TYVIX) - known as the Treasury VIX.

You can bet we’ll be looking at this chart again. It will be in the headlines this week.

While volatility is trending higher, we can’t help but notice the distortions in the Treasury market that stand to send it much, much higher. The biggest example comes from the dangerous world of leveraged hedge funds... our second critical and disturbing fact.

We’re watching a fund named Element Capital that’s bought tens of billions of dollars’ worth of Uncle Sam’s debt at recent auctions. In fact, the fund has been the largest purchaser in more than two dozen Treasury sales over the last year.

That’s disturbing.

It’s not China buying Washington’s debt. It’s not Goldman Sachs. It’s not even Janet Yellen these days.

It’s the secretive Element Capital.

And what they’re doing with the debt is downright scary. They’re using leverage to exploit the actions of the Federal Reserve. They are taking advantage of the Fed’s market manipulation and are profiting from short- and long-term anomalies.

Put simply, Element Capital - and others like it - is placing billion-dollar bets on the direction of the nation’s vital interest rates.

What happens if they make a wrong move? Well, keep an eye on that chart above for the answer. It’s very similar to the action in the derivatives market in 2008. As trades like these unwind, we stand to see massive distortions in one of the world’s most critical markets.

Moves like these are exactly why Washington is investigating the Treasury market. They know just a few wrong moves by an overleveraged player could wreak havoc on the American and global economies.

Which takes us to our third critical and disturbing fact... there’s a good chance you’ll get directly dragged into the fight.

If you’re anything like the average investor, you’ve been selling your stocks (against our advice) into this recent storm of volatility.

On Friday, we learned investors yanked another $19 billion from equity funds last week - taking the four-week sum to a whopping $49 billion. That’s bad enough... but it gets worse. The money is going from the frying pan into the fire.

It’s going into the Treasury market. Yep, investors are taking huge amounts of money out of stocks and are putting it into the “safest” investment they know. This 10-week string of inflows is the largest run in more than four years.

Problem is... thanks to nearly a decade worth of overt manipulation, Treasurys may not be nearly as safe as we think.

There’s trouble in Treasurys. They’re manipulated. They’re being gamed. And you’re being set up to fail.

Next week is going to be big. Keep an eye on the Treasury VIX. Keep an eye on interest rates. And keep an eye on the Fed.

There’s a strong chance we’ll have plenty to talk about.

Good investing,

Andrew

P.S. Perfect Timing. Alex Green’s new Escape Hatch Portfolio has been in the works for months - but its release couldn't have come at a more crucial time. What's happening in our economy is unlike anything we've ever seen. Our national debt is bigger than our GDP... the Fed has held rates at zero for nearly seven years. This situation isn't sustainable. Alex's advice? Take action now.

To get the full details of Alex’s Escape Hatch Portfolio - which contains 15 carefully selected stocks, funds and holding companies that will ensure you’re protected as market volatility surges - click here.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.