The Most Interesting Story In Gold

Commodities / Gold and Silver Stocks 2015 Sep 26, 2015 - 04:47 PM GMTBy: John_Rubino

Or: Gold Miners’ Doom Is Streaming Companies’ Boom.

Or: Gold Miners’ Doom Is Streaming Companies’ Boom.

The gold and silver miners are in crisis, as metal prices hover around break-even for many and capital dries up for most. Dozens of companies are one or two quarters away from running out of cash and closing down, and their executives are ready to deal.

This is, in short, the part of the cycle when the smart money sets itself up to make a fortune in the next bull market. Chief among this bunch are the streaming companies that finance developing mines in return for a share of future production.

In good times they do all right but find it hard to cut deals on favorable terms because the miners have access to cheap capital from less discerning banks and equity investors. But at the bottom of bear markets — like now — the streaming companies find themselves virtually alone in the industry in having both cash and an interest in putting it to work. Miners who need financing to survive now have nowhere else to turn, and the streaming companies are feasting. Here’s a recent Bloomberg profile of the biggest of them:

Franco-Nevada Mulls Credit as `Hokey’ Streaming Goes Mainstream

For Franco-Nevada Corp., the best time to take on debt is at the bottom of a market. The day may be approaching for the Canadian royalty and streaming company as the commodity rout boosts demand for alternative funding.“There are so many opportunities out there, we might have to dip into our credit lines,” Chief Executive Officer David Harquail said in an interview last week from his Toronto offices. “The ideal is you lever yourself up at the very bottom of the bear market and hopefully, if you’ve called it right, then you really benefit as the market turns around.”

Streaming companies like Franco-Nevada, Silver Wheaton Corp. and Royal Gold Inc. give miners upfront payments in exchange for the right to buy metals at a discount in the future. Franco-Nevada also does royalty agreements, tying portions of production to land titles.

Plunging metal prices, with copper down 24 percent and gold 11 percent in the past year, combined with surging credit costs and volatile stock markets, have made streaming attractive even for majors such as Barrick Gold Corp. and Freeport-McMoRan Inc., giving the business more credibility.

“It’s something that’s gone from being seen as kind of hokey, to where now every major company and their CFO has to consider it among their financing options,” Harquail said.

For an idea of how much things have changed in mining, consider Glencore. With a 2011 market cap of $100 billion, it could have swallowed all the streaming companies without getting indigestion. Then commodities tanked and Glencore’s stock crashed — and now it’s scrounging for the funds to keep its mines afloat:

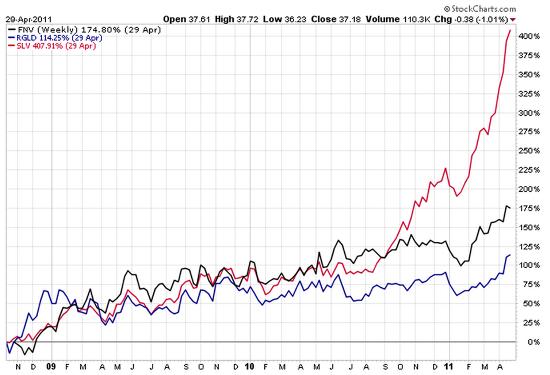

Here’s what this meant for the market values of the biggest streaming companies following the 2008 precious metals bear market:

Will they do this again? No. They should do a lot better because the 2008 precious metals bear market lasted less than a year, which was too little time for the proper amount of panic to take hold. This bear market has been grinding on for three years, and now the miners are out of cash and desperate, which should allow far more ounces to be bought at bargain basement prices — and far more cash to be generated on those ounces when prices start rising.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.