China's Stock Market Crashing; Time for Panic or Restraint

Stock-Markets / Chinese Stock Market Oct 03, 2015 - 11:11 AM GMTBy: Sol_Palha

Fortune always fights on the side of the prudent. ~ Critias

Fortune always fights on the side of the prudent. ~ Critias

Lately one cynic after another, some of which claim to be experts are all marching to the same drumbeat. The Chinese economy is in trouble; the Chinese markets are going to continue crashing. The Shanghai index experienced an astounding advance over a brief period of time and so it should not have come as a surprise that such a stupendous rally would culminate with an equally brutal correction. The Doctors of gloom and doom are over doing it and this was our recent response to our subscribers.

Not much to add here, except that it followed the project path. The fear has not peaked yet, so that means more downside is to be expected. It traded below 3000, and as long as it does not close below 3200 on a monthly basis, the bottoming action will gain traction. As it has already traded below 3000 and fear levels have not hit the extreme ranges yet, a monthly close below 3200 will drive this below 2800. If the Chinese economy is dead, then there are no words to describe our economy. Our economy is based on smoke and mirrors. Alchemists are trying to create something from nothing, and so far the cocaine sniffing crowd is buying this. ~ Market update Sept 1st, 2015

Stephen Roach the former manager of Morgan Stanley Asia seems to concur with this assessment. He made the following procolomation on the 3rd of septemer, 2015,

Growth in China has slowed, "but it's not going in for a crash...and that will present, I think, an opportunity for shares to re-evaluate the China threat, big time."

When the crowd panics, it takes a bit of time for the dust to settle down. Their confidence has been shaken, and they are letting their emotions do the talking. When emotions take over, the reaction is almost always overdone. When this occurs, the level-headed investor is provided with a once in a life time opportunity to purchase shares in top rated companies for a fraction of their true value. Prudence is still warranted, but for the brave of heart and those that have a long-term view, opening positions in companies such as NTES, BABA, SOHU, HNP, CHA, etc., will most likely prove to a good call.

Our V indicator is signifying that we are going to witness volatility on a scale never seen before; the wild gyrations the Shanghai index has been experiencing clearly reflects this new trend in play. Volatility has a destabilising effect on the small player; they become nervous and end up throwing the baby out with the bath water. In this instance, they might end up joining the baby and the bath water.

The Technical Outlook

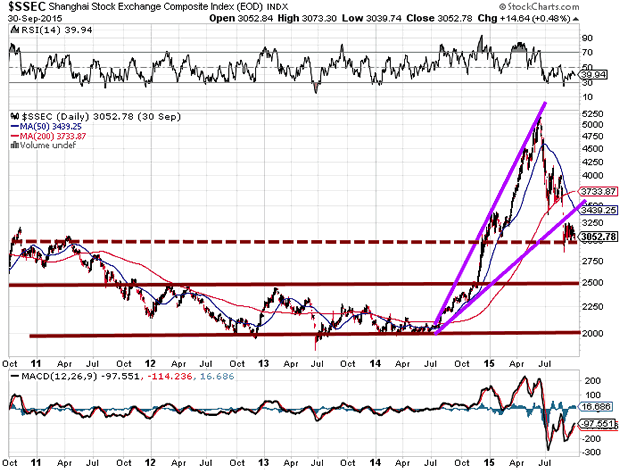

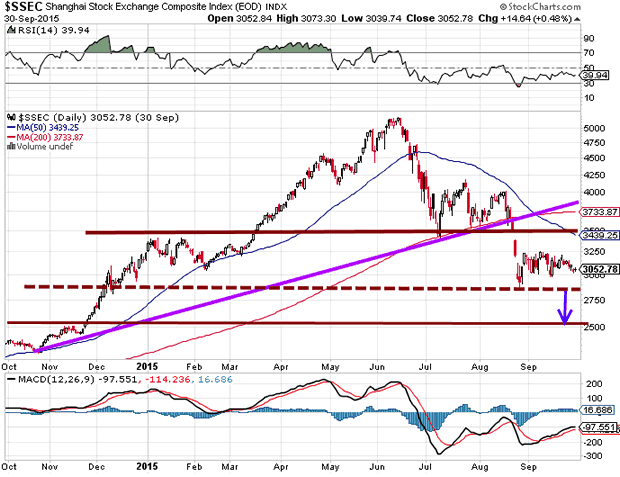

This five-year chart clearly illustrates how explosive the move from Oct 2014 to June of this year was. Only the foolish would expect such a rally to continue unabated. In our opinion, the market is letting out well deserved steam and in doing so getting rid of all the speculative money that was pumped into it. The Shanghai index is sitting on zone of support right now. However, we feel that there is still more downsides, albeit not that much, and would not be surprised by a hard-and-fast move down to the 2500-2600 ranges. In the interim, there is a very good chance that the Index could trade to the 3500 ranges with a possible overshoot to the 3700 ranges before dropping below 3000.

The trend in both the five year and the one-year charts have been violated, and therefore, one should expect more volatility before the dust settles down. The one-year chart illustrates that the index could run up as high as 3700 before dropping below 3000. For this to occur, a weekly close above 3250, would be needed. As the trend is not positive in all time frames, a test of the lows is almost a given.

To trigger a move down to the 2500 ranges, the index needs a weekly close below 2750. Any move below 2700 should be viewed as a splendid long term entry point.

Long term reasons to be bullish.

- The markets in the West have been rigged in favour of short-term gains via years of unconventional monetary policy and the Fed's insane desire to maintain an ultra-low interest rate environment that favours speculators and punishes savers.

- China's middle class continues to grow in leaps and bounds. According to a report by the South China morning post (SCMP), China's middle class grew by 203 million in 10 years.

- China is transforming into a consumer-driven economy, and according to a report by Bloomberg, China has the potential to create a $67 trillion economy.

- China is not ploughing as much money as it was into US treasuries. In fact, in April of this year, Japan overtook China as the largest holder of U.S. debt. A report on Bloomberg by Daniel Kruger and Wes Goodman in August revealed that China had slashed its stake in U.S. Debt by $180 billion. Instead of putting boat loads of money into U.S. treasuries, China is looking into moving billions into funding infrastructure projects, such as the ""One Belt, One Road" initiative.

Conclusion

As an investor, you have the option to dance to your own drumbeat or dance to the drumbeat of those banging the drums of gloom. If you take this route, you run the risk of missing an opportunity. Fear knows no limits and is only superceded by stupidity. The masses are in a state of panic, and so it will take sometime for the turbulent water to settle down. However, this is the time for the astute investor to start looking for good companies with great future prospects; we mentioned a few earlier.

China's market looks more promising that ours from a long-term perspective. If you decide to open positions right now, don't be over zealous; take nibbles instead of large bites. Naysayers would have you believe that the world is about to end. They sing the same song of doom, and so far the world is still here and many of them are not. The naysayers have an innate knack for singing bloody murder after the correction is almost over and chanting songs of joy when the markets are close to putting in a top.

There is a wide abyss that separates fear from prudence. Prudence is warranted as the driving force behind it is usually logic and not the irrational emotion of fear. If you embrace fear, you would not recognise opportunity even it slapped you hard in the fact. Fear is parasitic in nature; it only takes and gives nothing in return. One should look for symbiotic relationships when it comes to investing. There is no such thing as a good parasite, so the logical option is to get rid of this parasitic emotion as soon as you can.

A learned blockhead is a greater blockhead than an ignorant one. ~ Benjamin Franklin

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.